The crypto market is up today. The majority of the top 100 coins per market cap have appreciated over the past 24 hours. At the same time, the cryptocurrency market capitalization has decreased by 0.9% to $3.45 trillion. The total crypto trading volume is at $128 billion, significantly up from $82.5 billion seen yesterday.

TLDR:

Crypto Winners & Losers

The crypto market has continued the green streak, with all top 10 coins per market cap rising today.

Bitcoin (BTC) is up 2.2%, currently trading at $111,250.

At the same time, Ethereum (ETH) is the category’s best performer for the second day in a row. It appreciated by 3.1%, currently changing hands at $2,794.

The second-highest rise is Dogecoin (DOGE)’s 5.1% to the price of $0.181.

Moreover, only three of the top 100 coins are red today. Leo Token (LEO), Aaave (AAVE), and Gate (GT) fell by 1%, 0.8%, and 0.6% to $8.96, $297.69, and $16.09, respectively.

On the other hand, Pudgy Penguins (PENGU) is the category’s best performer, having appreciated 28.3% to the price of $0.01829.

It’s followed by Virtuals Protocol (VIRTUAL), which is the only other coin with a double-digit increase. It’s up 12% to $1.62.

Meanwhile, BTC’s price surged yesterday from the $109,000 level towards $112,000. This was partly the result of the $56.8 billion trading volume. The market cap is unshaken by recent events that were pushing the price down, holding above $2 trillion, signaling strong interest.

Meanwhile, the US Federal Reserve’s June minutes, released on 9 July, said that “tariffs pose a persistent risk for driving up prices.” They decided to keep the federal funds rate steady, but many believe that a rate cut will come later this year – if inflationary pressures ease.

‘July Will Test Markets, But Bitcoin is Built for It’

As BTC surged towards a new ATH, analysts commented on its most recent news. Roshan Roberts, CEO of OKX US, argued that “Bitcoin is showing why it’s in a class of its own. As trade tensions flare and altcoins stumble, institutions are treating BTC as a macro hedge and a maturing asset class.”

Roberts says that “July will test markets, but Bitcoin looks built for it.”

Additionally, Mauricio Di Bartolomeo, co-founder and CSO of Ledn, said that BTC’s surge is the result of “relentless demand from investors and corporations.”

In the last 30 days alone, at least 21 companies have announced new plans to raise and deploy an estimated $3.5 billion into their BTC treasuries, he says. They have bought 6,745 BTC, which is some 20% of their planned purchases.

He added that “there is still a lot of money sidelined and waiting to be deployed. If this trend continues, we may see Bitcoin price move much higher from here,” Di Bartolomeo argued.

Meanwhile, analysts are debating if we’re about to see an actual breakout or not. As the coin stopped just shy of breaking the high, there may be a pullback next. Overall, many still argue that new all-time highs are near.

Additionally, onchain data and intelligence platform Glassnode noted that Bitcoin RHODL Ratio (which compares the realized value of Bitcoin held by different investor age groups) “turned upwards.” It reached its highest level in this cycle on Wednesday, signaling a shift, with single-cycle holders holding more wealth.

“Historically, such turns mark transitions in market cycles and cooling speculative momentum,” Glassnode says.

Levels & Events to Watch Next

At the time of writing, BTC trades at $111,250. Yesterday, the price surged to the monthly high of $111,742, nearing the all-time high of $111,814, before settling on the current level.

The next level to keep an eye on is $110,550. BTC holding this level firmly would validate the latest breakout. A drop below and towards the $109,850 level could lead to additional falls. That said, the coin may also retest the $112,000 zone.

Moreover, Ethereum is currently trading at $2,794. It started the day with the daily high of $2,869, before diving to $2,182. The price recovered shortly afterwards and gradually climbed back to the current level.

Analysts are noting an increased interest in ETH exchange-traded funds (ETFs), which is likely to impact its price positively. Glassnode noted on Monday that spot ETF flows remained positive for the 8th consecutive week, with inflows surpassing 61,000 ETH.

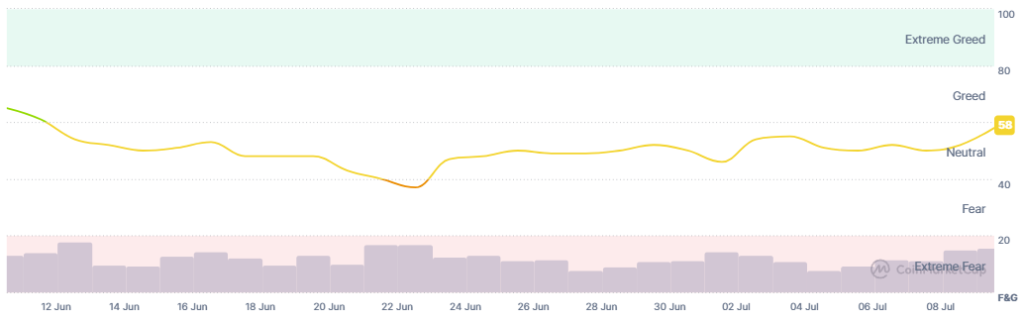

Also, the crypto market sentiment finally made a more significant move after days of trading within neutral territory. While still in this zone, the Fear and Greed Index moved up to the threshold of greed territory, from 52 yesterday to 58 today. There are no signs of an overheated market yet.

Moreover, on 9 July, the US BTC spot exchange-traded funds (ETFs) recorded another day of inflows of $218.04 million, significantly higher than the $80.04 million seen on 8 July and back to the level seen two days ago.

BlackRock leads the list again with inflows of $125.58 million. Ark & 21Shares saw the second-highest amount of $56.96 million. Fidelity, Grayscale, Bitwise, Valkyrie, and Invesco also saw positive flows between $2 million and $16 million.

On the same day, US ETH ETFs saw inflows surge to $211.32 million, up from less than $47 million a day prior. This is the second-highest amount in over five months.

Of this amount, BlackRock’s is $158.62 million. Grayscale ($17.96m), Fidelity ($29.53m), and Franklin ($5.21m) also recorded inflows.

Meanwhile, during a 9 July hearing, US Senate Banking Committee Chairman Tim Scott urged the lawmakers in that country to advance key crypto market structure legislation. “Today’s hearing is the first full committee hearing on digital assets,” Scott said. “This is a crucial step toward developing a comprehensive framework that gives innovators the clarity they need and gives investors the protections they deserve.”

He continued: “Make no mistake: blockchain technology and digital assets are not going away – they are here to stay.”

Additionally, Elizabeth Warren, Ranking Member of the Senate Banking, Housing, and Urban Affairs Committee, proposed her crypto market legislation framework during this hearing. She devised a list of five priorities to “guide” the legislative process while developing crypto policy.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market saw a notable increase over the past 24 hours, as did the US stock market on Wednesday, despite enduring uncertainty about US trade policy. For example, the S&P 500 rose by 0.61%, the Nasdaq-100 increased by 0.72%, and the Dow Jones Industrial Average is up by 0.49%.

- Is this rally sustainable?

Short answer: long-term, yes. Analysts argue that the prices will continue to increase in the mid and long term, but these increases will be followed by typical pullbacks. So far, there is no sign of an incoming bear.

The post Why Is Crypto Up Today? – July 10, 2025 appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.