The latest market downtrend has not been kind to Ripple’s XRP, whose price slipped by nearly 25% over the past two weeks.

However, some key factors suggest the bulls may soon regain control.

Rally on the Way?

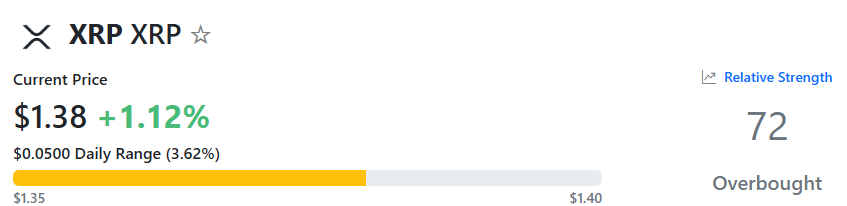

Last week, Ripple’s cross-border token fell to almost $1.10, its lowest point since November 2024. In the following days, it recovered from the sharp decline and currently trades at roughly $1.40, still well below the levels seen in previous months.

Certain elements, including the XRP exchange reserves, suggest that a further revival could be on the horizon. According to CryptoQuant’s data, the amount of coins stored on Binance recently fell to approximately 2.55 billion, the lowest mark since the beginning of 2024. As of this writing, the reserves on that particular platform stand at around 2.57 billion XRP, or quite close to the local bottom.

This trend indicates that investors have been shifting from centralized trading venues to self-custody methods, which in turn reduces immediate selling pressure.

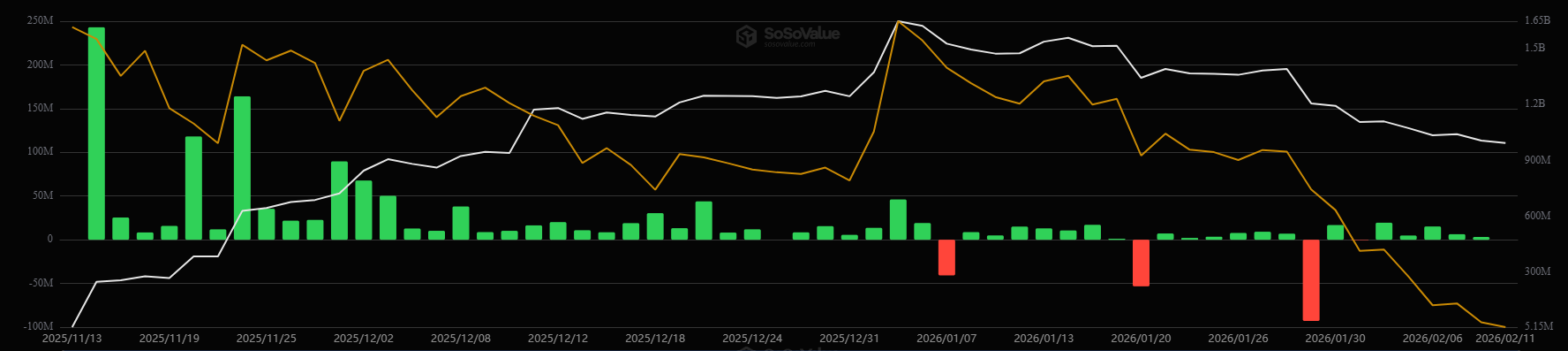

The spot XRP ETFs are the next bullish factor on the list. Recall that the first such product in the USA, which has 100% exposure to the asset, saw the light of day in November 2025. It was introduced by Canary Capital, whereas shortly after, Bitwise, Franklin Templeton, 21Shares, and Grayscale did the same.

The investment vehicles have seen solid demand, with total cumulative net inflows surpassing $1.23 billion. The last negative daily netflow occurred on January 29, meaning institutional investor appetite remains high.

Some technical setups also hint that XRP could make a decisive move to the upside soon. X user Niels spotted the formation of an “inverse head and shoulder pattern” on the token’s price chart. The configuration consists of three bottoms, with the middle being the lowest, and a “neckline” that connects the highs between the dips.

Analysts believe a breakout above the “neckline” could fuel a substantial pump. Niels, for instance, claimed that a jump above the $1.44 level might be that spark.

Something for the Bears

It is important to note that the environment of the broader crypto market remains predominantly bearish, so a renewed downtrend for many leading digital assets (including XRP) in the near future is not out of the question.

XRP’s Relative Strength Index (RSI) also suggests that the bulls may have to take another blow soon. The technical analysis tool measures the speed and magnitude of recent price changes and is often used by traders to identify potential reversal points.

It ranges from 0 to 100, and readings above 70 signal that the asset is overbought and due for a pullback. In contrast, anything below 30 is considered a buying opportunity. Data shows that XRP’s RSI currently stands at around 72.

The post Is XRP Ready to Blast Off? 3 Signs the Ripple Bulls Are Back appeared first on CryptoPotato.

Here’s what signals that XRP’s bears might step back soon. Crypto Bits, Crypto News, Ripple (XRP) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.