After a day of significant increases, the crypto market is down today. The majority of the top 100 coins have dropped over the past 24 hours. Moreover, the cryptocurrency market capitalization has fallen by 1.6% in that period to $3.4 trillion. The total crypto trading volume is at $99.8 billion.

TLDR:

Crypto Winners & Losers

Six of the top 10 coins per market cap are up, but with low increases of less than 1% per coin.

Bitcoin (BTC) appreciated by 0.7%, now trading at $106,413. This is up from $101,924 seen two days ago.

Furthermore, Ethereum (ETH) appreciated by 0.8%, changing hands at $2,443. It’s one of the category’s best performers again today. Lido Staked Ether (STETH) and Tron (TRX) also recorded a 0.8% rise each.

XRP (XRP) recorded the highest decrease in this category of 0.7% to the price of $2.18.

Moreover, the majority of the top 100 coins saw their prices drop over the past day. The highest decrease among these is Virtuals Protocol (VIRTUAL)’s 8.5% to $1.56.

On the other hand, Pi Network (PI) appreciated the most today: 13.4% to $0.5998. This is the only double-digit change in this category. Aptos (APT) follows with a 9% rise to $4.83.

Notably, the market has cooled off following several positive news seen yesterday.

The prices saw a swift uptick yesterday after Japan’s Financial Services Agency proposed to reclassify digital assets under the Financial Instruments and Exchange Act, which could cut crypto taxes from 55% to 20% and increase chances for spot ETFs.

Moreover, recent macroeconomic changes and lower geopolitical risks, specifically the announced ceasefire between Israel and Iran, boosted the crypto market, with investors turning their attention to risk assets again.

The fragile agreement seems to be holding for now, though the information coming from Israel, the US, and Iran is not exactly clear. At the same time, Israel has continued the genocide in Gaza.

The developments in the region can shift quickly and affect the markets across the board equally as fast.

‘Bitcoin is Undeniably on the Rise’

Dom Harz, co-founder of Layer 2 BOB, said that BTC’s recent price dip below $100,000 shows how geopolitical uncertainty triggers a risk-off sentiment. That said, the dip is “not a long-term concern and is merely a distraction from Bitcoin’s true trajectory,” Harz says.

“While some are fixated on short-term corrections, it is undeniable that Bitcoin, and particularly Bitcoin DeFi, is ultimately on the rise.”

It’s certain that Bitcoin is actively maturing and entering a phase defined by institutional adoption, clearer regulation, and rapid technological progress, he says. This is because Bitcoin’s utility, says Harz. Institutions don’t just want to hold Bitcoin, but put it to work too.

Moreover, Gadi Chait, Head of Investment at Xapo Bank, argued that Bitcoin’s safe-haven asset status is still taking shape. However, “recent signals suggest it’s edging closer.”

“Traditionally seen as volatile, Bitcoin’s response to recent macro shocks, like the events in the Middle East, has been notably restrained, neither tracking gold perfectly nor mirroring equity sell-offs,” says Chait.

Geopolitical shocks often trigger an initial flight to cash, but Chait says that “the combination of institutional rallies and macro-driven bids now means that dips are shallower and recoveries faster than in previous cycles.”

“In recent market downturns, Bitcoin’s relatively shallow pullbacks, which have been paired with consistent institutional inflows, point to a shift in perception. Its increasing correlation with gold suggests it’s being viewed as a store of value, while on the other hand, its rapid rebounds reflect its growing integration into mainstream finance,” Chait concludes.

Levels & Events to Watch Next

At the time of writing, BTC trades at $106,413. Over the last day, the price gradually increased from the daily low of $104,854 to the intraday high of $106,691.

The coin has surpassed the $106,000 level. Investors now wait to see if it will break the $107,500 level next, or possibly drop below $104,000. These moves would open doors for further price rises or drops.

At the same time, Ethereum is currently trading at $2,443. It jumped to the intraday high of $2,473 before decreasing to $2,428 overnight (UTC).

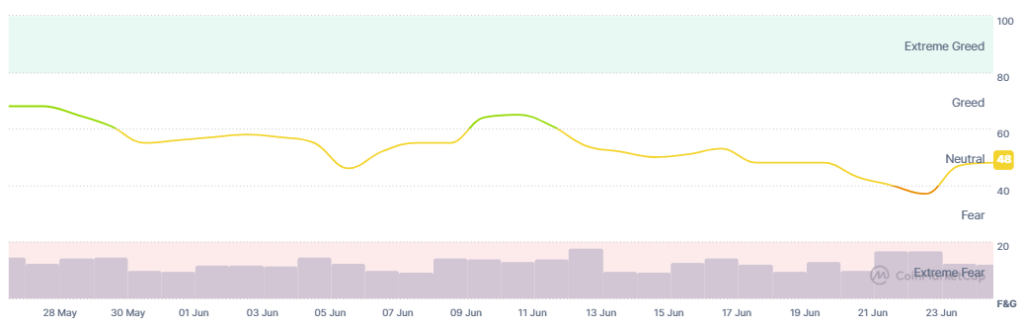

Meanwhile, the crypto market sentiment remained in neutral territory after exiting the fear zone yesterday. The Fear and Greed Index has increased from 47 yesterday to 48 today. The chart below shows the sentiment gradually decreasing over the past 30 days.

The current value suggests certain uneasiness and caution in the market, though investors are not panicking.

Furthermore, on 24 June, when the market saw a significant uptick, US BTC spot exchange-traded funds (ETFs) recorded notable $588.55 million in inflows. BlackRock is at the top of the list, recording $436.32 million in inflows.

Moreover, US ETH ETFs recorded inflows of $71.24 million. BlackRock took in $97.98 million, while Fidelity lost $26.74 million.

Meanwhile, Japanese investment firm Metaplanet raised more than $517 million on the first day of its ‘555 Million Plan’. The company plans to acquire 210,000 Bitcoin by the end of 2027, roughly 1% of the total supply.

Also, entrepreneur Anthony Pompliano’s ProCap BTC announced that it had acquired 3,724 BTC for $386 million. This comes just days after revealing plans to go public later this year.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market saw a shift to red developing since last night, while the stock market saw increases on Tuesday. The S&P 500 went up by 1.11%, the Nasdaq-100 increased by 1.53%, and the Dow Jones Industrial Average rose by 1.19%. The stock market reacted directly to a ceasefire agreement between Israel and Iran.

- Is this dip sustainable?

The market shows caution. There is no panic to speak of yet, and analysts are bullish in the long term, but the unstable global situation can still pull the prices lower.

The post Why Is Crypto Down Today? – June 25, 2025 appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

Japan’s Financial Services Agency proposed to bring crypto assets under the Financial Instruments and Exchange Act.

Japan’s Financial Services Agency proposed to bring crypto assets under the Financial Instruments and Exchange Act. Follow our LIVE coverage:

Follow our LIVE coverage:  (@APompliano)

(@APompliano)