TLDR

- Bitcoin declined to $88,400, down 4% over the past week as cryptocurrencies underperformed rising stocks and precious metals

- Gold broke above $5,000 per ounce while silver surged over 14% intraday to record highs above $117 before pulling back

- US stock futures rose with S&P 500 up 0.4% and Nasdaq climbing 0.7% ahead of Federal Reserve meeting and earnings reports

- Federal Reserve expected to maintain interest rates at 3.5% to 3.75% range on Wednesday

- More than 90 S&P 500 companies including Meta, Microsoft, Tesla, and Apple report earnings this week

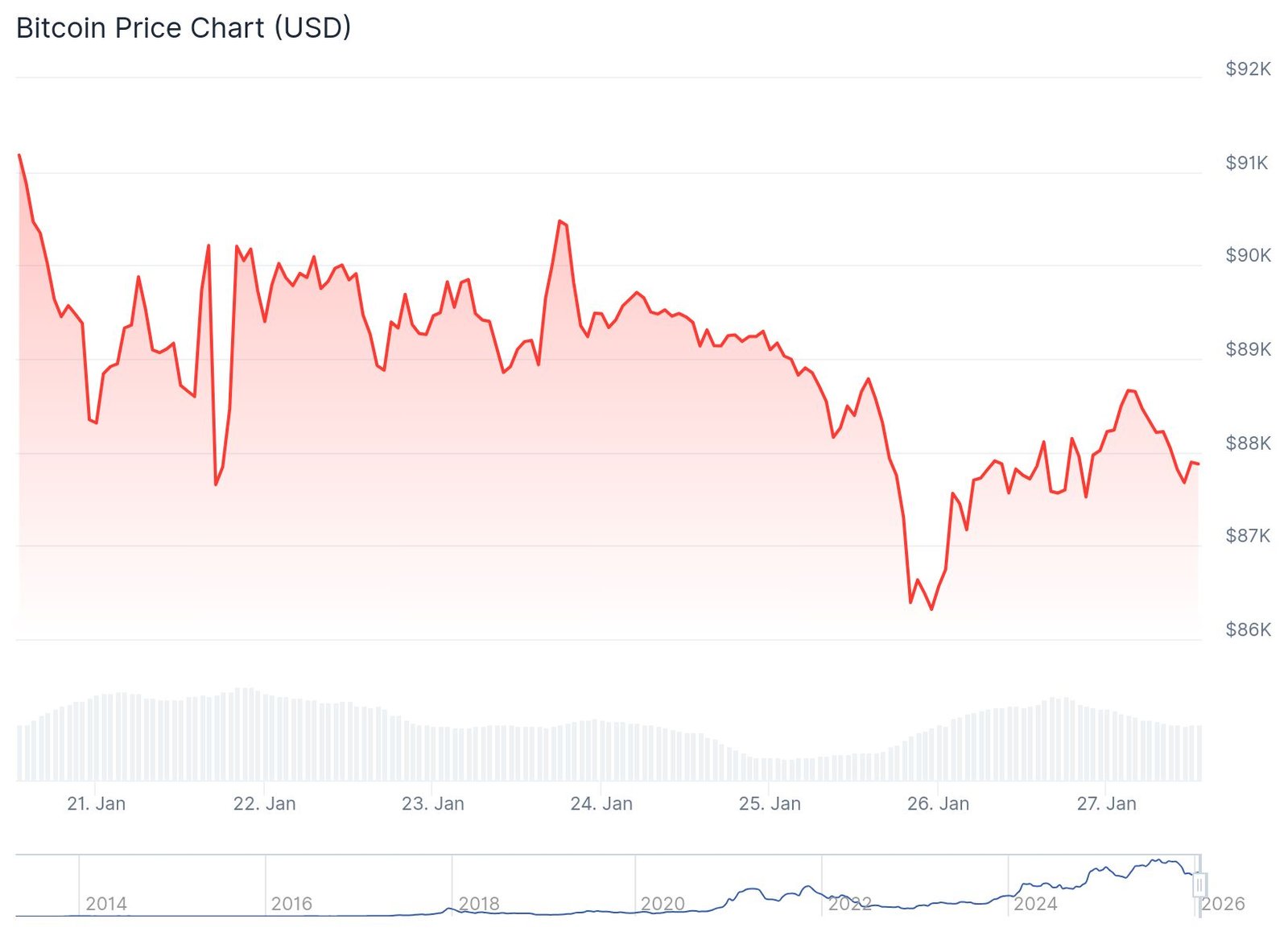

Bitcoin traded near $88,400 during Tuesday’s Asian session as cryptocurrency markets weakened while stocks and precious metals advanced. The largest digital asset has fallen roughly 4% over the past seven days.

Ethereum hovered around $2,940 with Solana, XRP, and Dogecoin posting small losses. Trading volumes remained subdued across major tokens as investors adopted a wait-and-see approach.

US stock futures moved higher with S&P 500 futures gaining 0.4% and Nasdaq 100 futures up 0.7%. Dow Jones futures traded flat as Wall Street prepared for a critical week of economic events.

Gold and Silver Rally While Crypto Lags

Gold briefly exceeded $5,000 per ounce before retreating from record levels. Silver experienced its largest one-day move since 2008 with an intraday surge of more than 14% that pushed prices above $117 per ounce.

The white metal closed Monday up 0.6% after volatile trading in late US hours. The precious metals rally contrasts sharply with bitcoin’s performance despite similar macro factors.

Bitcoin remains well below its October peak even as falling real yields, dollar weakness, and geopolitical tensions have supported equities and metals. The divergence suggests crypto is currently behaving as a high-beta risk asset rather than a safe-haven hedge.

“Cryptocurrencies remain a lagging class of risk-sensitive assets, falling short of metals and the strongest global currencies,” said Alex Kuptsikevich, FxPro chief market analyst.

Bitcoin trades below key moving averages and has not broken through support levels established over the past two months. The technical picture remains bearish despite recent modest gains.

Fed Decision and Big Tech Earnings Ahead

The Federal Reserve is expected to hold interest rates steady in the 3.5% to 3.75% range at Wednesday’s policy meeting. Traders will scrutinize the statement for clues about future rate cuts.

Earnings season intensifies this week with more than 90 S&P 500 companies scheduled to report. Meta, Microsoft, and Tesla announce results Wednesday followed by Apple on Thursday.

Technology stocks lifted markets during Monday’s session. Shares of Apple, Meta Platforms, and Microsoft rose ahead of their quarterly reports.

President Trump raised tariffs on South Korean products to 25% from 15% late Monday. The increase covers automobiles, pharmaceuticals, and lumber following delays in trade agreement approval.

Tuesday’s economic calendar includes consumer confidence data and home price readings. General Motors, American Airlines, and Boeing report earnings.

UnitedHealth and other insurance stocks declined after reports the US will maintain current Medicare payment rates. Senate Democrats are working to block Department of Homeland Security funding, raising shutdown concerns.

Analysts view the Fed meeting and tech earnings as potential catalysts for shifts in risk appetite. Crypto’s next move may depend more on these macro events than crypto-specific developments as bitcoin remains pinned near current levels.

The post Daily Market Update: Gold Hits $5,000 While Bitcoin and Stock Futures Rebound appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.