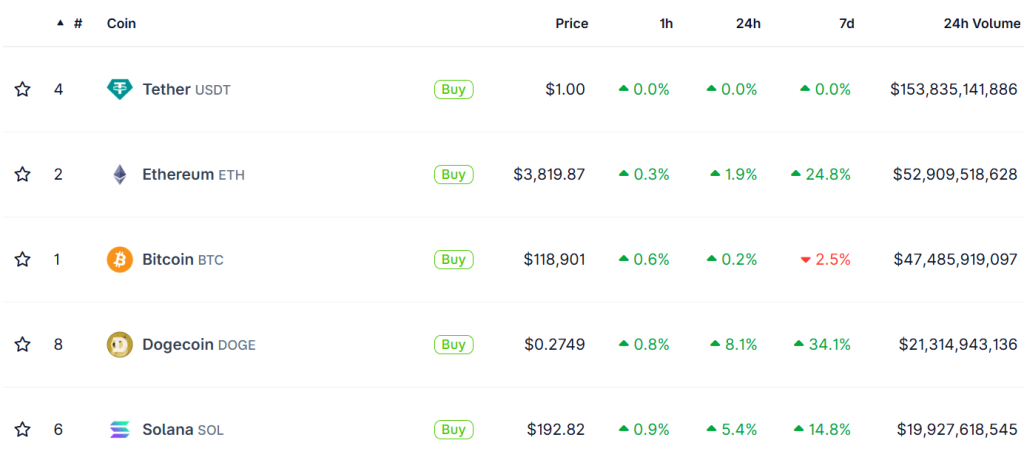

With altseason sentiment heating up, SOL has become the fourth most traded cryptocurrency outside of stablecoins, a sign of bullishness for the Solana price outlook as demand outpaces its market cap rank.

It trails behind Ethereum, Bitcoin, and Dogecoin with almost $20 billion in volume over the past 24 hours, contributing to a 5% gain as capital rotates deeper into altcoins.

Geopolitical and macroeconomic FUD has largely cleared, replaced by a wave of pro-crypto regulatory momentum that continues to unlock sidelined capital for riskier plays.

This not only creates more demand for Solana itself, but for its ecosystem as speculative demand returns and its leading meme coin launchpads see a combined $1 billion in volume.

With the GENIUS Act now signed into law and the CLARITY Act expected to follow in October, bullish catalysts now extend well beyond “Crypto Week,” setting a stage for continued upside.

Solana Price Analysis: Does SOL Have a Claim to the Throne?

There’s a growing case that Solana could run alongside or even challenge Ethereum and Bitcoin, especially with TradFi demand still largely untapped.

Unlike its larger counterparts, Solana has yet to benefit from its own spot ETF approval, leaving a major gateway for institutional capital closed.

And with altseason not yet in full swing, both SOL and the tokens within its ecosystem could draw further demand as the cycle deepens.

Near-term, however, the Solana price rally looks primed for a correction as it exhausts the breakout momentum from an ascending channel forming since late June.

The pattern points to a potential 7.6% move higher to reclaim $211.70, but momentum indicators are flashing early warning signs that this could be a local top.

The RSI now sits deep in overbought territory at 85—typically a zone that precedes a cool-off as buyers run out of steam.

That said, the MACD line continues to widen its lead over the signal line, suggesting the prevailing trend remains bullish despite short-term friction.

Once the pattern plays out, a pullback to immediate support at $190 appears likely, marking a 4.2% correction that could establish a firmer base for the next leg up once volatility settles.

This scenario fits current market conditions: regulatory optimism is driving upside, but the next major catalyst, like a Solana ETF or further bill advancement, isn’t expected until October.#

With the looming August 1 “Liberation Day” tariff pause deadline, macro FUD could re-enter the narrative and suppress bullish momentum until the CLARITY Act advances beyond the US Senate.

Solana is Stalling – Here’s How to Find Greater Opportunities

When it comes to large coins like SOL, gains are limited. Explosive breakouts take months to build, and pan out in a fraction of that time—holder spend most of their time waiting.

Meanwhile, the low-cap meme coins in its ecosystem are printing 10-100x gains as retail liquidity floods in.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

While trading bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised over $1.9 million in its initial presale weeks, likely driven by its high 186% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.

The post Solana Price Prediction as SOL Becomes 4th Most Traded Crypto – Can it Overtake ETH and Bitcoin Next? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

Crypto Czar David Sacks:

Crypto Czar David Sacks: BREAKING:

BREAKING: