Nvidia (NVDA) inventory rose 4% in Tuesday, notching its fifth straight day of beneficial properties.

Wall Road analysts at KeyBanc, Citi (C), Bernstein, and a number of other different funding companies reiterated their Purchase scores on the inventory this week.

KeyBanc analysts raised their fiscal 12 months 2025 gross sales outlook for Nvidia from $128.5 billion to $130.6 billion, with Nvidia’s new flagship Blackwell AI chips contributing $7 billion to fourth quarter revenues. That’s increased than Wall Road’s consensus estimate of $125.6 billion for 2025 income, in response to Bloomberg information.

Whilst manufacturing of Nvidia’s Blackwell chips ramps up, KeyBanc mentioned in a observe to traders Monday that demand for Nvidia’s prior AI chip fashions — H100s and H200s — “stays extraordinarily sturdy.”

Nvidia shares are up almost 14% over the previous week and 190% from final 12 months.

Wedbush analysts mentioned “one other constructive information level” for Nvidia is a possible new wave of funding for AI startups. The Data reported Monday that OpenAI’s staggering $6.6 billion funding spherical will doubtless drive a wave of recent AI investments. New funding for AI-related startups would, in flip, gas demand for Nvidia’s AI chips.

Wedbush’s Matt Bryson mentioned on Tuesday that the report is a sign “that there’s little chance AI spending development pauses by means of a lot (if not all of 2025) to NVDA’s profit.”

Nvidia can be trying to show its value past AI {hardware}. At its AI Summit in D.C. this week, the corporate is trying to highlight the strength of its AI software offerings in a bid to indicate that it’s greater than only a chipmaker.

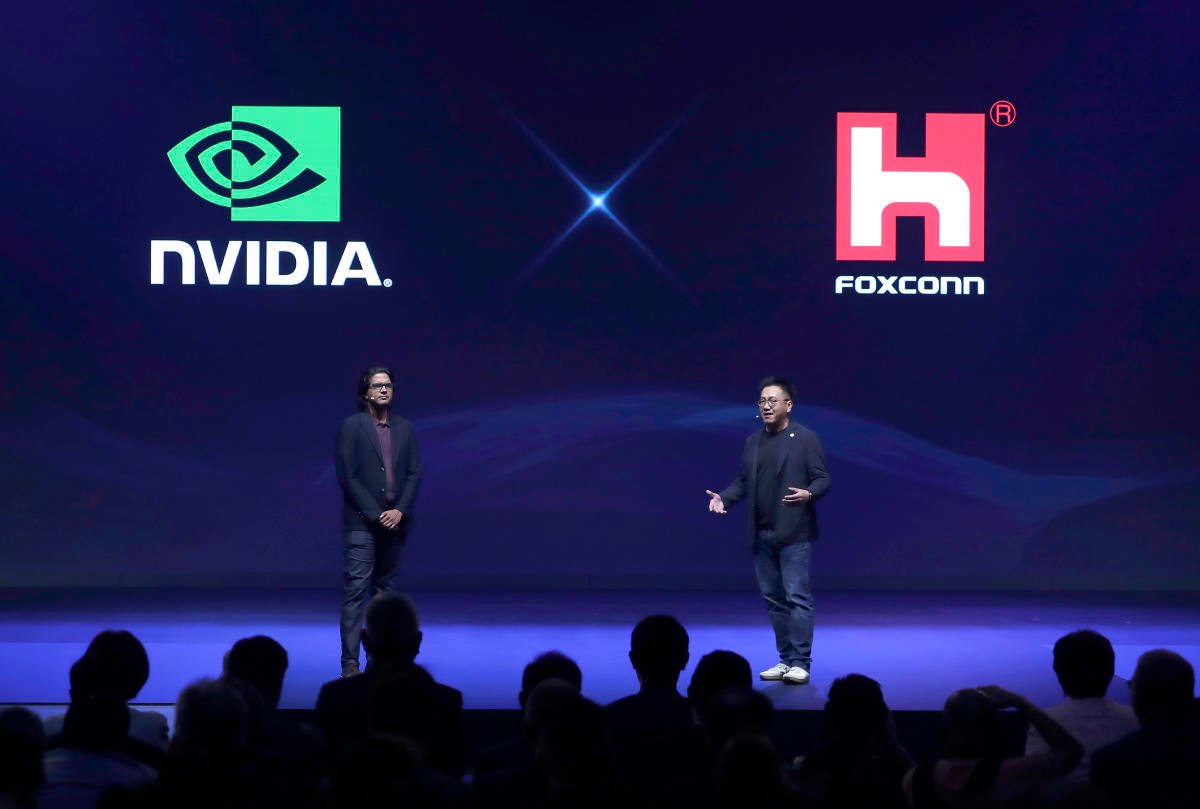

Deepu Talla, vice chairman of Robotics and Edge Computing of NVIDIA, and Zhe Shi, chief digital officer of Foxconn, ship a speech in the course of the Hon Hai Tech Day in Taipei on Oct. 8, 2024. (AP Photograph/Chiang Ying-ying) (ASSOCIATED PRESS)

Including to the wave of constructive press for Nvidia was the announcement of Foxconn’s (2354.TW) new megafactory assembling Nvidia’s AI servers. The chair of the Taiwan-based electronics producer, Younger Liu, mentioned throughout an annual occasion in Taipei Tuesday that Foxconn is constructing the world’s largest manufacturing unit assembling Nvidia GB200 servers in Mexico, in response to the Monetary Instances. Liu mentioned there may be “loopy” demand for Nvidia’s newest AI chips. The transfer will scale back Nvidia’s reliance on China amid rising commerce tensions.

Nvidia and Foxconn mentioned they’re additionally working to build Taiwan’s fastest supercomputer.

Nvidia isn’t the one semiconductor firm that’s thriving. Citing WSTS semiconductor business information, JPMorgan (JPM) mentioned Tuesday that sector-wide gross sales rose 28% in August from final 12 months.

“We stay constructive on semiconductor and semiconductor gear shares as we consider shares ought to proceed to maneuver increased in anticipation of higher provide/demand in 2H24/25 [the second half of 2024 and 2025] and steady/rising earnings energy traits in CY24/25 [the 2024 and 2025 calendar years].”

The PHLX Semiconductor Index (^SOX) and the tech-heavy Nasdaq (^IXIC) each rose greater than 1% on Tuesday.

In the meantime, chipmakers in China confronted a distinct destiny Tuesday. After China’s financial planning company failed to live up to the market’s hope for extra stimulus measures, China’s Semiconductor Manufacturing Worldwide Company (0981.HK) fell 18%. Traders had expected stimulus initiatives to spice up China’s semiconductor sector.

Laura Bratton is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.