US Ethereum spot ETFs hit the second-highest peak in five months and the third-highest this year, as investors highlight a significant increase in institutional interest in this vehicle.

On 9 July, the US ETH spot exchange-traded funds (ETFs) saw inflows surge to $211.32 million. This is a significant increase from $46.63 million a day before.

But most notably, this is the second-highest amount in over five months. It’s also the third-highest amount in 2025 so far.

More precisely, the highest increase in this period is $240.29 from 11 June this year. The previous peak is $307.77 million, seen on 4 February. This means that between 5 February and today, this is the ETFs’ second-highest inflow, as well as the third-highest since the beginning of the year.

Overall, the all-time high still stands at $428.44 million. The amount was recorded on 5 December 2024.

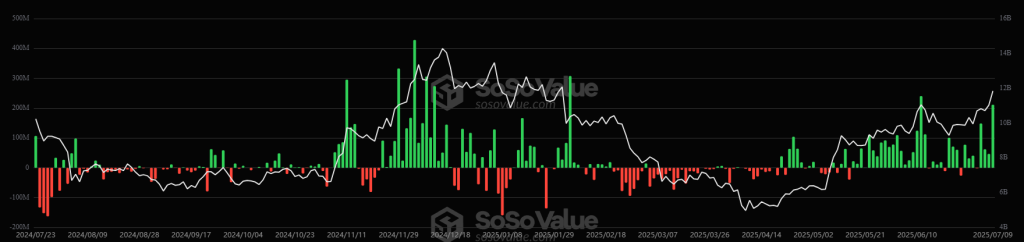

Following the launch of nine US spot bitcoin ETFs in January 2024, the ETH spot ETFs began trading in July that year. The chart below shows flows since the launch (red and green), as well as the total net assets (white).

Moreover, the cumulative total net inflow climbed to $4.72 billion as of 9 July. Total valued traded stood at $1.26 billion, while total net assets were at $11.84 billion, or 3.58% of Ethereum market cap.

Of the $211.32 million in inflows, BlackRock took in $158.62 million.

Four more Ethereum spot ETFs saw positive flows, and none saw negative flows. Fidelity’s share is $29.53 million, followed by Grayscale’s $17.96 million and Franklin’s $5.21 million.

In comparison, the US BTC spot ETFs recorded inflows of $218.04 million on 9 July. Its ATH is $1.38 billion on 7 November 2024.

BlackRock saw the highest inflows of this amount, standing at $125.58 million. This is followed by Ark & 21Shares’ $56.96 million. Fidelity, Grayscale, Bitwise, Valkyrie, and Invesco also saw positive flows between $2 million and $16 million.

Ethereum ETFs: ‘Inflows Surpass 61,000 ETH’

Analysts are highlighting an increased interest in Ethereum spot ETFs in particular. This factor, they argue, is likely to benefit the coin’s price as well as it pushes higher.

Onchain data and intelligence platform Glassnode noted on Monday that spot ETF flows remained positive for the 8th consecutive week. Inflows surpassed 61,000 ETH, it said.

The crypto market overall has seen a notable increase over the past 24 hours. One of the positive factors is the regulatory support for the industry in the US, as the country works towards forming a crypto market structure regulation.

“Make no mistake: blockchain technology and digital assets are not going away – they are here to stay,” said US Senate Banking Committee Chairman Tim Scott during the first full committee hearing on digital assets on 9 July.

Moreover, the US Federal Reserve decided to keep the federal funds rate steady, per the June minutes released on 9 July, as “tariffs pose a persistent risk for driving up prices.” However, many believe that a rate cut will happen this year if inflationary pressures ease. And interest rate cuts are typically favorable for crypto assets.

Meanwhile, Ethereum is currently trading at $2,776. It’s up 5.5% in a day and 7% in a week. It’s unchanged in a month and down 10.5% in a year.

It started the day with the intraday high of $2,869 and then plunged to $2,182, before gradually climbing back to the current level. You can read more below.

The post US Ethereum Spot ETFs See Second-Highest Inflows in Five Months appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.