The number of US banks saddled with major issues continues to climb, according to new numbers from the Federal Deposit Insurance Corporation (FDIC).

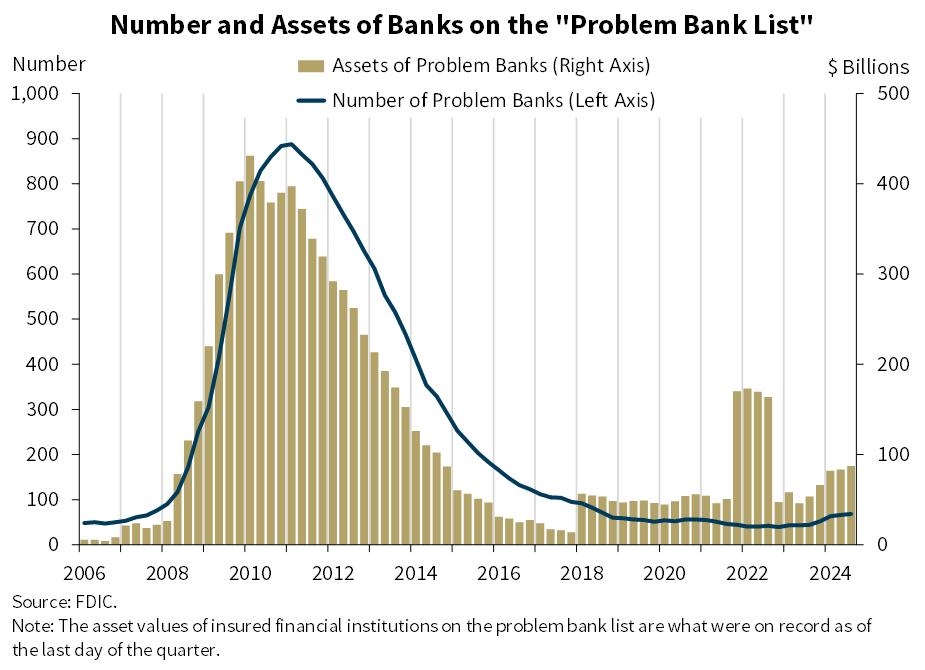

In its Quarterly Banking Profile report, the FDIC says the number of US lenders on its “Problem Bank List” rose to 68 in Q3.

The figure represents the fifth quarterly increase in the number of banks receiving a rating of 4 or 5 on the CAMELS rating system since Q2 of 2023.

A lender with a CAMELS rating of 4 indicates that the firm is experiencing financial, operational or managerial weaknesses – or a combination of such issues – that could reasonably threaten its soundness if unresolved. Meanwhile, a bank with a 5 score on the CAMELS system suggests it is critically falling short in one or more areas and requires abrupt remedial attention.

“Total assets held by problem banks rose $3.9 billion to $87.3 billion. Problem banks represent 1.5 percent of total banks, which is within the normal range of 1 to 2 percent of all banks during non-crisis periods”

Meanwhile, the amount of unrealized losses on banks’ balance sheets has dropped.

The FDIC says banks are burdened with $364 billion in paper losses as of the third quarter of this year, largely due to exposure to the residential real estate and Treasury markets.

Unrealized losses represent the difference between the price banks paid for securities and the current market value of those assets.

The banks’ paper losses declined in the third quarter by $148.9 billion from $512.9 billion reported in Q2.

However, FDIC Chair Martin J. Gruenberg says the decrease in banks’ paper losses last quarter is only temporary.

According to Gruenberg, changes in longer-term interest rates since the end of Q3 indicate that US banks are likely now holding unrealized losses at closer to half a trillion dollars.

“Increases in longer-term interest rates since the end of the third quarter would likely reverse most of these improvements in unrealized losses if measured today.”

While Gruenberg reiterates the resilience of the banking industry, the FDIC chair notes that a handful of headwinds continue to threaten US lenders.

“The industry still faces significant downside risks from the continued effects of inflation, volatility in market interest rates, and geopolitical uncertainty. These issues could cause credit quality, earnings and liquidity challenges for the industry.

In addition, weakness in certain loan portfolios, particularly office properties, credit cards, auto and multifamily housing loans, continues to warrant close monitoring. These issues will remain matters of ongoing supervisory attention by the FDIC.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post FDIC Warns 68 US Banks in Danger of Insolvency As Lenders Face $364,000,000,000 in Unrealized Losses appeared first on The Daily Hodl.

The number of US banks saddled with major issues continues to climb, according to new numbers from the Federal Deposit Insurance Corporation (FDIC). In its Quarterly Banking Profile report, the FDIC says the number of US lenders on its “Problem Bank List” rose to 68 in Q3. The figure represents the fifth quarterly increase in the

The post FDIC Warns 68 US Banks in Danger of Insolvency As Lenders Face $364,000,000,000 in Unrealized Losses appeared first on The Daily Hodl. Financeflux, FDIC, News, Problem Bank List, Unrealized Losses, US banks

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.