Liquidity pools are the foundation of DeFi, ensuring easy and direct trading without involving third parties. However, some of these liquidity pools are very different from each other. Scammers are active in some, devising various ways to swindle investors of their hard-earned cryptocurrencies.

Let us consider crypto pools, how fake ones work, and how to avoid such scams.

What Are Crypto Pools?

Smart contracts lock cryptocurrency funds to create crypto pools. These liquidity pools (commonly called LPs) let users trade their liquidity against popular cryptocurrencies, eliminating the need for order books. Liquidity providers contribute their money and tokens to the pool. For this, they get incentives, which include transaction fees or governance tokens, among others.

Source: X

But here’s the catch: it is common to find fraudulent individuals performing an initial coin offering and disappearing with the money or simply liquidating the customer’s coins without their knowledge. This makes it crucial to learn the signs to look out for and how you can guard your investments.

How Fake Crypto Liquidity Pools Work

The fake crypto liquidity pools work as normal pool services but use misleading methods like rug pulls. Here’s how it happens:

Many of the memecoins are SCAMS

Scammers create rug pulls and steal your liquidity!

They will be enraged that I exposed their scam methods.

Here’s how to protect yourself before it’s too late

pic.twitter.com/gzJAzHpj4N

— 0xDarya

(@0xDarya_) November 30, 2024

- Set Up the Pool: Developers deposit tokens against their tokens in a pool with a generally recognized currency like Ether or USDT.

- Hype the Token: They lure investors through flashy advertisements and mouth-watering, attractive rates of return on investment.

- Pull the Rug: Enough money is attracted, and then the scammers take out the liquidity, and the investors receive nothing.

Real-life example: Meerkat Finance lured investors in 2021 and drained $31 million from its liquidity pool, claiming a “smart contract compromise.” Another project, Swaprum, disappeared with $3 million in 2023 and deleted all social media profiles.

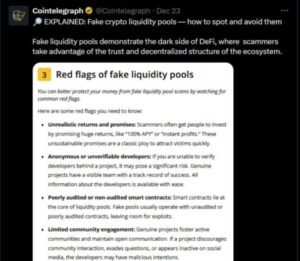

How to Spot Fake Crypto Liquidity Pools

Source: X

Too-Good-To-Be-True Returns

Anything that promises doubling money within a single day should ring an alarm. Real investments do not give such a high rate of return.

Anonymous Developers

It is better to be careful if you have little or no information about the team behind some projects. Legitimate projects have transparent, experienced teams.

Non-Audited Smart Contracts

Scammers often skip audits to avoid scrutiny. Verify if the pool’s smart contract has undergone proper third-party audits. This is an easy one to check out. Don’t skip it.

Inactive Communities

Crypto projects are healthy if users are active and developers are always courteous in replying to users’ inquiries. It is important not to engage in projects with few or no social shares and to beware of communities controlled by bots.

Suspicious tokenomics

Manipulation will likely rise when insiders or developers keep many tokens.

Source: X

Conclusion

While liquidity pools drive DeFi forward, several scams stem from fake ones. These are the red flags you should avoid to protect your investments. It also shows that doing research will help you avoid getting scammed. Do not forget the adage, ‘He who pays the piper calls the tune,’ or the reality that not all ‘shining’ coins are cryptos. Stick with legitimate crypto pools, and you’ll be all good.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post How to Avoid Fake Crypto Liquidity Pools appeared first on Altcoin Buzz.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.