US financial markets plunged Monday while cryptocurrency prices remained firm, as US President Donald Trump ramped up his public feud with Federal Reserve Chairman Jerome Powell, The Guardian and other news outlets reported Tuesday.

The clash between the country’s highest political and monetary leaders shook traditional markets to their core but left crypto surprisingly unscathed.

Stock Markets Plummet After Presidential Remarks

American stock indices closed forcefully lower on April 21, with broad losses at major benchmarks. The S&P 500 declined 2.3%, the tech-dominated Nasdaq lost 2.4%, and the Dow Jones Industrial Average plummeted by almost 1,000 points, down 2.4%, based on Google Finance data.

JUST NOW: President Trump calls Jerome Powell a “major loser” and demands interest rates lowered “now” pic.twitter.com/rAM7CVmPw2

— Morning Brew

(@MorningBrew) April 21, 2025

Trump Calls For Rate Cuts And Slams Fed Chair

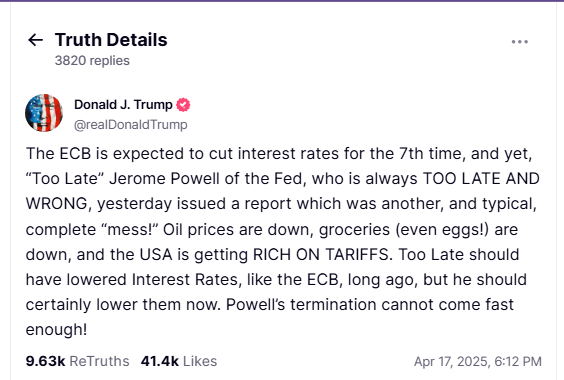

Underlying the market volatility is a rapidly intensifying clash between President Trump and Federal Reserve Chairman Powell. Trump used his April 21 Truth Social forum to post that “Preemptive Cuts in Interest Rates are being called for by many.”

The President contended rate cuts are warranted because “Energy Costs [are] way down, food prices [are] substantially lower, and most other ‘things’ [are] trending down,” asserting “there is virtually No Inflation.”

Trump has repeatedly criticized Powell, calling him “Too late and wrong” for not cutting interest rates, which remain at 4.5%.

Tensions rose after Powell warned that Trump’s tariffs could cause stagflation, prompting the president to demand his removal, saying his “termination cannot come fast enough.”

Dollar Weakens While Crypto Shows Strength

As the political conflict rages on, the US Dollar Index (DXY), which tracks the greenback relative to other significant currencies, dipped below 98 on April 21, recording a three-year low.

This follows a falling trend that has had the dollar drop over 10% of its value since the start of 2025, latest data shows.

Bitcoin Unfazed Amid Political Turmoil

In stark contrast to traditional markets, cryptocurrencies have maintained their weekend gains. The total cryptocurrency market capitalization, based on TradingView data, remained steady at $2.74 trillion.

Bitcoin price, according to data from Coingecko, hit a four-week high of $88,428.

Why is the price of bitcoin flat? Should Trump fire Jerome Powell? Will The US lose reserve currency status?

I answer your questions

pic.twitter.com/S7Q6hANR3H

— Anthony Pompliano

(@APompliano) April 18, 2025

Industry Figures Warn Vs. Political Interference

Cryptocurrency businessperson Anthony Pompliano warned against presidential intervention in the Federal Reserve leadership.

In a video he uploaded on X on April 18, Pompliano declared that he does not believe that Trump should come in and unilaterally fire the Fed chair.

He further stated that policy disagreement firings would lead the nation into perilous waters: “Where you have a disagreement and then the firing, I think that’s not really the area that we want to go into.”

Market experts believe the central bank will hold steady at its next meeting on May 7. According to data, interest rate markets now forecast only a 13% probability of a rate reduction at that session.

Featured image from Chip Somodevilla/Getty Images. chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.