Intel’s blockbuster deal with Nvidia to jointly design custom PC processors containing RTX GPUs gives Nvidia an entry point into the vast majority of laptops even as Intel trades some of its future away in return for cash.

Although the mammoth Intel-Nvidia deal has ramifications both for the data center as well as the PC, it’s the integration of Nvidia’s GPU and Intel’s CPU that will be the most impactful. And while that could affect Intel’s desktop SOC roadmap that includes integrated CPUs, the most natural fit is how it will affect Intel’s mobile roadmap. We’re now told that the Nvidia-Intel chips will be in addition to Intel’s current roadmap.

According to both companies, “Intel will build and offer to the market x86 system-on-chips (SOCs) that integrate NVIDIA RTX GPU chiplets,” the companies said. “These new x86 RTX SOCs will power a wide range of PCs that demand integration of world-class CPUs and GPUs.”

According to Jensen Huang, Nvidia’s chief executive, the impact on Intel’s mobile processors is fairly straightforward. “It fuses the CPU and Nvidia GPU, RTX GPU, using NVLink, and it fuses these two dies into one, essentially a virtual giant SOC that would become essentially a new class of integrated graphics laptops that the world’s never seen before,” he said during a conferendce call with financial reporters on Thursday.

“That segment of the market is really quite rich, and it’s really quite large, and it’s underserved today,” Huang added — referring to Nvidia, at least.

Essentially, the deal pairs two of the biggest names in the notebook chip market. Intel, though it has suffered market-share losses in the desktop space, controls just under 80 percent of the mobile PC processor market, according to Mercury Research. Nvidia, meanwhile, owns a 94 percent share in discrete graphics chips, and gaming laptops that do include AMD silicon usually do so as part of the CPU, not the GPU — even though AMD’s mobile “Fire Range” HX3D offers the advantages of its Ryzen X3D desktop cousins. AMD also has another problem: the HX3D CPUs are found just within a handful of laptops, like the MSI Raider A18, whose CPU is combined with an Nvidia RTX 5090 GPU.

The Nvidia-Intel partnership is aimed at premium devices across a wide range of markets, including consumer, creator, the education market, and gaming. It involves multiple generations of products, and development is already underway. It should be complementary to Intel’s existing roadmap, I’m told — Intel’s current roadmap remains the same.

Still, the pairing of both Nvidia and Intel inside notebook PCs feels like a case of the rich getting richer.

Is history repeating itself?

A reliable source close to Intel said that Nvidia and Intel had been in contact about a similar partnership when Pat Gelsinger was still the company’s chief executive, as a way of bringing in additional funding. Huang confirmed that talks began a year ago.

The deal, which also includes a partnership for Intel and Nvidia to co-design chips for the data center, opens up every socket Intel owns to Nvidia IP, the source said. Michelle Johnston Holthaus, the former co-CEO and head of Intel Product, called it a “deal with the devil,” the source said. Johnston Holthaus, who had worked at the company for decades, left Intel as part of a recent restructuring.

In 2017, Intel and rival AMD launched something similar: a partnership between an Intel CPU and an AMD GPU that produced the “Kaby Lake G” chip. At the time, AMD held the reins in the integrated GPU market; Intel couldn’t quite keep up. The Kaby Lake-G chip was predicated upon the the Embedded Multi-die Interconnect Bridge, or EMIB, which connected various silicon dies within the chip package. Technically, the Kaby Lake-G chip was a success. However, the combined chip eventually floundered for lack of driver support, and the effort faded away into history.

The Nvidia-Intel partnership, backed by a $5 billion investment, appears headed in a different direction.

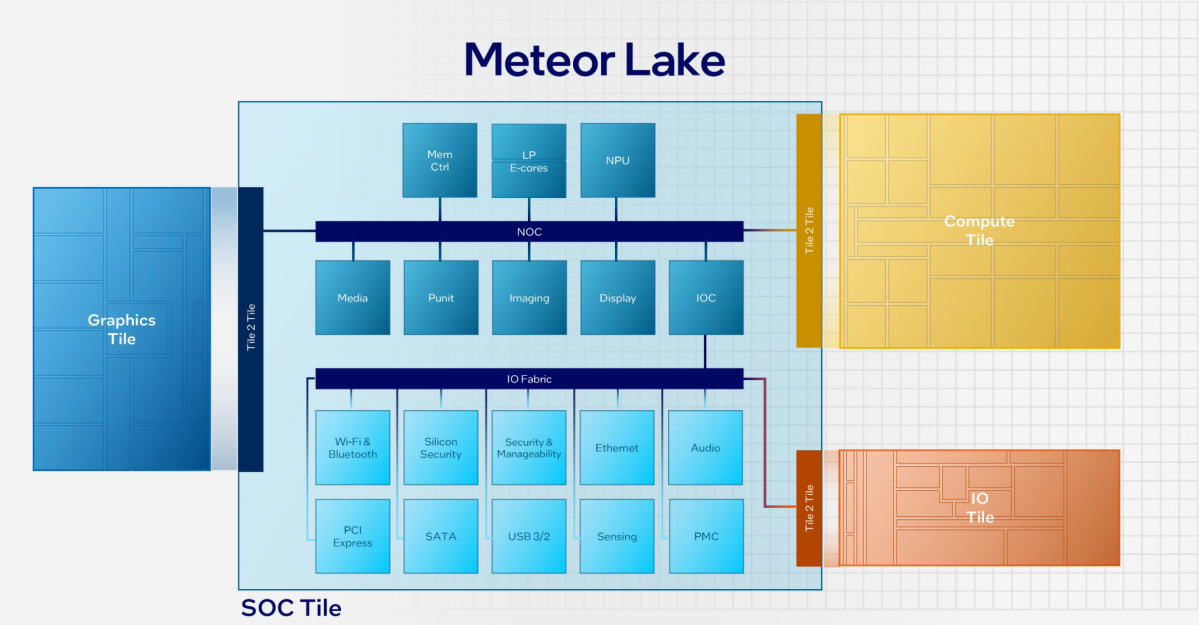

Intel’s mobile processors are built on a chiplet architecture, where various tiles are placed inside a package and then connected together. Within Intel’s first-generation Core Ultra tile diagram (code-named “Meteor Lake”), various tiles or chiplets were connected together, with separate tiles allocated to the compute, graphics, IO, and the main SOC tile. Intel’s Core Ultra Series 2 (Lunar Lake) took a different approach, reorganizing the tiles, but the overall architecture was the same — chiplets or “tiles,” all connected.

Because of Intel’s ongoing struggles with its own manufacturing, Intel’s mobile CPUs were made up of a combination of internally-developed CPU tiles and externally-fabricated chiplets, made by TSMC. The flexibility of the tiled architecture allowed Intel to mix and match pieces of intellectual property from inside and outside of its own factories, and it stands to reason that Nvidia GPU tiles could be designed to “drop in” to an integrated Intel CPU.

As our Core Ultra Series 2 tests showed, Intel’s Core Ultra Series 2 (Lunar Lake) already slightly outperforms AMD’s Ryzen AI 300 CPU in terms of gaming benchmarks. While there’s no guarantee that AMD couldn’t catch up with an improved GPU option in future mobile SOCs, on paper Nvidia would offer an advantage. The real question will be what Nvidia will contribute to the partnership: what GPU architecture would appear in these GPUs, how many graphics cores there will be, how many ray-tracing units, how much power would be allocated to the GPU, and so on. All of these questions would affect the real-world performance of the Intel-Nvidia CPU roadmap.

Nvidia won’t use Intel’s foundries to manufacture its GPU chiplets. However, it will be an Intel customer of Intel CPUs, which it will package with Nvidia GPUs for the data center. Neither company commented on the exact process — from either TSMC or Intel — that would be used.

Though the U.S. government transformed its XX investment in Intel into an equity stake, Huang didn’t really answer the question when asked why it, too, took an equity stake. “We were delighted to be a shareholder, and we’re delighted to have invested in Intel, and the return on that investment is going to be fantastic, both, of course, in our own in our own business, but also in in our equity share of Intel,” he said.

One of Intel CEO Lip-Bu Tan’s top-ten priorities is to strengthen Intel’s balance sheet, Tan said during the call.

Questions about the deal

When most enthusiasts think of Nvidia GPUs, for example, they leap right to the Nvidia GeForce RTX 40- and 50-series GPUs. But Nvidia shipped entry-level MX-series parts like the MX250, MX330, and MX350 GPUs for years, up until 2020 or so, based on the ancient “Pascal” architecture. Those GPU s allowed basic gaming, but couldn’t hold a candle to a “true” discrete GPU. How much horsepower will Nvidia supply?

Another question: integration with external GPUs. Given Nvidia’s dominance in the PC space, any outside connection to an external GPU by an Intel-Nvidia SOC would likely pair directly with an Nvidia GPU itself. Typically, PC components use PCI Express to connect to an external graphics card; could Intel and Nvidia architect a proprietary graphics bus from the CPU to the GPU?

“The companies will focus on seamlessly connecting Nvidia and Intel architectures using Nvidia NVLink,” according to the company’s press release. However, NVLInk has been strictly relegated to clusters of servers in the data center. Still, the question intrigued at least one analyst.

“On PC, a high performance notebook with tightly-coupled Intel+NVIDIA seems strong for AI, gaming and workstation,” Pat Moorhead, the founder of Moor Insights and Strategy, wrote on Twitter. “While deets are slim, it’s interesting to think about multi-GPU configs (are we back?)”

Adam Patrick Murray / Foundry

So far, Intel has said nothing publicly about the fate of its own Intel Arc GPU, which serves as the integrated 3D GPU core within Intel’s Core Ultra chips and also as a standalone graphics chip — though the company’s market share is basically zero. Integrated graphics are fine, but our tests show games really demand a discrete GPU at higher resolutions. In one source’s view, Intel could wind down its integrated GPU efforts, than the discrete Arc project, and let Nvidia take over.

That might not be the case, however. “We’re not discussing specific roadmaps at this time, but the collaboration is complementary to Intel’s roadmap and Intel will continue to have GPU product offerings,” an Intel representative said.

Intel’s own CPU roadmap, meanwhile, includes a path to “Panther Lake” this fall and beyond. So far, Intel has talked up its CPU and NPU expertise, with 3D graphics out of the picture. That’s going to have to be a focus going forward.

Nvidia’s aspirations into the PC processor market were well known, and many believed that Nvidia would either take an Arm license or work with a company like Mediatek to enter the PC space with a chip reportedly known as the N1X. Another question: are those plans dead? So far, we don’t know.

While the latest deal doesn’t rule those strategies out, it does offer Nvidia another way into the heart of the PC, the CPU. The financial investment, alongside the stake the U.S. government took to help ensure Intel’s foundry aspirations remain on track, certainly will serve as reins to guide Intel’s way forward.

In any event, both Qualcomm and AMD could find it much more challenging to compete within the PC space.

AMD doesn’t seem worried. “Overall, AMD continues to consistently execute our x86 leadership roadmap, delivering high-performance products that power everything from PCs to data centers,’ a spokesman for AMD said. “We are confident in our ability to continue driving innovation and market share growth and reinforcing AI as the company’s top strategic priority.”

Still, the big are getting bigger, and both AMD and Qualcomm — CPU players hoping to escape their niche status and move mainstream — will find it an even more uphill battle unless they find an edge.

Additional reporting by Brad Chacos. This story was updated at 11:54 AM with additional information.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.