Around 38,500 Bitcoin options contracts will expire on Friday, Nov. 15, and they have a notional value of around $3.4 billion.

Today’s options expiry is pretty similar in magnitude to last week’s, as markets have remained buoyant for most of the week.

However, analysts have cautioned that a correction is due following the largest rally for around eight months.

Bitcoin Options Expiry

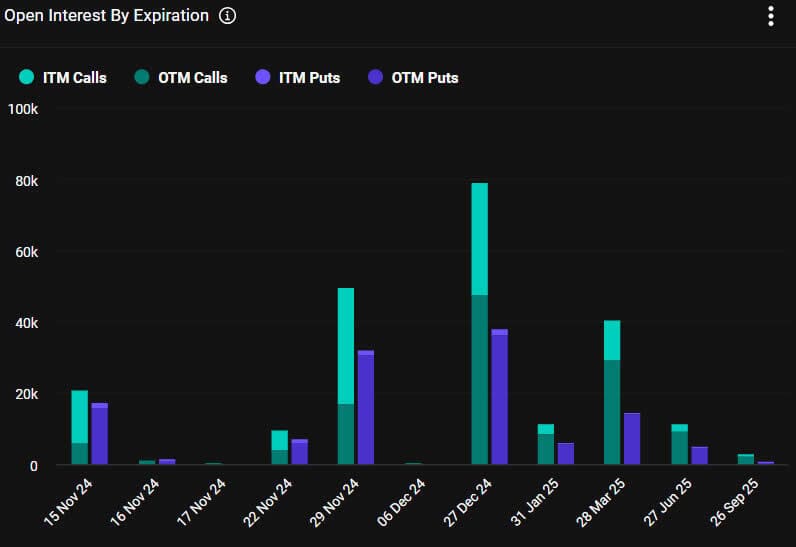

This week’s tranche of Bitcoin options contracts has a put/call ratio of 0.84, meaning that there are slightly more long (calls) than short (puts) expiries.

Moreover, open interest (OI), or the value or number of open options contracts yet to expire, is high at the $80,000, $90,000, and $100,000 strike prices, which are all within the realms of possibility following this week’s pump.

Earlier this week, crypto derivatives provider Greeks Live commented that market sentiment has not reached the peak FOMO (fear of missing out), adding that “options investors are still tentative to build positions and 90,000 and 100,000 piled up a large number of options positions.”

If Bitcoin breaks through $100,000, it is “very likely to cause FOMO in the options market, which will trigger a surge in IV (implied volatility),” it added.

However, the breakout price of ETH will be $4,000, “which is still far away and can only follow BTC for the time being,” Greeks noted. There are around 189,000 Ethereum contracts expiring today in addition to the big batch of Bitcoin options.

These have a notional value of $582 million and a put/call ratio of 0.92, bringing Friday’s combined crypto options expiry notional value to around $4 billion.

In its weekly crypto derivatives recap, analytics firm Block Scholes commented:

“Both BTC and ETH now benefit from a powerful combination of spot price gains and robust bullish derivatives activity, signaling strong demand to participate in further upside potential.”

Crypto Markets Cool

Crypto markets have retreated towards the end of the week with total capitalization dropping 3.3% on the day, but remaining just above $3 trillion.

Bitcoin has dipped 2%, hitting an intraday low of $87,000 before recovering marginally during the Friday morning Asian trading session to reach $88,000 at the time of writing.

Ethereum has corrected harder, dropping 4% in a fall to just over $3,000, where it remains at the time of writing.

The altcoins were mostly in the red, aside from XRP, Cardano (ADA), Near Protocol (NEAR), Litecoin (LTC), and Stellar (XLM).

The post Will Crypto Markets Bounce Back When $3.4B Bitcoin Options Expire Today? appeared first on CryptoPotato.

Friday means another Bitcoin options expiry event is due, and it is another big one, as markets have been surging recently. AA News, BTCEUR, BTCGBP, BTCUSD, BTCUSDT, Crypto News, Bitcoin (BTC) Price, Deribit

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.