TLDR:

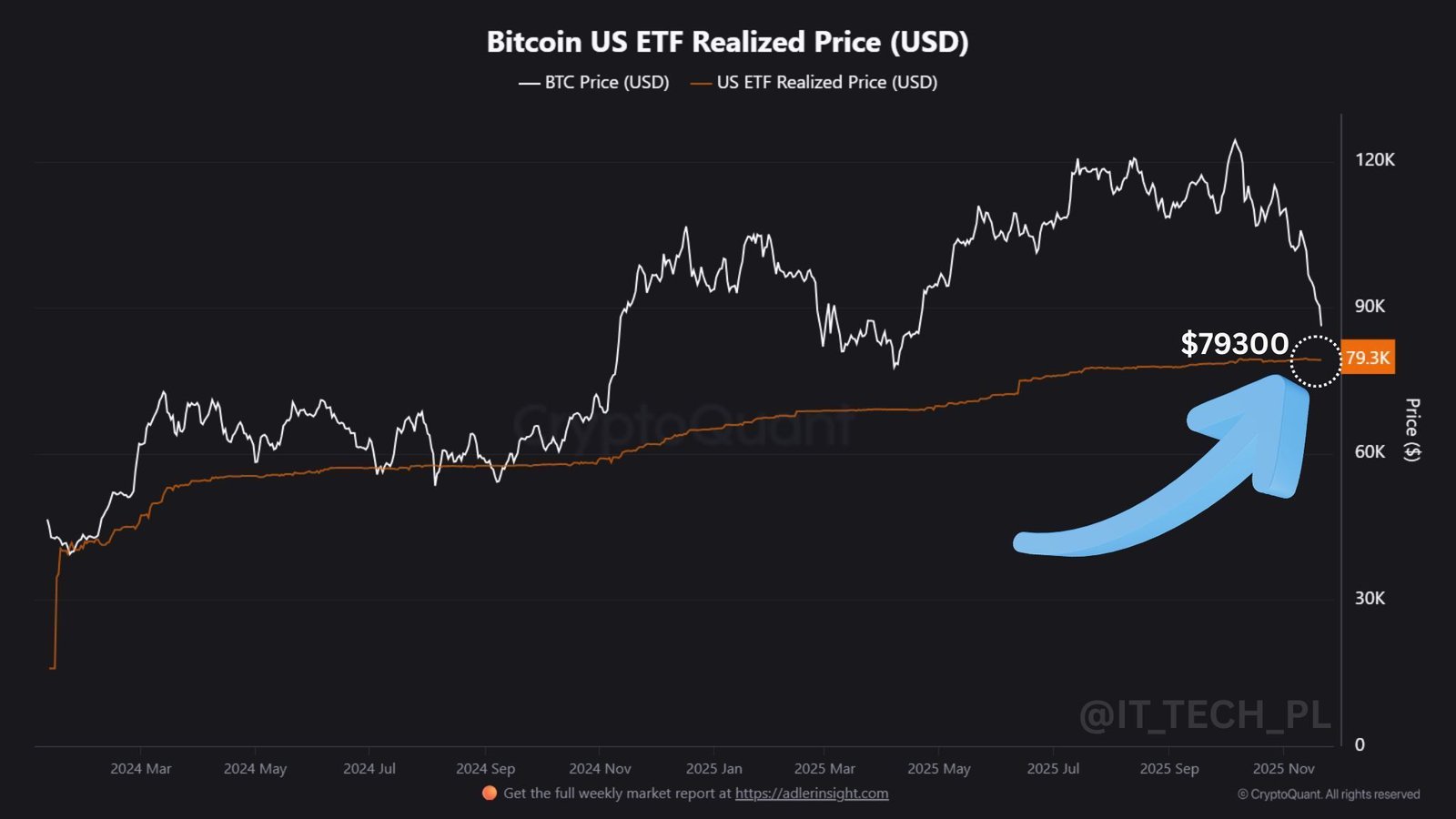

- Bitcoin nears the $79,300 realized price as ETF buyers face their first major volatility test.

- CoinGecko data shows Bitcoin down 12 percent weekly, stressing new entrants across ETF platforms.

- Daan Crypto Trades tracks a 0.382 Fibonacci zone near $84,000 after a 30 percent pullback.

- October’s liquidation wave exceeded $20 billion in a day, shaping the current market backdrop.

Bitcoin trades near a level that could shape behavior among new ETF buyers. Market participants track $79,300 as a pressure point for recent entrants.

Data from CoinGecko shows price weakness after a sharp weekly decline. The shift comes as analysts highlight key retracement levels during the latest correction.

Bitcoin ETF Buyers Confront Rising Pressure at $79,300

Bitcoin ETF buyers face their first meaningful stress point, according to IT Tech, who marked $79,300 as the realized price that defines sentiment. He noted that ETF flows often appear institutional, though activity largely comes from retail accounts using brokerage apps.

This creates sensitivity at the stated threshold, where confidence tends to shift quickly. He warned that prolonged trading below this level may trigger a new wave of selling from investors unused to large crypto drawdowns.

At publication, Bitcoin trades near $84,197 based on CoinGecko data. The figure reflects a 1.77 percent daily decline. It also represents a 12.30 percent slide over the past week amid broader market unwinding. This puts the current price within reach of the level that IT Tech described as a stress zone for new entrants.

Daan Crypto Trades added context using weekly Fibonacci levels from recent cycle lows to highs. His chart showed 0.382 retracements aligning with major correction bottoms throughout the current cycle.

He pointed to similar percentage declines that occurred during earlier pullbacks, despite larger nominal moves as Bitcoin advanced. His overview suggested that BTC now sits near a similar confluence around $84,000 after a 30 percent retreat from 2025 highs.

Historical Patterns Meet Uncertain Market Conditions

Recent moves follow what Daan described as a consistent correction rhythm through past cycles. He referenced retracements seen in the 2013, 2017, and 2021 bull markets, where similar patterns preceded renewed advances.

Bitcoin’s current structure shows a comparable setup, though traders remain alert to broader liquidity concerns. This includes leverage tied to stablecoin activity and the rapid unwind seen after early October volatility.

The sharp liquidations that began around October 10 still shape market behavior. That period produced more than $20 billion in wiped-out positions within a single day.

As previously reported by Blockonomi, it pushed total losses above $41 billion for the month despite limited macro shocks. Many traders continue to evaluate whether those events marked the start of a deeper reset or a temporary flush.

Bitcoin now trades in a zone where realized price, Fibonacci support, and market sentiment converge. ETF buyers continue to watch the same threshold. The next sessions may reveal whether the level becomes support or triggers further outflows from newly exposed retail traders.

The post Expert Outlines $79,300 as Key Level To Watch For Bitcoin ETF Buyers: Here’s Why appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.