TLDR:

- MicroStrategy bought 51,780 Bitcoin for $4.6 billion, bringing total holdings to 331,200 BTC

- Company plans to raise additional $1.75 billion through convertible notes for more Bitcoin purchases

- MicroStrategy now owns 1.58% of total maximum Bitcoin supply

- Major Wall Street firms including Vanguard and Morgan Stanley are increasing their MSTR holdings

- Company stock (MSTR) is up 485% this year, outperforming Bitcoin’s 112% gain

MicroStrategy, the business intelligence company turned Bitcoin treasury firm, has made its largest cryptocurrency purchase to date, acquiring 51,780 Bitcoin for $4.6 billion. This latest move brings the company’s total Bitcoin holdings to 331,200 BTC, valued at over $30 billion at current prices.

The Virginia-based company completed the purchase between November 11 and November 17, according to an SEC filing. The average purchase price was $88,627 per Bitcoin, adding to the company’s existing holdings which were acquired at an average cost of $49,874 per coin.

Not content with this massive purchase, MicroStrategy announced plans on Monday evening to raise an additional $1.75 billion through zero-interest convertible senior notes. These notes, set to mature in 2029, will be offered exclusively to qualified institutional buyers and could potentially fund the purchase of approximately 19,000 more Bitcoin.

The convertible notes offer flexibility to holders, who can convert them into cash, MicroStrategy stock, or a combination of both. The company has also included an option for initial buyers to purchase an additional $250 million in notes within a three-day window.

Wall Street’s biggest players are taking notice of MicroStrategy’s aggressive Bitcoin strategy. Vanguard Group and Capital International Investors each acquired about 15.8 million shares of MicroStrategy stock last quarter. Morgan Stanley has also increased its position substantially, purchasing 8.8 million shares on Thursday, representing an 1,126% increase from their previous holdings.

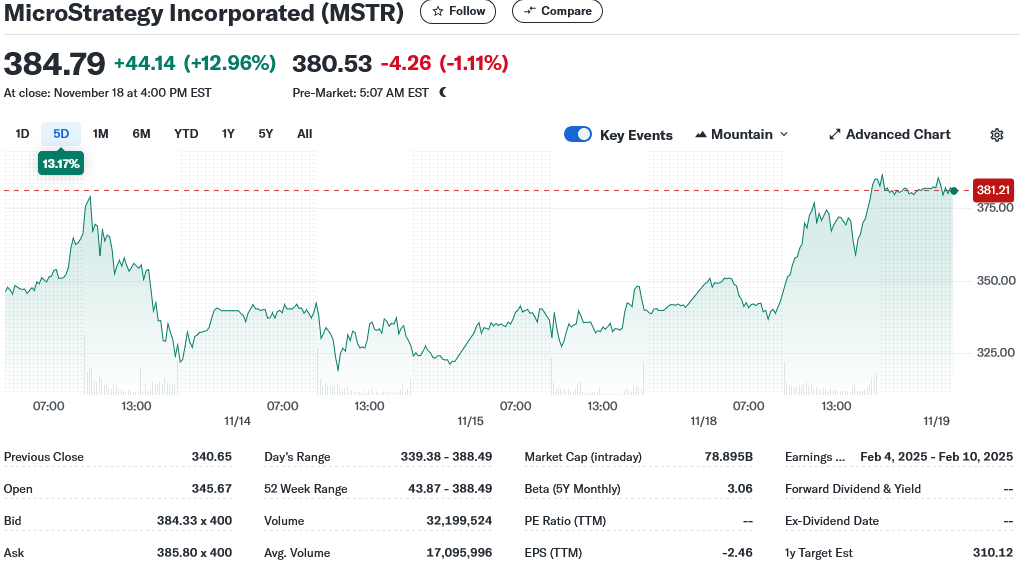

The company’s Bitcoin-focused approach has led to remarkable stock performance. While Bitcoin has risen 112% this year, MicroStrategy’s stock (MSTR) has surged 485%. The company’s market capitalization now stands at $78 billion, with shares closing at $384 on Monday.

To fund its recent Bitcoin acquisition, MicroStrategy utilized its at-the-market program to sell 13.6 million shares into the market over the week ending November 17. This is part of a larger $21 billion program that allows the company’s bankers to create and sell shares into the market as needed.

The company’s transformation from a traditional software firm to what it calls “the world’s first and largest Bitcoin treasury company” has been dramatic. MicroStrategy now controls 1.58% of Bitcoin’s maximum supply of 21 million coins.

In October, MicroStrategy unveiled its ambitious “21/21” plan, aiming to raise $42 billion over three years for additional Bitcoin purchases. The plan involves an even split between stock and bond offerings to fund future acquisitions.

The company’s co-founder and Executive Chairman, Michael Saylor, has been the driving force behind this strategy since 2020, when MicroStrategy first began investing in Bitcoin as a hedge against inflation.

MicroStrategy’s approach has evolved from using cash reserves for initial purchases to leveraging proceeds from stock sales and convertible debt to increase its buying power.

The company has scheduled a webinar for Tuesday morning to discuss the latest convertible notes offering, though attendance is restricted to qualified institutional buyers.

All these moves come as Bitcoin’s price has shown strong performance in 2024, though MicroStrategy’s stock shows higher volatility at 32% compared to Bitcoin’s 16%.

With its latest purchase and planned note offering, MicroStrategy continues to cement its position as the largest institutional holder of Bitcoin, having invested approximately $16.5 billion in total to build its current holdings.

The post MicroStrategy (MSTR) Expands Bitcoin Holdings with $4.6 Billion Purchase, Announces $1.75 Billion Notes Offering appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.