If you’ve been trading crypto for any length of time, you know the feeling. Choosing an exchange almost always feels like you’re making a trade-off. You find one with an amazing futures engine, but its spot market is an afterthought. You find another with a huge menu of altcoins, but the tools feel clunky and the liquidity is paper-thin.

The need to find a platform that could be your go-to for everything is completely understandable. A place with a massive selection of pairs, professional-grade tools that don’t get in the way, and deep enough liquidity to not be afraid to trade with real size.

That said, in the following, we will take a closer look at two serious contenders that have been making a lot of noise lately: Toobit and Bitunix.

The following provides a closer look and breakdown of their features, along with an objective comparison between the two.

Setting the Standards

At a glance, it might seem that Toobit and Bitunix are running neck and neck, and to some extent and in specific regards, they might as well be. But there are some clear distinctions that you might want to take into account, so let’s have a closer look

1. Trading Pair Breadth

Toobit boasts a broader selection of trading pairs, offering 422 Futures trading pairs compared to Bitunix’s 400-ish. Although the difference is not as considerable, this still provides Toobit users with a greater variety of instruments to capitalize on market movements.

Having more choice means users aren’t boxed in if they want to trade something outside of the top 20, and a lot of them do have this preference. Still, it’s worth noting that both Toobit and Bitunix are adding new trading pairs consistently and in line with traders’ demand, so on this particular front, the exchanges are running neck-in-neck.

2. Leverage

Leverage enables traders to open positions larger than their actual account balance. For those who understand and embrace the risks associated with leverage, Toobit offers a higher ceiling.

With up the recent addition of up to 200x leverage on XAUT and Bitcoin, Toobit allows traders to magnify their positions far beyond Bitunix’s 125x.

While higher leverage comes with increased risk, it also presents the potential for amplified returns for experienced traders.

Again, leverage is helpful but not key. While it’s not a deal-breaker by any stretch, Toobit gets the nod here. It’s a decent perk, but no biggie unless you’re really that confident in your position.

3. Novice-Friendly Features

One of the most obvious differentiators between the two platforms emerges before a single dollar is ever traded. Toobit offers a comprehensive Demo Trading environment, a feature whose importance cannot be overstated, particularly for traders navigating the risky and steep learning curve of derivatives.

This is a full-fledged sandbox that perfectly mirrors the live trading interface. For a beginner (and even some advanced traders) this is invaluable. It provides a pressure-free space to:

Understand trading mechanics: You get to learn the difference between a limit order and a market order, understand how to set a stop-loss or take-profit, and get comfortable with the platform’s layout without the fear of costly “mis-clicks.”

Understand leverage: You can experiment with various levels of leverage to truly appreciate its power to amplify both gains and losses. Seeing a position get liquidated in a demo account is a lesson that costs nothing but teaches everything.

Develop and test strategies: You also get to practice trading strategies based on real-time market data, building confidence and discipline before putting real funds on the line

Bitunix, on the other hand, offers no such practice environment, which means that new users pretty much have to learn on the go with their real money. This “trial by fire” approach creates a less forgiving entry point, where the inevitable mistakes of a novice trader result in immediate financial losses.

4. USDC-Settled Futures

Toobit’s provision of USDC-settled futures trading pairs is a clear benefit on this front. USDC, being a regulated stablecoin pegged to the US dollar, offers greater stability and predictability in settlement, reducing exposure to the volatility of other cryptocurrencies.

When you trade a USDC-settled contract on Toobit, your margin, profits, and losses are all calculated in USDC. Since USDC is a stablecoin pegged 1:1 to the US dollar, it provides a stable and predictable baseline for your trading activity.

A profit of 500 USDC is always worth approximately $500. This simplifies P&L analysis and allows you to focus purely on the price movement of the asset you’re trading, like Bitcoin or Ethereum.

The main difference here is that Bitunix denominates its futures contracts in USDT, which, in practice, is the largest stablecoin by market capitalization, but there is a caveat, at least for European traders.

USDT is not regulated and Tether has made it clear that they will not abide by MiCA, which is the new crypto-oriented regulatory framework in the Old Continent. Those of you who prefer to stay on the side of caution would likely be more inclined to use Toobit for its USDC denomination options.

5. Automated Trading

For traders looking to automate their strategies and capitalize on market inefficiencies, Toobit’s integrated trading bots are a game-changer.

The platform’s integrated Futures Grid and DCA (Dollar-Cost Averaging) bots are not just add-ons; they are powerful tools that enable a more systematic and less emotional approach to trading.

This tool is perfect for ranging or “choppy” markets where prices move up and down without a clear trend. It removes the need for constant screen-watching and the emotional fatigue that comes with manually trading small price swings. Of course, if a trend emerges and the price goes outside of the specified range, this could leave your orders hanging and at a loss, therefore requiring attention and oversight nonetheless.

There is no equivalent feature on Bitunix.

6. Risk Management

Success often hinges on small details, and one of the most impactful is understanding your exact profit and loss in real-time. One of the most valuable features for active traders is Toobit’s ability to show your break-even price for open positions (fees included).

This might sound minor, but in practice, its value is immense. A trader’s actual break-even point is never their entry price. It’s the entry price adjusted for the fees paid to open the position and, crucially, the fees that will be paid to close it. Without this calculation, you’re flying partially blind.

This feature is noticeably absent on Bitunix and on many other exchanges, for that matter.

7. Flexible Position Management

Most traders are familiar with the default “merged” or “one-way” mode, which is the standard on many exchanges. In this mode, if you have an open long position on BTC and decide to buy more, the platform merges the two orders.

It combines the total size and calculates a new average entry price for your single, consolidated position. While simple and clean, this approach lacks granularity.

This is where Toobit provides a powerful advantage. By enabling Split Mode (often called “Hedge Mode” on some other platforms), every order you place creates a separate, independent position that can be managed individually. Each one has its own entry price, take-profit, and stop-loss levels.

Imagine you have a long-term BTC position that you plan to hold for weeks. Suddenly, you spot an opportunity for a quick, short-term scalp trade based on a 1-hour chart.

In Split Mode, you can open a new, separate position to capitalize on this short-term move and close it for a profit without ever touching or altering the average price of your core long-term position.

The absence of these options on Bitunix and some other platforms means traders are locked into a single, consolidated view of their risk. For my trades, it prevents the almost-micro control needed for advanced hedging and multi-layered trading strategies, forcing a more simplistic approach.

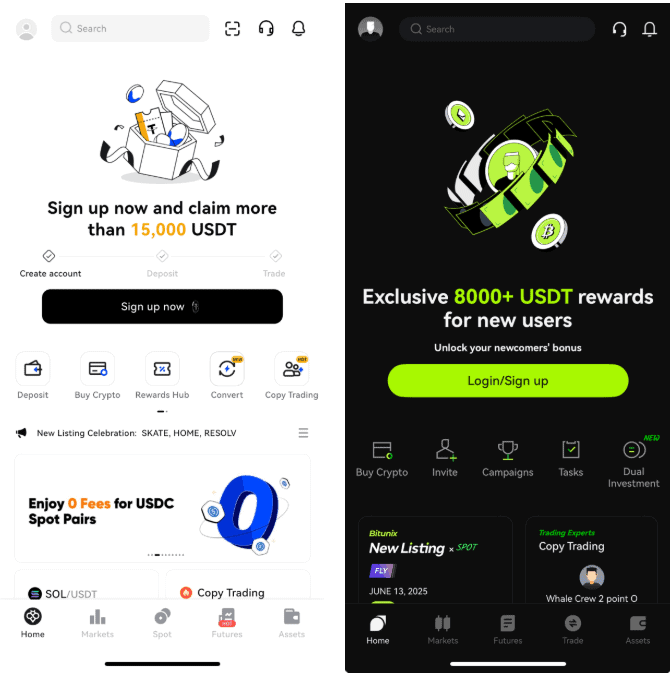

8. Welcome Rewards

For most serious traders, this isn’t the main event, but when you’re new to a platform, a good welcome can make a real difference, and the contrast here is worth mentioning. For new users, Toobit offers an incentive: over 15,000 USDT in welcome rewards.

This is nearly double what Bitunix provides and, probably most importantly, the tasks to earn these bonuses are simple.

- Completing your account verification (KYC).

- Making your first deposit.

- Executing your first futures or spot trade.

As with most platforms, these bonuses function as real trading capital. The bonus can be used to support your open futures positions, effectively increasing your position. Every dollar extra in this regard is a dollar extra put towards a potential opportunity, risk-free.

9. The Advantage of GTD TP/SL Orders

We’re in crypto, so prices can move in the blink of an eye. A standard stop-loss order works by triggering a market order once your price is hit. However, during a rapid price crash, by the time your order is executed, the market price may have already fallen further.

In this regard, Toobit’s support for guaranteed take profit/stop loss orders with zero slippage is a critical advantage for precision-focused traders. A guaranteed TP/SL order on Toobit is a game-changer. It acts as an insurance policy against slippage.

This ensures that exit strategies are executed exactly at the intended price, minimizing unexpected losses due to market volatility.

Bitunix has omitted this on their platform, though considering the minimalist approach of the platform in general, this could be an intentional feature, and not a bug.

10. Enhanced Mark Price Protection

First, let’s be clear: the Mark Price is not the last price traded on the exchange itself. It’s a composite index, an average price calculated from the real-time spot prices on multiple major, high-volume exchanges.

This is a deliberate and critical design to protect you. It prevents a single, manipulative event or a “scam wick” on one platform from unfairly liquidating your position. Imagine a whale dumps a massive sell order, causing a flash crash for a few seconds on a single exchange.

If liquidations were based on that exchange’s last price, thousands of traders could be unjustly wiped out. The Mark Price, by drawing from multiple sources, remains stable and reflects the true global market consensus, ignoring such localized anomalies.

In highly volatile markets, reliable mark price calculation is paramount. Toobit’s 6-exchange index for mark price offers superior protection compared to Bitunix’s 3-source model.

While better than using a single price, a 3-source index is inherently more vulnerable. If just one of those three sources experiences a technical glitch, has thin liquidity, or is targeted by manipulation, it can disproportionately pull the entire Mark Price away from the true market value.

A broader range of price sources reduces the likelihood of manipulation and provides a more accurate reflection of the true market price, especially during periods of rapid price swings.

Liquidity is A Key Consideration

Liquidity is arguably the single most important characteristic of a great exchange. It’s the “depth” of the market, and it determines how easily you can execute trades at the price you want.

While specific real-time liquidity data for trading pairs on Toobit versus Bitunix can fluctuate and requires live market observation. However, using market monitoring resources such as CoinMarketCap, which has largely been considered the gold standard, suggests that Toobit has the clear upper hand, as the tracker is regularly showing that Toobit has double the trading volume and market depth compared to Bitunix. Of course, this is subjected to change.

A Bit More than Crypto?

So, following this breakdown – which one is better – Toobit or Bitunix? It’s true that both exchanges provide a range of interesting tools and features and even come close in certain aspects.

But Toobit’s advanced solution kit, which features guaranteed take-profit and stop-loss orders, enhanced mark price protection, automated trading bots, a sandbox trading environment, amongst a myriad of others, helps it pull ahead by a considerable margin.

Bitunix is not a bad exchange by any means, but if you’re looking for an advanced platform that brings pretty much all the bells and whistles, it appears that Toobit is more suitable for that, at least for the time being.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Toobit or Bitunix? Your Ultimate Guide to Features, Benefits, and Your Best Bet appeared first on CryptoPotato.

If you’ve been trading crypto for any length of time, you know the feeling. Choosing an exchange almost always feels like you’re making a trade-off. You find one with an amazing futures engine, but its spot market is an afterthought. You find another with a huge menu of altcoins, but the tools feel clunky and Projects

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.