TLDR

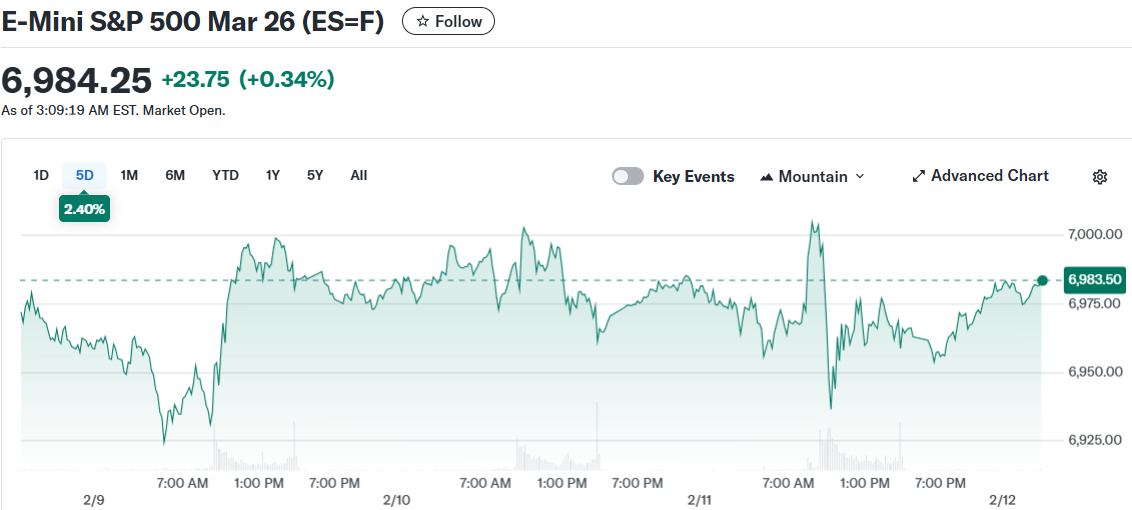

- U.S. stock futures advanced Thursday with Dow, S&P 500, and Nasdaq all posting gains after January jobs data showed 130,000 positions added

- Consumer Price Index report delayed by government shutdown now scheduled for Friday, expected to show 2.5% year-over-year inflation

- Federal Reserve rate cut probability stands at 5.4% for near-term action as strong employment complicates easing plans

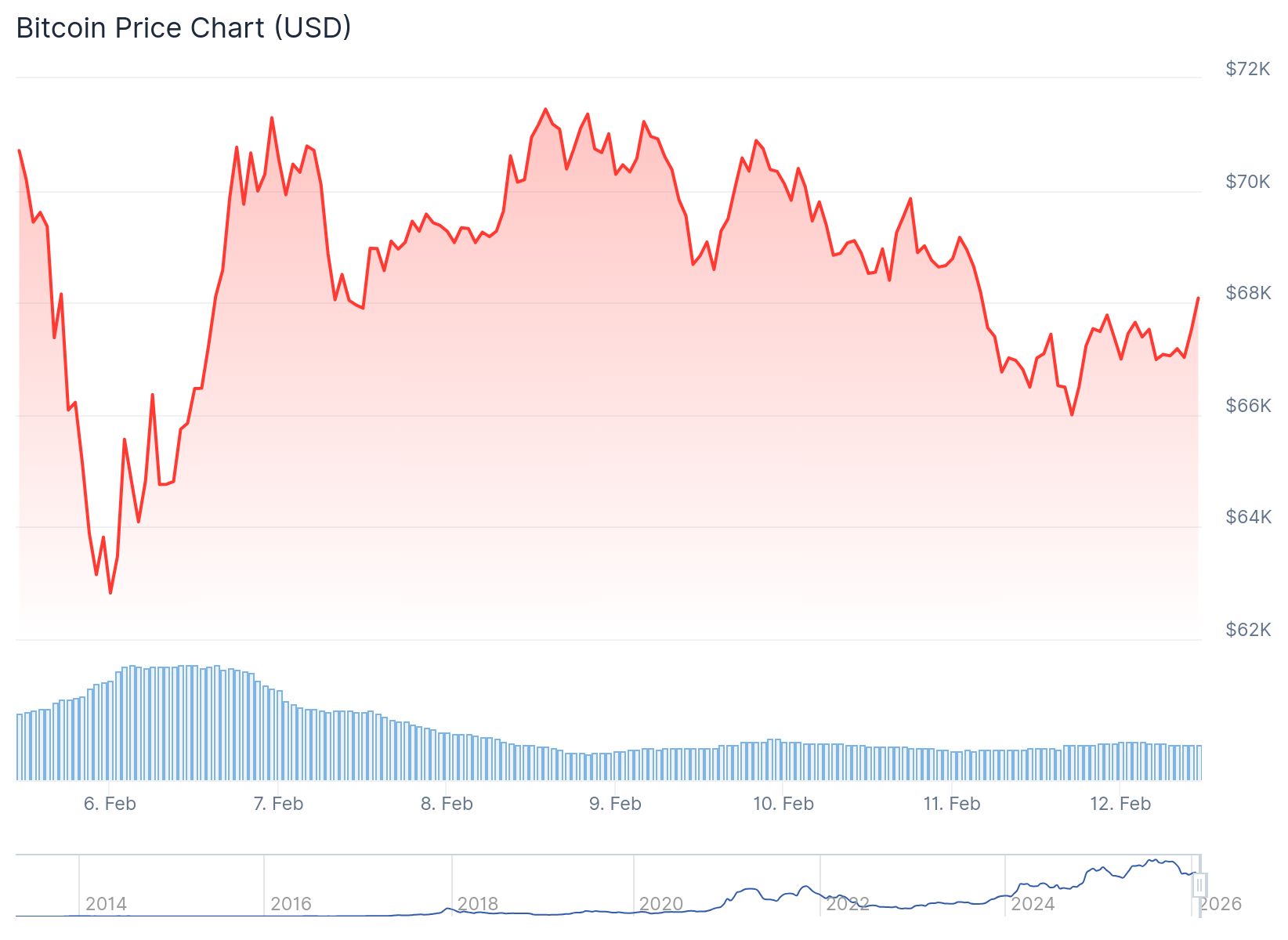

- Bitcoin consolidates at $67,200 while trading in $62,822 to $72,000 range following recent market selloff

- Cisco stock dropped 7% after-hours on missed earnings while McDonald’s dipped slightly despite beating estimates

U.S. stock futures moved higher Thursday morning as traders processed January’s employment report. The data showed 130,000 new jobs added last month, surpassing analyst expectations.

Dow Jones Industrial Average futures gained approximately 0.2% in early trading. S&P 500 futures rose by a similar margin while Nasdaq 100 futures advanced 0.1%.

The futures gains followed a mixed Wednesday session on Wall Street. Major indexes closed relatively flat after the jobs data complicated Federal Reserve policy expectations.

Employment Data Reshapes Market Outlook

Markets initially rallied following the January jobs report release. However, the stronger-than-expected hiring numbers created new questions about monetary policy timing.

Year-end 2025 employment figures were revised downward in the report. The revisions revealed slower job growth last year than initially calculated.

A resilient labor market paired with persistent inflation could reduce near-term rate cut likelihood. This scenario has become a key concern for equity investors who anticipated policy easing.

CME’s FedWatch tool currently indicates a 94.6% probability of unchanged rates. The Federal Reserve is expected to maintain the 3.50%-3.75% range at upcoming meetings.

Tim Sun from HashKey Group explained that positive economic news creates challenges for risk assets. Strong employment removes urgency for the Fed to implement early policy easing.

Inflation Report Takes Priority

Investors now turn attention to Friday’s Consumer Price Index data. The report was delayed due to a partial government shutdown but will provide crucial inflation insights.

January CPI is forecast to decline to 2.5% on a year-over-year basis. This would mark a 0.2% drop from December’s reading.

Derek Lim from Caladan stated that inflation data carries more weight than employment figures. A lower-than-expected reading would increase pressure on the Fed to cut rates sooner.

Lower policy rates typically ease financial conditions and reduce discount rates. This environment has historically supported both equities and cryptocurrencies during high liquidity periods.

Conversely, hotter inflation numbers could cement a higher-for-longer rate environment. Such an outcome would likely pressure risk assets across markets.

Crypto and After-Hours Movers

Bitcoin currently trades at $67,200, down 0.5% over 24 hours. Ethereum holds steady at $1,970 according to CoinGecko.

The leading cryptocurrency has traded between $62,822 and $72,000 this past week. Volatility remains relatively muted following late January and early February declines.

Sun noted that interest rate futures repriced quickly after jobs data. Rate cut expectations compressed and shifted toward the second half of 2026.

Cisco Systems fell roughly 7% in after-hours trading after missing profit forecasts. McDonald’s declined modestly despite surpassing earnings expectations.

Friday’s earnings calendar includes reports from Coinbase, Applied Materials, and Rivian. A softer inflation print would signal easing price pressures while growth continues.

The post Daily Market Update: Stock Futures Rise With Bitcoin at $67,200 Ahead of Inflation Report appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.