TLDR

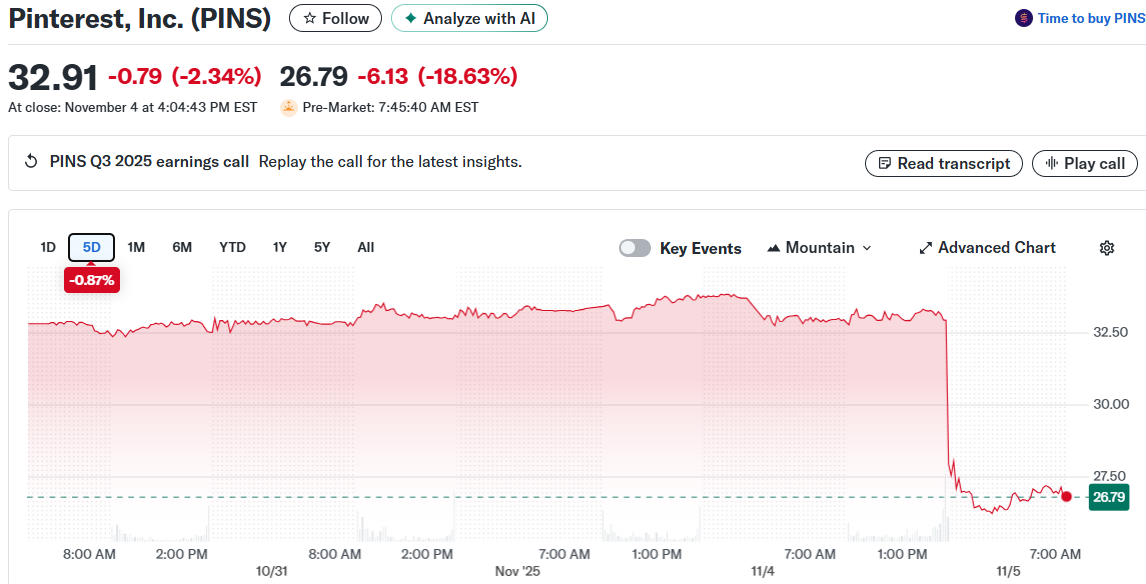

- Pinterest reported Q3 earnings of $0.38 per share, missing the $0.42 estimate, causing shares to fall 20%.

- Q4 revenue guidance of $1.31-$1.34 billion disappointed investors expecting $1.34 billion.

- Monthly active users grew to 600 million, beating the 590 million forecast.

- CFO blamed tariff pressures on large U.S. retailers for moderating advertising spend.

- Competitors Meta, Amazon, and Alphabet reported stronger digital advertising results.

Pinterest shares crashed nearly 20% in extended trading Tuesday after the social media platform missed third-quarter earnings expectations. The company reported earnings of $0.38 per share, falling short of Wall Street’s $0.42 consensus.

Revenue reached $1.05 billion, matching analyst projections and growing 17% year-over-year. Net income jumped 201% to $92.11 million from $30.56 million in the prior year period.

The earnings miss wasn’t the only problem. Pinterest’s fourth-quarter revenue guidance of $1.31 billion to $1.34 billion disappointed investors. The midpoint of $1.325 billion trailed the $1.34 billion estimate.

The stock decline wiped out Pinterest’s entire year-to-date gains. Adjusted EBITDA came in at $306 million, topping the $295 million estimate, but it wasn’t enough to calm investor concerns.

User Growth Hits Record Levels

Pinterest added 600 million global monthly active users during the quarter. The figure exceeded analyst expectations of 590 million users and marked an all-time high for the platform.

The company had 578 million users in the second quarter. Growth came from international markets and product enhancements designed to boost engagement.

Global average revenue per user was $1.78, slightly below the $1.79 projection. U.S. and Canada revenue totaled $786 million, missing the $799 million estimate.

CEO Bill Ready emphasized the company’s AI progress. He said Pinterest has transformed into an “AI-powered shopping assistant” serving 600 million consumers through visual search improvements.

Tariff Impact Weighs on Advertiser Spending

CFO Julia Donnelly identified specific challenges during the earnings call. She noted “pockets of moderating ad spend” from major U.S. retailers dealing with tariff-related margin pressures.

President Trump announced 10% tariffs on imported timber and lumber in September. The administration also plans 25% duties on kitchen cabinets, bathroom vanities, and related furniture items.

Donnelly said these tariffs are creating uncertainty in the home furnishing category. She expects “these broader trends and market uncertainty continuing” into the fourth quarter.

The company’s performance contrasted sharply with tech competitors. Meta reported 26% revenue growth to $51.24 billion, with 98% coming from online advertising.

Amazon’s advertising unit grew 24% to $17.7 billion. Alphabet posted nearly 13% growth in total advertising sales to $74.18 billion.

Competition Intensifies in Digital Advertising

Reddit delivered particularly strong results with 68% revenue growth to $585 million. Daily active users climbed 19% to 116 million, exceeding analyst estimates.

Morgan Stanley analysts admitted they misjudged Pinterest’s growth potential. They said they “were wrong about Pinterest’s ability to drive durable, faster than expected revenue growth” from platform improvements.

Free cash flow totaled $318 million for the quarter. The company continues generating strong cash flow despite revenue concerns and competitive pressures.

Pinterest’s U.S. and Canada segment underperformed expectations at $786 million. This region represents the company’s most mature and profitable market.

The post Pinterest (PINS) Stock: Earnings Miss and Tariff Worries Trigger 20% Share Decline appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.