TLDR

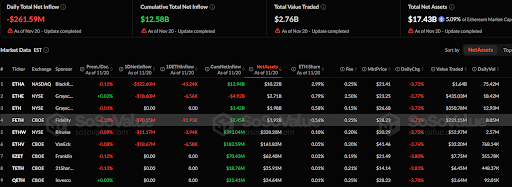

- Ethereum ETFs saw a daily net outflow of -$261.59 million as of November 20.

- ETHA ETF had a price decrease of 0.11% and a net outflow of -$122.60 million.

- The ETHE ETF saw a slight price increase of 0.02%, with a net outflow of -$18.60 million.

- FETH ETF had a price increase of 0.23%, despite a large net outflow of -$90.55 million.

- The ETHW ETF reported a minor price increase of 0.09%, with a net outflow of -$11.17 million.

According to a recent SoSoValue update, it is confirmed that Ethereum ETFs leaned on the negative side with a daily net outflow of -$261.59 million as of November 20. This outflow is part of a larger cumulative total net inflow of $12.58 billion, indicating an ongoing movement of funds. The total value traded for the day stands at $2.76 billion.

ETHA and ETHE See Outflows, ETH ETF Remains Stable

Focusing on individual ETFs, the update presents various movements in key exchange-traded products. The ETHA ETF on NASDAQ, backed by BlackRock, has experienced a 0.11% decrease in its price, with a net inflow of -$122.60 million and 43.24K shares redeemed. The cumulative net inflow for ETHA stands at $12.94 billion, with net assets of $10.22 billion. The ETF holds an ETH share of 2.99%.

The ETHE ETF on the NYSE, sponsored by Grayscale, has seen a slight increase in its price by 0.02%. However, it registered a net outflow of -$18.60 million, with 6.56K shares redeemed. The ETF’s cumulative net inflow is -$4.92 billion, and the total net assets are $2.71 billion. Its ETH share stands at 0.79%.

The ETH ETF, also on the NYSE and backed by Grayscale, is down by 0.10%, reporting no net inflows or outflows. Its cumulative net inflow remains at $1.42 billion, with net assets reaching $1.98 billion. The ETH share is 0.58%.

FETH and ETHW See Outflows, While Others Ethereum ETFs Experience Price Fluctuations

The FETH ETF on CBOE, sponsored by Fidelity, has experienced a price increase of 0.23%. This ETF saw a large net outflow of -$90.55 million, with 31.93K shares redeemed. The cumulative net inflow is $2.45 billion, and net assets are $2.45 billion, with an ETH share of 0.56%.

The ETHW ETF on the NYSE, backed by Bitwise, recorded a minor increase of 0.09% in price but experienced a net outflow of -$11.17 million, with 3.94K shares redeemed. Its net assets stand at $328.20 million, with an ETH share of 0.10%.

The ETHV ETF on CBOE, sponsored by VanEck, has seen a slight decrease of -0.08% in its price, with a net outflow of -$18.67 million and 6.58K shares redeemed. The ETF’s cumulative net inflow is $182.59 million, and net assets are $161.82 million. Other ETFs such as EZET on CBOE, TETH on the 21Shares exchange, and QETH on Invesco, have all recorded varying degrees of price fluctuations and outflows.

The post Ethereum ETFs Update: Daily Net Outflow Hits -$261.59M as ETHA Leads Losses appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.