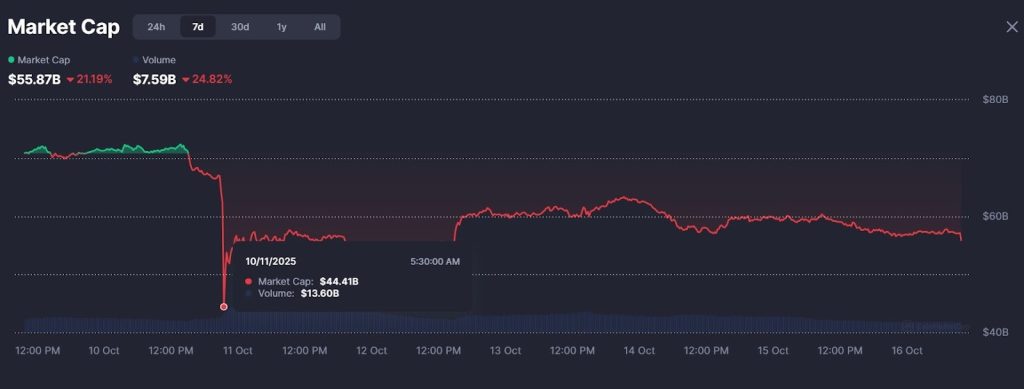

The once-booming meme coin sector has suffered one of its sharpest declines this year, with nearly $28 billion wiped out in less than 48 hours as traders rushed to exit amid a wider crypto market crash.

According to data from CoinMarketCap, the total market capitalization of meme-based tokens fell to $44 billion on Saturday, down almost 40% from $72 billion the previous day.

The crash dragged the sector to levels last seen in July, erasing months of steady growth fueled by Solana and BNB Chain trading activity.

A modest recovery followed on Sunday, lifting the market back to $53 billion, but that remained well below its recent peak of $77 billion.

At the time of writing, the meme coin market stands at around $57 billion, still far below its recent highs.

The sell-off followed Friday’s sharp market-wide crash, which erased over $19 billion in leveraged positions across crypto after U.S. President Donald Trump announced plans to impose a 100% tariff on Chinese imports.

After Months of Mania, Meme Coin Markets Face Harsh Correction

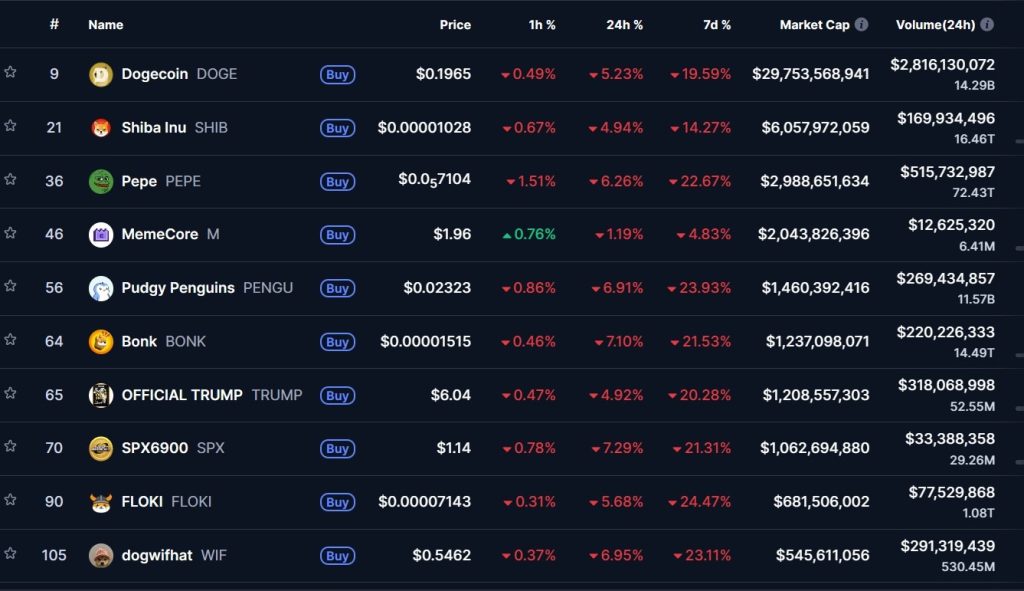

Meme coins, which are typically driven by retail speculation, were among the hardest hit. Dogecoin, the largest meme coin by market capitalization, fell nearly 20% over the week to around $0.19. Shiba Inu dropped 13%, while Pepe lost more than 21%.

Other major tokens, such as BONK and FLOKI, also shed over 20% of their value in the same period.

Collectively, the top 10 meme tokens now account for roughly $47 billion, about 82% of the total market cap, and all are currently trading in the red on both daily and weekly charts.

Additionally, even politically themed tokens were not spared, as the official meme coin linked to U.S. President Donald Trump dropped 20% over the week, extending losses across a market already struggling to stabilize.

For most of 2025, Solana and BNB Chain have dominated meme activity, each hosting massive trading volumes and rapid token launches.

BNB Chain, in particular, had recently surpassed $38.7 billion in value with $335 million in daily trading volume, driven by an influx of new meme projects.

From late September to early October, a lot of BNB meme coins were seeing a lot of attention, with tokens like $4, BSC, PALU, 币安人生 (“Binance Life”), and many others surging by tens of thousands of percent before collapsing.

Data from Bubblemaps shows that over 100,000 traders had joined the BNB meme coin frenzy at its height, with nearly 70% in profit.

However, most of the tokens collapsed by as much as 95%, wiping out hundreds of millions in value after CZ warned that he does not endorse any of the tokens.

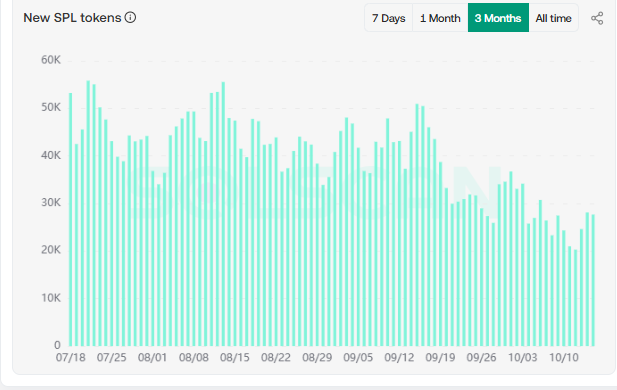

Meanwhile, activity within the Solana ecosystem, once the hub of meme coin creation, has also cooled sharply.

According to Solscan data, the number of newly minted SPL tokens, which includes meme coins, dropped by about 50% from early August to mid-October, falling from about 60,000 per day to as low as 30,000.

Weekly launchpad volumes on Solana have also declined from a peak of $1.5 billion in July to roughly $600 million by late September, reflecting waning retail enthusiasm and liquidity.

Meme Coin Boom Masks Uneven Profits as Platforms Rake in Millions

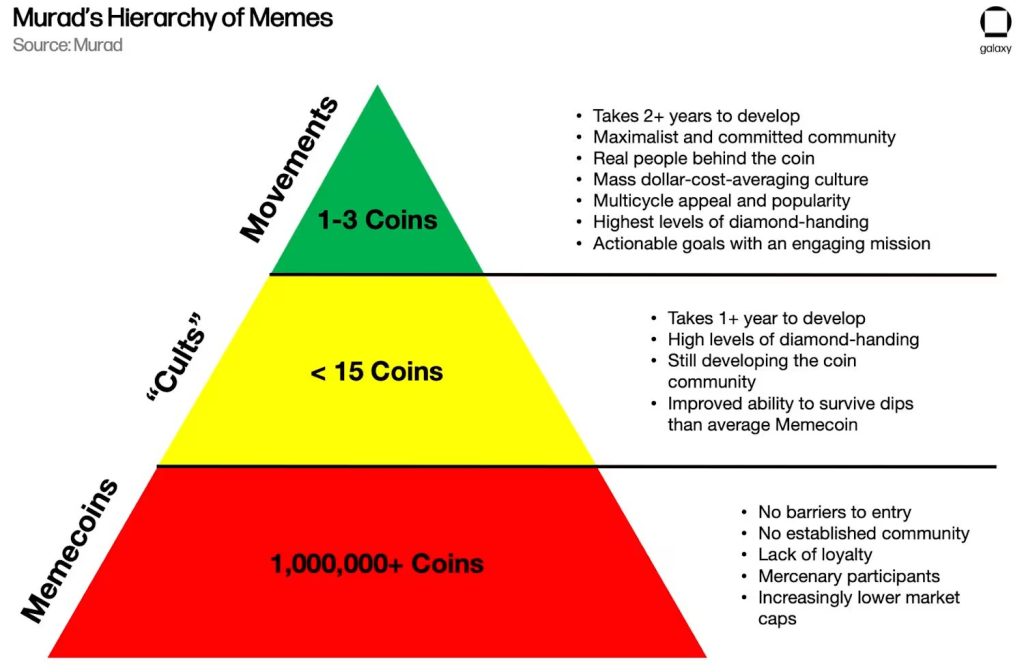

Meme coins, which began as a lighthearted corner of crypto trading, have grown into a multi-billion-dollar market dominated by hype, speculation, and community-driven trends.

MetaTech Insights valued the meme coin market at $68.5 billion in 2024 and projected it could reach $925 billion by 2035, but the latest downturn shows the volatility that continues to define this sector.

While meme coins are set for more growth, most of the profits end up elsewhere in the hands of the platforms that launch and trade them, according to a new report from Galaxy Research.

For example, trading tool Axiom has generated over $200 million in fees with fewer than 10 employees, while BONKbot and Trojan earn steady revenue by charging users to automatically snipe new tokens at launch.

The study also found that meme coin traders typically lose money in what resembles a short-term gambling market, while infrastructure providers such as launchpads, decentralized exchanges, and trading bots collect millions in fees.

As the meme coin market struggles to stabilize, other crypto sectors have shown quicker signs of recovery.

Non-fungible tokens (NFTs) rebounded 10% after a 20% drop during the sell-off, regaining about $600 million in value.

Crypto ETFs also saw renewed inflows, with spot Bitcoin ETFs adding $102 million and Ether ETFs attracting $236 million on Tuesday.

Bitcoin has climbed back above $111,000 after briefly dipping to $102,000, while Ether has recovered to above $4,000 from lows near $3,700.

The post Meme Coin Market Crash: $28 Billion Vanishes as Prices Plunge 40% to July Lows appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

BNB memecoins have dropped as much as 95% after

BNB memecoins have dropped as much as 95% after