Solana (SOL) is back in the spotlight as Bloomberg analysts James Seyffart and Eric Balchunas now estimate a 90% chance of a Solana spot ETF being approved by the U.S. Securities and Exchange Commission (SEC) before year-end.

According to their June 21 research note, the question is no longer “if,” but “when.”

The momentum behind crypto ETFs has surged since Bitcoin and Ethereum funds made their debut on Wall Street. BlackRock’s iShares Bitcoin Trust alone gathered over $70 billion in assets under management, faster than any ETF in history.

With crypto legitimacy rising in D.C., the SEC has shown a willingness to engage with altcoin ETF filings, including updated S-1 forms from Fidelity, Grayscale, Bitwise, and VanEck.

Solana is seen as a frontrunner due to its market depth, developer traction, and now, staking-enabled ETF proposals. If approved, these ETFs wouldn’t just track SOL, they’d also stake held tokens, generating additional yield for investors.

What a Solana ETF Could Mean for Price

Institutional investors gaining direct access to Solana could dramatically shift market dynamics. According to Brian Rudick, Chief Strategy Officer at Solana-focused Upexi, top-tier altcoin ETFs, such as SOL, are likely to see strong inflows post-launch, similar to Bitcoin’s explosive run after its ETF debut.

“Spot ETFs were the main reason Bitcoin more than doubled after BlackRock filed in mid-2023,” Rudick said. A comparable demand shock for Solana could ignite a similar rally. If history repeats itself, ETF-driven inflows could propel SOL toward the $200 mark, especially if market sentiment and macroeconomic tailwinds align.

Analysts also point to the CFTC’s futures approval for SOL as another positive signal, which reinforces market maturity and regulatory openness toward the asset.

Price Faces Technical Hurdles Before Breakout

Despite ETF optimism, Solana’s short-term technicals remain bearish. At $140.40, SOL is struggling below the key resistance zone between $144.49 and $145.49, aligned with a descending trendline and the 50-period EMA.

A bearish engulfing candle followed the last failed breakout attempt, sending the token into a consolidation phase just above support at $138.39.

The MACD indicator remains in bearish territory, suggesting continued downside risk unless SOL reclaims the $145 zone. Should support at $138.39 give way, price could drop toward $135.74 or even $132.57.

Key Takeaways:

- Bloomberg pegs SOL ETF approval odds at 95%

- ETF issuers include Grayscale, Fidelity, VanEck

- Staking-enabled ETFs could boost investor yield

- SOL must break $145.49 to regain bullish momentum

- Downside levels to watch: $138.39, $135.74, $132.57

Outlook: ETF approval is a long-term catalyst; however, for short-term Solana price prediction, traders should watch for a confirmed breakout above $145 to signal a bullish continuation.

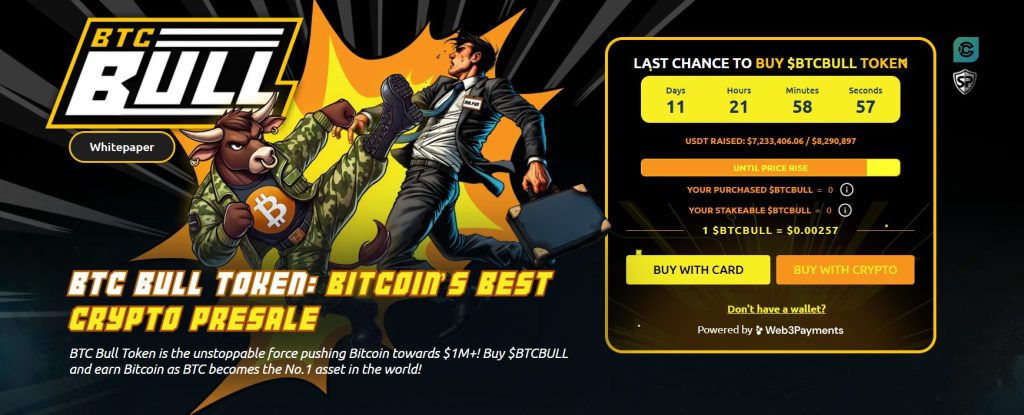

BTC Bull Token Nears $8.2M Cap as 58% APY Staking Attracts Last-Minute Buyers

In addition to Solana, with BTC trading near $104K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $7,249,360 out of its $8,290,897 cap, leaving less than $1 million before the next token price hike. The current price of $0.00257 is expected to increase once the cap is hit.

BTC Bull Token links its value directly to Bitcoin through two core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 58% APY staking pool holding over 1.81 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Solana Price Analysis: Analysts Say SOL ETF Approval Is “Near-Lock” – What Does This Mean for the $200 Target? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.