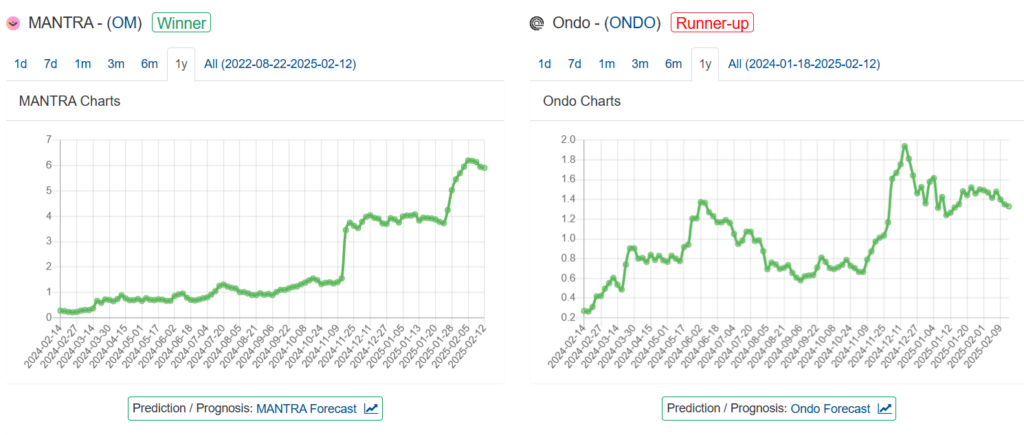

So, there you are. Larry Fink, BlackRock’s CEO, is shilling RWA. And undoubtedly two leaders of the RWA sector are Ondo and Mantra. One is up 34439.2% in the last 1 year 4 months and the other is up 1599.3% in about a year.

And if we want to believe VanEck’s RWA report, this could be a $50 billion sector THIS YEAR. Its projected potential is 50x by 2030. Will Ondo or Mantra also do a 50x? Let’s find out the true winner in this hottest crypto sector.

What Is RWA?

To break the ice here, let me give you a quick idea of what RWA is about. Earlier, you heard Larry Fink already mention tokenization. Well, that pretty much sums it up. RWA is about tokenization. It’s short for Real-World Assets.

Breaking: Larry Fink, BlackRock CEO, calls tokenization of #RWA “the revolution of finance!”

Trillion-dollar companies are bullish on RWA—are you?

pic.twitter.com/DIV1x0tC1i

— Real World Asset Watchlist (@RWAwatchlist_) December 26, 2024

This can be anything, really. From real estate to precious metals, or bonds and treasuries. You can tokenize them, which means digitalizing the RWA. You turn it into an NFT. What makes RWA interesting is the fact that you can also fractionalize these assets.

Let’s take real estate for example. Most of us can’t afford real estate, at least not in one lump sum. However, when you fractionalize the tokenized real estate. Now it is becoming much more affordable to many people. In other words, you don’t own all the estate, but fractions of it. The following video gives an explanation on what RWA is.

Both Mantra and Ondo Finance cater mostly to institutions. However, both also have options for retail. You can also buy or trade in their respective tokens. The tokens are Mantra’s $OM token and Ondo’s $ONDO token. These two tokens are available at almost all major exchanges. And anyone can buy them, not only institutions.

What Is Mantra ($OM)

Mantra ($OM) is currently leading the RWA chart, measured by market cap. On the other hand, their mainnet didn’t launch until October 2024. That’s only 4 months ago. This integrates RWAs into the blockchain. Before mainnet, there was an incentivized testnet. This was the Hongbai testnet.

#MANTRA Brings Real-World Assets Onchain with #Mainnet Launch.

We’re thrilled to announce that the highly anticipated launch of the MANTRA Chain Mainnet will be coming in October 2024.

As part of MANTRA’s vision to become the preferred ledger of record for real-world… pic.twitter.com/AGkZ5Xe6R1

— MANTRA

Consensus 2025 HK

(@MANTRA_Chain) September 18, 2024

Unfortunately, many testnet users are disappointed about the delay of the airdrop. Mantra had a $50 million airdrop on the table. However, it changed the vesting a few times, and now tokens are locked until September 2025. Airdrop releases continue until March 2027.

Breaking: Mantra Chain $OM Claim Update

MANTRA team member revealed the $OM airdrop plan:

• 10% claimable on March 18, 2025

• 6-month wait till September 2025

• 90% release by March 2027Now at $5.64$BOOST @AlphabotApp #Alphabot pic.twitter.com/J6g6tkWabR

— BestEarningTips ( Airdrop

) (@BestEarninTips) January 31, 2025

But let’s look at what Mantra offers. Here’s something that stands out. Mantra advertises itself as a permissionless chain for permissioned applications. What does that mean? Permissionless means that anybody can use it. It has all the advantages that a blockchain offers. For instance, there’s no single entity that controls it and it’s anonymous.

On the other hand, Mantra is compliant, like almost all other RWA projects. This means that a KYC or KYB (know your business) is mandatory. In other words, out goes the anonymous part. However, now you can trade in regulated assets or products. That’s the trade-off.

So, when you say Mantra, you also say DeFi. But there’s more. It connects TradFi with DeFi. Traditional banking systems can now interact with crypto and fiat, on-chain and off-chain.

A few months ago, I did a deep dive into Mantra. If you want to find out more about Mantra, here’s the link.

The current $OM price is $5.93 with a $6.41 ATH from only four days ago. Its market cap is $5.7 billion. $OM has an unlimited token supply. Out of the 1.8 billion total supply, 971 million circulate. I can see it doing a 50x within the next 5 yrs at the rate of RWA growth.

What Is Ondo Finance ($ONDO)

Ondo Finance ($ONDO) announced Wall Street 2.0 only a few days ago. That was during their Ondo Summit in NYC. During the summit, Ondo also announced their very own Layer 1 chain. As a surprise last-minute guest, Donald Trump Jr was added as a speaker.

So, talking about the Trump family. Their DeFi platform, World Liberty Financial, bought an additional $4.7 million of $ONDO. That brings their total $ONDO investment to $5 million. Furthermore, a Binance listing might be in the making. Yes, indeed, surprisingly, $ONDO is not yet listed on Binance.

Just In: Trump’s World Liberty Finance has spent $4.7M $USDC to buy 342,000 $ONDO.

Ondo Finance launches Ondo Chain, a permissioned Layer 1 blockchain for tokenizing real-world assets in institutional finance.

Address: 0x5be9a4959308A0D0c7bC0870E319314d8D957dBB pic.twitter.com/RecxNEcIOI

— Onchain Lens (@OnchainLens) February 6, 2025

That’s a lot of exciting news in one go, right there. It should come as no surprise that the $ONDO token is doing well. A week ago, it was still at $1.30, and today it briefly touched $1.41. $ONDO’s market cap is $4.3 billion. However, in contrast to $OM, $ONDO has a fixed supply of 10 billion tokens. In other words, much better tokenomics. Currently, 3.1 billion tokens circulate.

$ONDO does things differently with their token vesting and unlocks. Recently it unlocked 1.94 billion tokens worth $2.4 billion. However, the expected token price drop didn’t happen. It went from $1.38 to $1.20 and immediately back up to $1.53. That means that holders believe in the project and don’t sell their tokens.

I already talked about Larry Fink and BlackRock. Well, Ondo Finance works together with BUIDL. Institutional investment is a minimum of $5 million. However, with Ondo’s $OUSG stablecoin, the minimal investment is only $100,000. This also offers retail an opportunity to take part.

Furthermore, Ondo introduced their Global Markets platform. This offers access to tokenized stocks, bonds, and ETFs. Ondo really is on fire and is ready to take over the RWA crown. They have 50x potential as well over the next few years.

The Verdict

So, which project do you prefer? Ondo Finance? It offers tokenized notes backed by US Treasuries to institutions and retail. Or rather Mantra? It offers a wider range of tokenized assets.

If we look back over the last year, Mantra wins. Its $OM token saw a 34439% price increase. $ONDO only saw a 1597% increase. But both are impressive, to be honest.

Source: Wallet Investor

Mantra is the current leader. However, Ondo launched a lot of new features during their summit. I can see Ondo taking over that RWA crown soon. Join the discussions on our Discord and X channels. Or let me know in the comments which project you prefer and why.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post RWA Crypto Bull Run WINNER – ONDO Finance or Mantra OM appeared first on Altcoin Buzz.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.