Institutional adoption of Solana is accelerating, with Franklin Templeton bringing its OnChain U.S. Government Money Fund (FOBXX) to the network—a move that could significantly reshape its investment landscape.

The news initially sent SOL soaring by 5%, as investors welcomed the latest sign of growing institutional confidence. However, broader market stagnation has since weighed on its momentum, leaving traders wondering if this could be the catalyst to push SOL to new highs.

Franklin Templeton Makes First Move on Solana

Franklin Templeton took to X on February 12 to announce that its Nasdaq-listed $594 million money market fund FOBXX will now be offered on Solana.

FOBXX enables investors to gain exposure to U.S. government securities, cash, and repurchase agreements through a tokenized fund.

With a share price of $1, the fund’s BENJI token closely resembles a yield-bearing stablecoin.

This move expands Solana’s institutional exposure, reinforcing its appeal as a high-performance blockchain for traditional finance (TradFi) adoption.

SOL Price Analysis: Could FOBXX push Solana to $10,000?

Institutional adoption appears to be front-loading Solana price forecasts this cycle.

FOBXX and the recent SEC acknowledgment of several U.S. Solana Exchange Traded Fund (ETF) applications stand to see Solana demand bolstered.

While a $10,000 target remains distant, technical indicators suggest strong upside potential for Solana.

A symmetrical triangle forming since mid-January is nearing its conclusion—a pattern that often signals explosive price moves.

Should a breakout materialize, SOL could surge 55% to $295.50, revisiting past highs.

However, a larger cup-and-handle formation—dating back to 2021—hints at an even bigger breakout target of $380, a 100% increase from current levels.

Despite these bullish structures, momentum remains weak.

The Relative Strength Index (RSI) remains in bearish territory at 38, a sign that the bulls may not have the backing they need to push forward.

More so, the MACD line maintains a firm side trend below the signal line, signaling that the bulls are not building momentum either.

A potential restest of lower support at the 200SMA could determine whether the triangle pattern holds—or if a deeper correction is ahead.

Increased Adoption Poses a Problem: This New ICO is the Solution

While increased demand for the Solana network could bolster the SOL price, it also stands to magnify its biggest flaw: scalability.

Post-inauguration, a new wave of “meme coin mania” has made the Solana network a goldmine for 10-100x meme coins, but the trading volume it brings has taken a toll.

As any user would know, failed transactions are the platform’s biggest gripe.

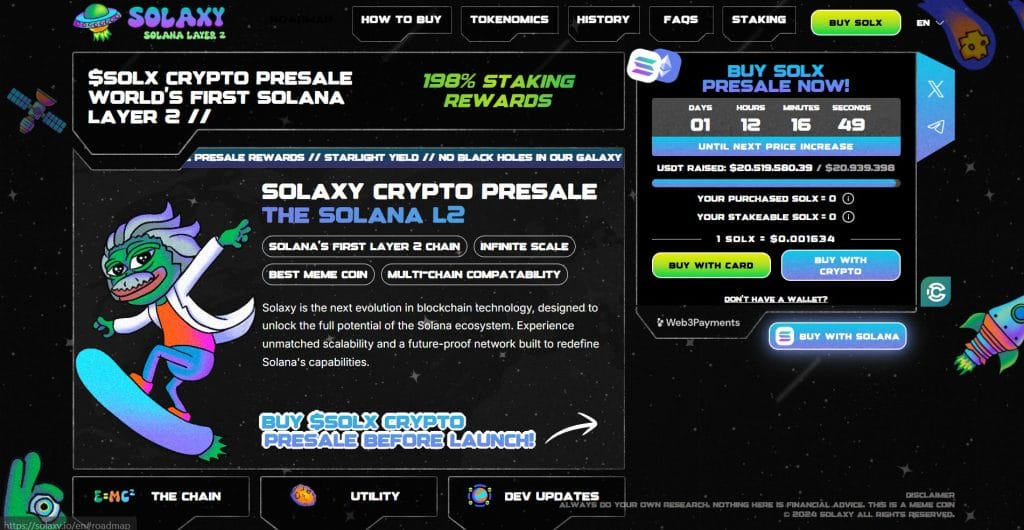

Well, Solaxy ($SOLX), the first-ever Layer-2 solution built on Solana, heeds the answer to this call—all the while riding its tailwinds.

Unlike Ethereum, which boasts several Layer-2 options, Solana has long lacked this capability—until now.

And Investors are flocking, with over $20.5 million raised in one of the biggest presales right now.

By processing transactions off-chain and finalizing them on Solana, Solaxy significantly reduces congestion and lowers transaction costs, while offering seamless interoperability across both blockchains.

To reward early adopters, Solaxy currently offers staking yields of 199%, though these rates will decrease as more users stake $SOLX.

For the latest updates on the project, connect with the Solaxy community on X and Telegram.

The post Institutional Money Flows Into Solana – Could Franklin Templeton’s Move Push SOL to $10,000? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.