TLDR

- MicroStrategy’s stock hit record high after $4.6B Bitcoin purchase

- Company stock up 500% in 2024

- Currently holds 331,200 BTC with $13.7B in unrealized profits

- Plans to raise $1.75B through zero-interest convertible notes

- Previous similar debt issuances in September and June successful

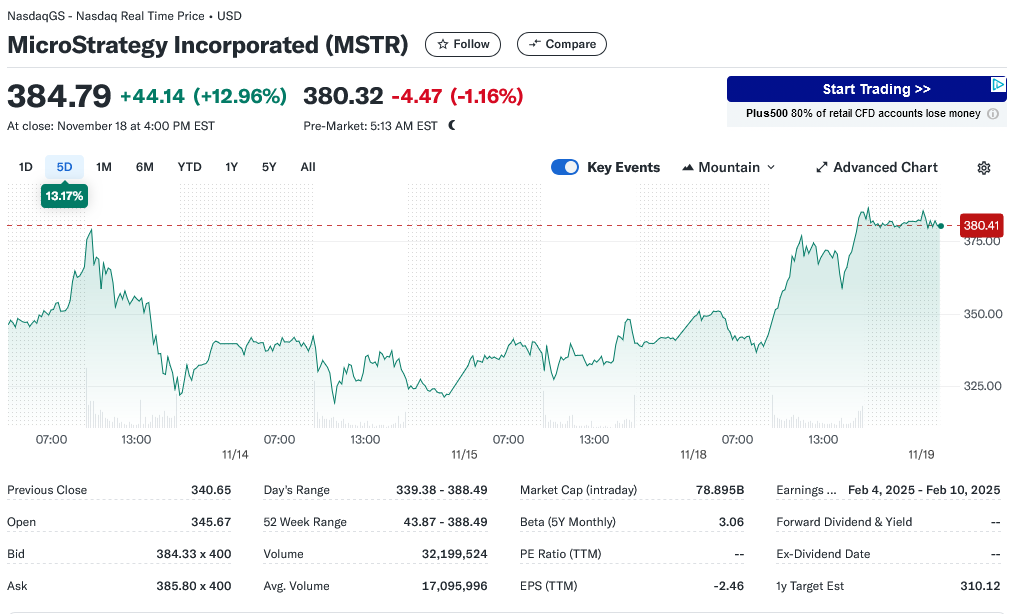

The business intelligence company MicroStrategy has expanded its Bitcoin holdings with a $4.6 billion purchase, leading to a record-breaking surge in its stock price. The company’s shares jumped 13% on Monday, marking another milestone in its aggressive cryptocurrency investment strategy.

MicroStrategy’s stock performance has been remarkable in 2024, with shares increasing by 500% since January. This growth substantially outpaces other major companies in the S&P 500 index, including tech giant Microsoft, which has seen an 11% increase during the same period.

Under the leadership of Michael Saylor, MicroStrategy has accumulated 331,200 Bitcoin at an average purchase price of $88,627 per coin. This investment strategy has resulted in approximately $13.7 billion in unrealized profits, based on current market prices.

The company continues to pursue its Bitcoin acquisition strategy through innovative financing methods. MicroStrategy has announced plans to raise $1.75 billion through senior convertible notes, which will mature in December 2029. These notes carry a 0% interest rate, making them an attractive financing option for the company.

This latest financing initiative follows similar successful debt issuances by MicroStrategy. In September, the company raised $875 million through convertible senior notes set to mature in 2028. Another round of note issuance took place in June, with those notes scheduled to mature in 2032.

The zero-interest convertible notes represent a strategic approach to acquiring Bitcoin. This financing method allows MicroStrategy to access capital without incurring interest expenses, which they then use to purchase additional Bitcoin. The strategy relies on Bitcoin’s price appreciation over future market cycles.

For investors, these convertible notes offer unique benefits. Noteholders have the option to convert their debt into MicroStrategy shares, which has proven valuable given the company’s strong stock performance. This conversion feature provides potential upside while maintaining downside protection.

The risk management aspect of these notes is noteworthy. If investors choose not to convert their notes to shares, they receive their principal back at maturity. This structure creates a relatively low-risk investment opportunity for those interested in gaining indirect exposure to Bitcoin’s price movement.

Monday’s stock performance demonstrated continued market confidence in MicroStrategy’s strategy. The 13% increase pushed the company’s shares to new heights, validating the market’s approval of their Bitcoin-focused approach.

The company’s treasury management strategy has evolved considerably since its initial Bitcoin purchase. MicroStrategy has refined its approach to acquiring and holding Bitcoin, using various financial instruments to optimize its position.

Current market conditions have favored MicroStrategy’s strategy. Bitcoin’s price appreciation has contributed to the company’s unrealized profits, while low interest rates have enabled favorable financing terms.

The timing of this latest announcement coincides with increased institutional interest in cryptocurrency. MicroStrategy’s approach has created a template for other companies considering similar treasury management strategies.

Trading volume for MicroStrategy shares has increased notably following the announcement. Market participants have shown strong interest in both the company’s stock and its convertible notes.

The company’s current Bitcoin holdings make it one of the largest corporate holders of the cryptocurrency. This position has made MicroStrategy a closely watched indicator of institutional cryptocurrency adoption.

MicroStrategy’s latest financing round and Bitcoin purchase represent a continuation of their established strategy rather than a departure from it. The company maintains its focus on Bitcoin acquisition through carefully structured financial instruments.

The post MicroStrategy Acquires $4.6 Billion in Bitcoin as Stock Hits Record High appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.