Ethereum is currently consolidating between $3,600 and $3,850 after an explosive rally that saw the second-largest cryptocurrency surge more than 80% since late June. Despite the brief pause in upward momentum, ETH remains in a strong technical position, holding above key support and showing signs of sustained bullish control. This period of sideways action could be a healthy reset, allowing the market to absorb recent gains before initiating the next leg up.

What’s fueling the optimism is not just price action, but a supportive macro and regulatory environment. Ethereum fundamentals continue to strengthen, with rising on-chain activity, institutional interest, and long-term holders accumulating. Adding to the bullish case is the growing legal clarity in the US, which is creating a more stable environment for crypto innovation and investment. As regulatory fog lifts, many investors now believe that Ethereum could lead the charge into what some analysts are calling the beginning of an altseason.

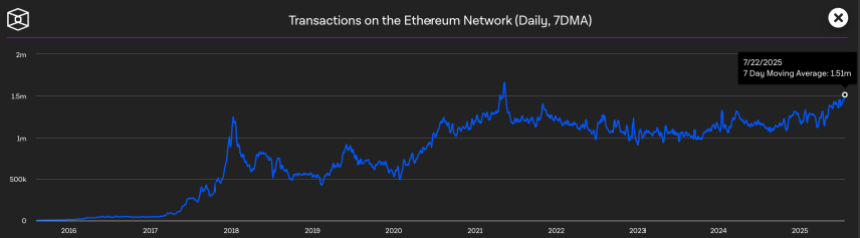

Ethereum Transactions Surge As Adoption And Momentum Accelerate

Ethereum is showing strong signs of renewed momentum as key network activity hits levels not seen in years. According to data from The Block, Ethereum daily transactions just reached a multi-year high of 1,510,000—the highest since 2021. This surge points to rising adoption across the network, with increased activity from both retail and institutional participants. Analysts suggest that this spike in transaction volume is more than a temporary trend; it may signal the beginning of a much larger phase in Ethereum’s growth cycle.

The renewed activity aligns with broader market movements and increasing confidence in Ethereum’s long-term value. Institutional players are beginning to accumulate ETH, while smart money continues to position for upside. These inflows come at a time when Ethereum is consolidating just below major resistance levels, offering what many see as a key entry zone ahead of further price appreciation.

Notably, Ethereum is now outperforming Bitcoin and much of the broader crypto market. This relative strength is significant, as ETH often leads the altcoin market during bullish phases. As the cycle progresses, Ethereum’s combination of strong fundamentals, rising utility, and institutional adoption is making a compelling case for continued growth.

Ethereum Holds Above Support After Rally, Eyes Next Breakout

Ethereum (ETH) continues to trade within a key range following a strong rally that pushed the price from below $2,500 to over $3,750 in just a few weeks. As of today, ETH is consolidating around $3,660 after being rejected near $3,742—a major resistance level seen since early 2024. The current weekly candle shows a long upper wick, indicating profit-taking at the top of the range, but price remains supported above the critical $2,852 level, now acting as a flipped support.

The rising volume seen during the recent breakout suggests strong participation from buyers, and price action remains bullish as long as ETH holds above its key moving averages. The 50, 100, and 200-week SMAs are all aligned below current price levels, providing structural support and reinforcing the bullish trend.

Traders are now closely watching for a decisive breakout above the $3,742 zone. If ETH clears that resistance, the next logical targets lie in the $4,000–$4,200 range. On the downside, a breakdown below $2,850 would invalidate the recent breakout structure.

Featured image from Dall-E, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.