Tremendous Micro Pc (NASDAQ: SMCI) inventory received crushed right this moment following a report that the corporate is being investigated by the Division of Justice (DoJ). The server specialist’s share value closed out the day’s buying and selling down 12.2%, and it had been down as a lot as 18.6% earlier within the session.

The Wall Avenue Journal reported right this moment that the DoJ is within the early phases of conducting an investigation into Supermicro. In accordance with the report, the investigation is probably going related to allegations of unhealthy accounting practices that had been made in a short-seller be aware revealed by Hindenburg Analysis on the finish of August.

Following right this moment’s huge sell-off, Supermicro inventory is now down 66% from the excessive that it reached earlier this 12 months. Regardless of the valuation pullback, the corporate remains to be on monitor to proceed with a 10-for-1 stock split that may take impact on Oct. 1.

Is Supermicro a purchase forward of its inventory break up?

Supermicro has been hit with some intense bearish pressures recently, nevertheless it’s attainable that adverse sentiment surrounding the inventory has grow to be overblown. For starters, the DoJ has not but introduced an official investigation into the corporate. Even when an investigation had been to happen, that would not essentially imply that any impropriety had truly occurred.

The Division of Justice has usually been making use of extra scrutiny to big-tech and monetary corporations recently, having has launched antitrust fits towards corporations together with Apple, Alphabet, and Visa. Supermicro is unlikely to face antitrust scrutiny, however the DoJ’s latest surge of exercise offers background context that is value conserving in thoughts.

If an investigation into Supermicro by the DoJ is underway, Hindenburg’s allegations that it had discovered proof of latest accounting violations by the tech firm might have been a key catalyzing issue. However it’s vital to remember that Hindenburg is a brief vendor, and it earnings when valuations for corporations it has positioned bets towards decline.

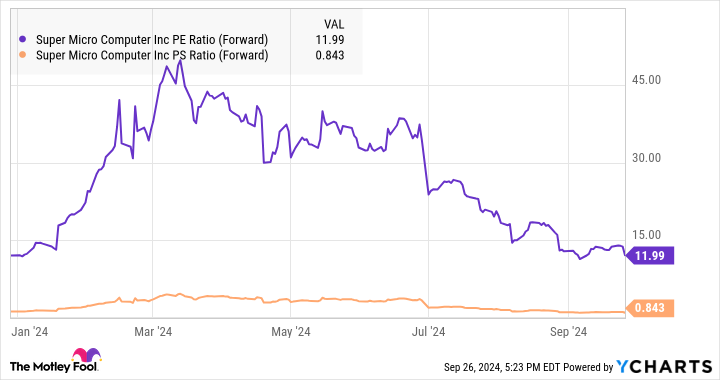

SMCI PE Ratio (Ahead) Chart

The dearth of visibility on the corporate’s outlook signifies that Tremendous Micro Pc inventory will not be match for traders with out above-average danger tolerance. Then again, traders who’re prepared to embrace danger and uncertainty might wind up scoring huge returns by treating latest sell-offs as a shopping for alternative.

Following right this moment’s inventory pullback, Supermicro is now buying and selling at simply 12 occasions this 12 months’s anticipated earnings and fewer than 85% of anticipated gross sales. Even with expectations that the enterprise will see cyclical moderation, that is a cheap-looking valuation for an organization that has been seeing stellar gross sales and earnings development due to synthetic intelligence (AI)-driven demand. If the tech specialist scores wins with liquid-cooling applied sciences that assist differentiate its high-performance rack servers, Supermicro inventory might push by latest controversies and are available roaring again.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Tremendous Micro Pc wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $756,882!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Visa. The Motley Idiot has a disclosure policy.

Super Micro Computer Plummeted Today — Should You Buy the AI Stock Before Its Stock Split on Oct. 1? was initially revealed by The Motley Idiot