The post Why ETH Is Going Down? How Low Can Ethereum Price Drop? appeared first on Coinpedia Fintech News

Ethereum ($ETH) has recently fallen below the key $4,000 support level, raising concerns among investors about how low the Ethereum price might go in the short term. Several factors, including macroeconomic uncertainty, slowing ETF inflows, and low exchange liquidity, are contributing to the recent drop.

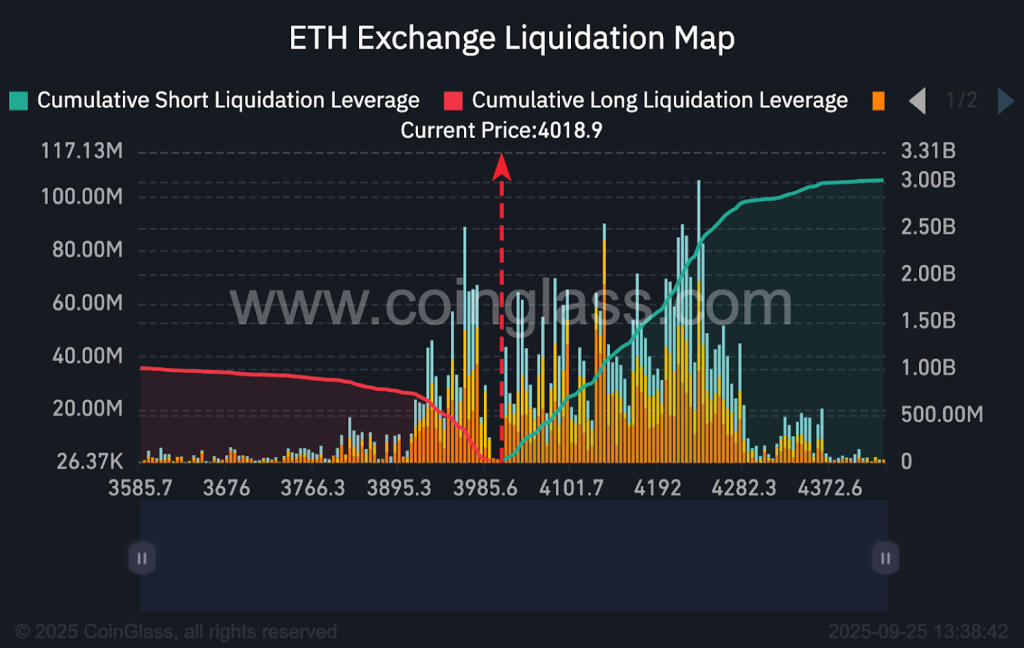

Ethereum Liquidation Heatmap

According to Coinglass, in the past hour, $100 million in Ethereum long positions were liquidated. One whale trader, 0xa523, lost $36.4 million on 9,152 $ETH, with total losses now over $45.3 million, and the account is left with under $500,000.

This shows how risky leveraged trading can be in volatile markets. High leverage is driving bigger price swings in Ethereum and affecting other cryptocurrencies like Bitcoin. Daily ETH long liquidations have recently topped $500 million, adding more pressure on the market.

Slowing ETH ETF Inflows

Over the past few weeks, Ethereum’s momentum has weakened after initial excitement from institutional purchases and ETF inflows. Public companies like Tomlin’s BitMine initially drove optimism, but recent data shows that Ethereum ETF inflows have slowed significantly.

On September 24, ETH-related ETFs experienced $79.4 million in net outflows, compared to BTC ETFs, which saw $241 million in net inflows. This indicates that institutional investors are cautious about Ethereum right now, adding downward pressure to the price.

Weak Institutional Demand

Large investors are stepping back from Ethereum. Grayscale recently sold $53,810,000 in Ethereum on Coinbase, signaling that big money is not buying $ETH at the moment.

At the same time, Ethereum supply on exchanges has dropped to just 14.8 million tokens—a nine-year low not seen since 2015. While low supply can sometimes create scarcity, it has coincided with the current price decline.

On-chain activity for Ethereum has decreased by 10%, and gas fees are lower due to reduced transaction volume, signaling weaker market participation and fading user confidence.

Ethereum Dominance Declining

Ethereum’s market dominance has declined from 14.6% to 12.8%, showing a loss of relative relevance. Analysts warn that if this trend continues, Ethereum could underperform altcoins by up to 45%.

This decline reflects both slowing institutional demand and a shift in broader crypto market flows, highlighting that Ethereum’s rally earlier this year is losing momentum.

How low Can ETH Price Go?

According to analyst TED, ETH/USD has tested the $4,060 support level twice in just three days, indicating strong selling pressure. Analysts now see the next support zone around $3,800, which could serve as a potential accumulation point for long-term investors.

The daily Relative Strength Index (RSI) is at 35, suggesting Ethereum is oversold but lacks immediate rebound momentum. These technical signals, combined with heavy derivatives liquidations, indicate a potential further drop before recovery.

For long-term investors, this pullback may also represent a potential opportunity to accumulate $ETH before any market recovery.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The post Why ETH Is Going Down? How Low Can Ethereum Price Drop? appeared first on Coinpedia Fintech News

Ethereum ($ETH) has recently fallen below the key $4,000 support level, raising concerns among investors about how low the Ethereum price might go in the short term. Several factors, including macroeconomic uncertainty, slowing ETF inflows, and low exchange liquidity, are contributing to the recent drop. Ethereum Liquidation Heatmap According to Coinglass, in the past hour, …

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.