The Bipartisan Policy Center says the US government’s multi-trillion dollar debt is now a clear threat to national security.

The Washington-based think tank highlights in a blog post that the US shelled out nearly $1 trillion just to pay the interest of its ballooning national debt during the 2024 fiscal year (FY), which ran from October 1st, 2023 to September 30th, 2024.

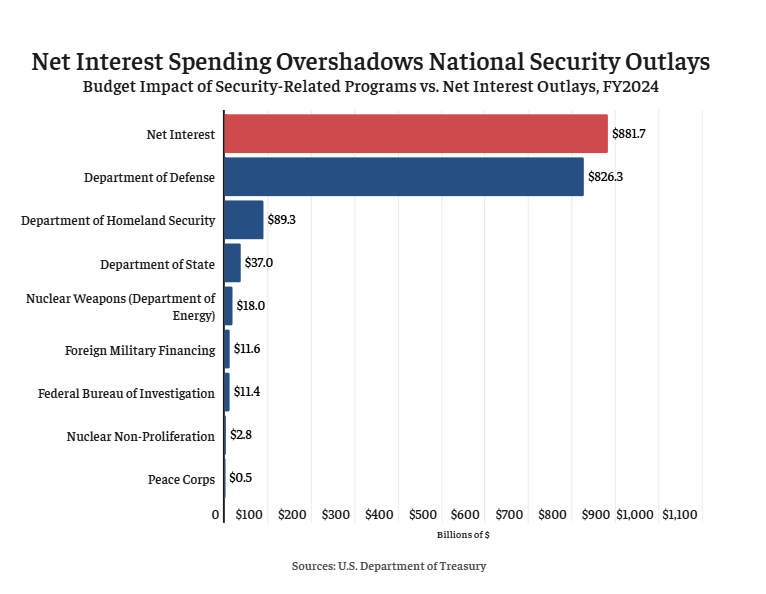

The organization notes that in FY 2024, net interest spending has overtaken the budget spent on various US national security programs.

“A large and growing national debt poses long-term economic and security risks to the United States. Those risks are becoming more evident. In fiscal year (FY) 2024, the US spent $882 billion on interest payments (to service its borrowing).

In comparison, the total national defense discretionary spending for FY2024 was $874 billion, plus billions more in other important national security areas.”

The Bipartisan Policy Center also warns that the growing US national debt is increasing pressure on lawmakers to strip spending on government programs such as national defense in an effort to reduce large budget deficits.

“If left unchecked, high debt service costs will eventually crowd out other priorities, potentially undermining the ability to protect our nation and support our allies.

Increased debt service costs will crowd out public investments in defense and make it more expensive to borrow to respond effectively to future crises. Heightened dysfunction of the federal budget process only exacerbates this threat, as national security agencies require stability and predictability to ensure military readiness.

The US will need the budgetary capacity to meet emerging national security challenges in a changing world.”

The organization is calling on the US government to right the ship now otherwise the country runs the risk of losing its global military dominance.

“Stabilizing the debt and putting fiscal policy on a more sustainable course is vital for ensuring the country is able to maintain our military edge, engage in effective diplomacy and cooperation with our allies, and respond to future emergencies.”

At time of writing, the US national debt stands at $36.03 trillion.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $36,000,000,000,000 US Debt Is National Security Issue As Massive Interest Payments Mount: Washington-Based Think Tank appeared first on The Daily Hodl.

The Bipartisan Policy Center says the US government’s multi-trillion dollar debt is now a clear threat to national security. The Washington-based think tank highlights in a blog post that the US shelled out nearly $1 trillion just to pay the interest of its ballooning national debt during the 2024 fiscal year (FY), which ran from

The post $36,000,000,000,000 US Debt Is National Security Issue As Massive Interest Payments Mount: Washington-Based Think Tank appeared first on The Daily Hodl. Financeflux, debt, interest, News, Trillion, US Debt, US National Debt

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.