Reports have disclosed that 16 wallets picked up 431,018 Ether between September 25 and 27, spending about $1.73 billion to do so. The buys came through names like Kraken, Galaxy Digital, BitGo, FalconX and OKX.

That scale of accumulation pushed attention back to who is buying the dip, and why larger players seem willing to add exposure while prices wobble.

Exchange Balances Fall To 9-Year Low

According to Glassnode data, the amount of ETH held on exchanges has plunged from roughly 31 million to about 14.8 million ETH — a drop of 52% from 2016 levels.

Many of those coins are likely in staking contracts, cold wallets or institutional custody, and the recent launch of the first Ethereum staking ETF has helped pull more supply off exchanges.

Lower exchange balances mean fewer coins ready to be sold instantly on exchanges, which can make price moves sharper when big orders hit the market.

ETH Hovers Near $4,000 As Volatility Rises

Based on TradingView readings, ETH is trading around $4,011, down roughly 0.33% over the last 24 hours and more than 10% over the past week.

The token briefly slipped under $3,980 earlier in the session before climbing back, and it remains below a recent close of $4,034.

This two-week pullback has returned ETH to a key $4,000 support area, and short-term swings have become more pronounced as holders reposition.

$3,700 Becomes A Line In Sand

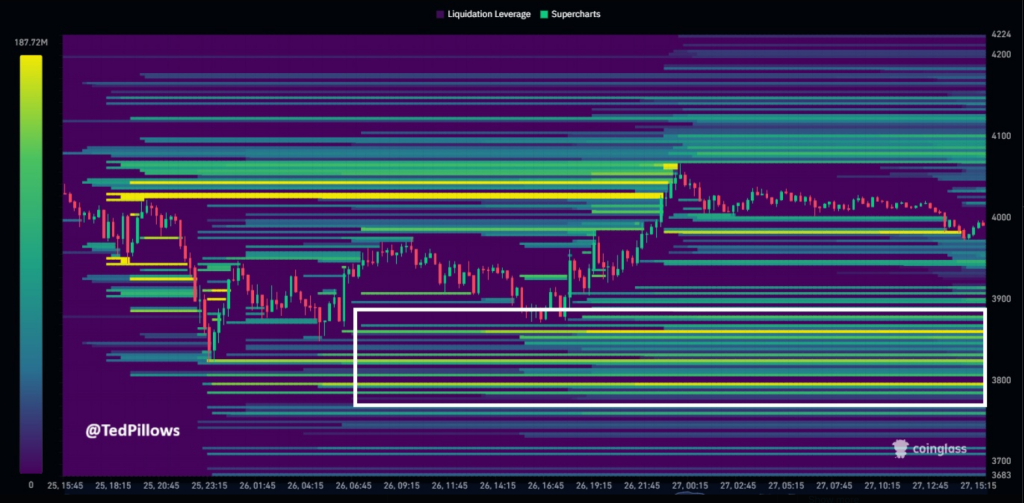

Crypto analyst Ted Pillows has warned that the $3,700 to $3,800 zone could face heavy pressure. Reports note that if ETH falls below $3,700, many margin positions could be wiped out and spark forced selling that pushes prices lower.

$ETH liquidity heatmap is showing decent long liquidations around the $3,700-$3,800 level.

This level could be revisited again before Ethereum shows any recovery. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

With fewer coins on exchanges and concentrated margin exposure, the short-term outlook is more fragile even as longer-term demand indicators look solid.

ETF Outflows Show Institutional Mood Can Flip

US-listed ETH funds recorded nearly $800 million in outflows this week, their largest redemptions to date. Still, roughly $26 billion sits in Ethereum ETFs, equal to 5.37% of total supply.

Whales keep accumulating $ETH!

16 wallets have received 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX in the past 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Those numbers underline how quickly institutional sentiment can change: big inflows can vanish just as fast, and ETF flows now add a new, sizable layer to price dynamics.

Lookonchain data also highlighted a prior accumulation of roughly $204 million in ETH, showing similar patterns of large players stepping up during dips.

Retail traders appear more cautious for now. But the sequence of big buys from institutional-grade custodians suggests some buyers view dips as buying chances while others choose to wait on the sidelines.

Featured image from Unsplash, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.