TLDR

- Bitcoin leads with institutional ETF inflows creating steady demand from asset managers and treasury departments

- Ethereum serves as the primary settlement layer for DeFi applications and tokenization with layer-2 networks scaling capacity

- Solana delivers fast transactions for consumer applications with growing user activity and real revenue streams

- Chainlink connects blockchains to traditional systems through oracle services supporting tokenization infrastructure

- Sui emerges as a high-speed layer-1 platform with expanding DeFi protocols and developer-friendly tools

An investment framework for November 2025 identifies five cryptocurrencies serving different portfolio functions. The approach balances institutional assets, infrastructure plays, and growth opportunities across the crypto market. Each asset addresses a specific role within a diversified crypto portfolio.

Bitcoin: Institutional Demand Driver

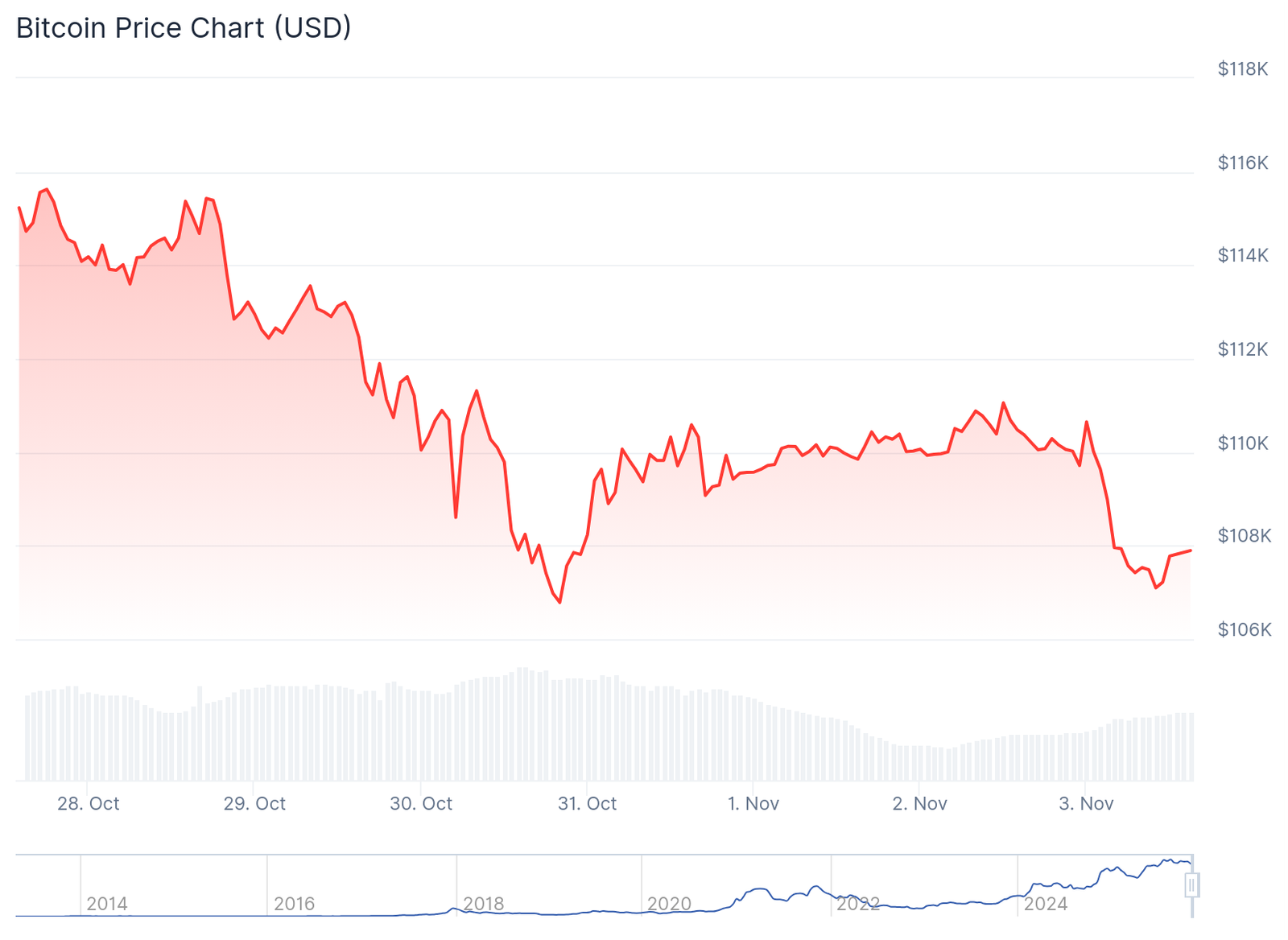

Bitcoin continues attracting institutional capital through exchange-traded fund products. Asset managers and corporate treasuries use ETFs to gain Bitcoin exposure. This creates buying pressure during market uptrends and support during downturns.

The strategy recommends accumulating Bitcoin during price pullbacks. Macroeconomic events can trigger short-term volatility. However, the long-term institutional bid remains the strongest support factor for Bitcoin prices.

Bitcoin functions as the first purchase during risk-on market conditions. During risk-off periods, institutional holders typically sell Bitcoin last. This pattern establishes Bitcoin as the market’s primary risk indicator.

Ethereum: Settlement Layer Foundation

Ethereum operates as the primary settlement network for decentralized finance protocols. Tokenization pilots from traditional financial firms run on Ethereum infrastructure. Layer-2 scaling networks handle transaction overflow while the main chain processes final settlements.

Enterprise adoption continues because compliance teams can evaluate Ethereum’s security model. The network’s technical roadmap focuses on reducing fees and improving transaction speed. Development activity remains concentrated on Ethereum compared to competing platforms.

The analysis recommends buying Ethereum during quiet market periods rather than chasing rallies. The asset provides exposure to DeFi growth without betting on individual protocols. Financial institutions can explain Ethereum infrastructure to their risk committees more easily than newer platforms.

Solana: Consumer Application Network

Solana has established itself beyond basic transaction speed metrics. The network hosts consumer-facing applications generating recurring users and protocol revenue. Payment experiments and client upgrades ship on regular schedules.

User activity data shows consistent growth across Solana applications. The network combines speed with practical consumer use cases. This positions Solana as a growth allocation within crypto portfolios.

The platform moved from being known as a fast layer-1 to hosting applications that feel instant to end users. Real revenue generation separates Solana from chains with high transaction counts but limited economic activity.

Chainlink: Oracle Infrastructure

Chainlink provides oracle infrastructure connecting blockchain networks to external data sources. The service verifies information for smart contracts and secures tokenized asset reserves. Tokenization projects across multiple chains use Chainlink’s data feeds.

Revenue for Chainlink comes from services across many protocols rather than dependence on single applications. This creates diversified exposure to blockchain adoption trends. The oracle network supports cross-chain communication as different blockchains interact.

As tokenization moves from press releases to production systems, middleware becomes more important. Chainlink operates as infrastructure supporting multiple blockchains. This positioning reduces risk compared to betting on a single platform winning market share.

Sui: Emerging Platform Play

Sui represents a newer layer-1 blockchain with fast transaction finality. Developer tools on Sui aim for ease of use compared to older platforms. The DeFi ecosystem continues expanding with new protocol launches each month.

Network activity metrics and total value locked have trended upward. Token unlock schedules create periodic selling pressure. The recommendation involves scaled purchases rather than large single positions.

The upside case depends on continued application launches and liquidity spreading across protocols. Developer adoption metrics remain the key indicator for Sui’s growth trajectory. Fast finality and friendly development environments attract builders from other ecosystems.

Final Thoughts

Portfolio construction treats Bitcoin and Ethereum as core holdings capturing 50-60% of total allocation. Solana receives 15-20% for growth exposure to consumer applications. Chainlink takes 10-15% as an infrastructure hedge across multiple chains. Sui occupies 5-10% for asymmetric upside potential based on developer momentum.

The post Top Crypto to Buy in November, According to ChatGPT appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.