The crypto market has gone up today, despite the small market cap fall. Eight of the top 100 coins have recorded increases over the past 24 hours. The cryptocurrency market capitalization has dropped by 0.9% to $3.45 trillion. The total crypto trading volume is at $76.7 billion, nearly half of what we’ve been seeing in the latter part of last week.

TLDR:

Crypto Winners & Losers

All top 10 coins per market cap have recorded price rises over the past 24 hours.

Bitcoin (BTC) is up 1.1%, surpassing the $106,000 again, standing at the current price of $106,734.

Ethereum (ETH) recorded the second-highest rise on the list: 3.2%, changing hands at $2,615.

The top increase is Solana (SOL)’s 6.8%, which now trades at $156.

At the same time, the smallest rise is Binance Coin (BNB)’s 0.6% to the price of $654.

Moreover, only eight of the top 100 coins have decreased today. Mantle (MNT) fell the most. It’s down 1.9% to $0.6238.

Tokenize Xchange (TKX) appreciated the most among the top 100, rising 12.8% and trading at $32.36. It’s followed by SPX6900 (SPX)’s 12.4%, currently trading at $1.65.

Cryptoworld has seen several significant events over just the past couple of days. Notably, another nation officially legalized cryptoassets. On Saturday, Vietnam’s National Assembly passed the Law on Digital Technology Industry, which defines, classifies, and outlines the management of digital assets.

While the escalating Iran‑Israel tensions and the subsequent Israel’s attack on Iran initially impacted crypto markets, these have recovered by today, at least by the time of writing.

Traders Aggressively Positioning for Upside or Volatility

Analysts at Glassnode have found that BTC 25 Delta Skew (a metric focusing on option contracts expiring in one week) has turned bullish. “Traders are aggressively positioning for near-term upside or volatility,” they commented today.

They also noted that demand growth is keeping pace with BTC’s maturation, describing it as “an impressive sign of sustained investor appetite.”

Others were focused on the regulatory impacts. Przemysław Kral, the CEO of the zondacrypto exchange, commented on the regulations opening doors to massive players to enter the space – but also their drawbacks.

“Regulations attract major players to the market,” he said. MiCA is a major one. It does impose limitations, but these are necessary for crypto to go mainstream.

“However, we’re already seeing one major systemic drawback of MiCA,” says the CEO. “If you wanted to start a crypto business from scratch today, MiCA makes that impossible. The directive’s requirements can only be met by large, established players. So, the resolution has eliminated my competition. MiCA cements and consolidates the market.”

That said, MiCA offers a level playing field. Until now, any exchange in Europe could choose the “softest” jurisdiction and compete on cost rather than quality, he says. “Now, everyone must meet the same security standards, so users benefit.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $106,734. At the time of writing, this is the highest 24-hour point, up from the intraday low of $104,627. Also, it’s currently down 4.6% from the all-time high of $111,814. It’s trying to hold the current level so to attempt higher points.

Notably, BTC’s overall stability holds despite headlines about retail and banking giants (potentially) launching stablecoins, which may be seen as bearish for BTC.

At the same time, Ethereum, currently trading at $2,615, pulled itself up from its intraday low of $2,494. At the time of writing, it’s still rising to retake the $2,500 zone and possibly continue upwards. Moving above $2,630 would open doors for the $2,700 level. However, dropping below $2,570 could lead to further downside.

Notably, it was revealed on Friday that SharpLink Gaming became the largest publicly traded ETH holder after purchasing 176,271 ETH.

Moreover, Ethereum whales increased their exposure to the asset over the past month, while smaller investors decided to sell during price stagnation. Wallets holding between 1,000 and 100,000 ETH added 1.49 million ETH over the past 30 days – a 3.72% increase. Also, as reported on Sunday, a whale purchased 48,825 ETH at an average price of nearly $2,605, taking advantage of the recent dip.

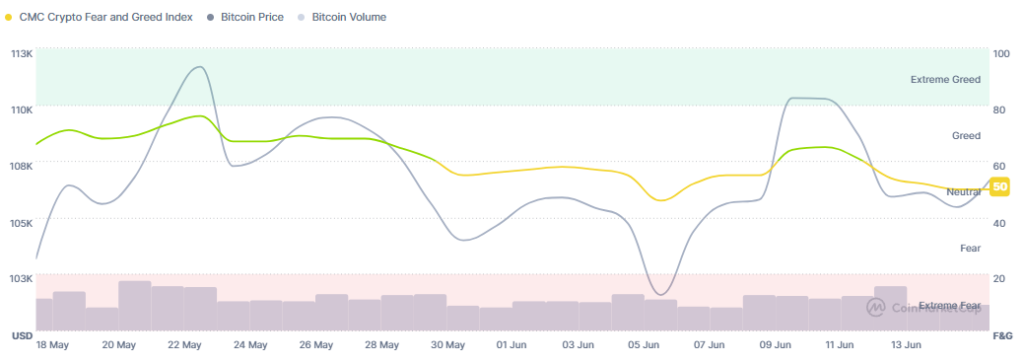

Furthermore, the crypto market sentiment has continued retreating towards the fear territory. Currently, it’s still standing within the neutral zone, but it has fallen from 54 seen on Friday to 50 today. If fear starts pushing prices down, it may create buying opportunities for both new and existing investors.

Meanwhile, US BTC spot exchange-traded funds (ETFs) saw $301.62 million in net inflows on Friday. Data for Monday is not yet available at the time of writing. Of this amount, BlackRock saw $238.99 million. Others are in green as well, albeit with smaller amounts.

However, US ETH spot ETFs broke their 19-day inflow streak on Friday with $2.18 million in outflows. Grayscale took in $6.67 million, and Fidelity bled out $8.85 million. Others saw no flows.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market turned another green corner over the past 24 hours. Stocks were down on their previous workday. The S&P 500 decreased by 1.13% by Friday closing time, the Nasdaq-100 was down 1.29%, and the Dow Jones Industrial Average fell by 1.79%. This was the result of the tensions between Israel and Iran, and Israel’s subsequent attack on Iranian cities and population.

- Is this rally sustainable?

The short answer is yes, but there are ‘buts’. This uptick is a continuation of the rally that led to BTC hitting an ATH in May. It will continue to see short-term pullbacks, as is typical. However, the prices may be more significantly hit by escalating geopolitical issues.

The post Why Is Crypto Up Today? – June 16, 2025 appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

1-week: -2.6% → +10.1%

1-week: -2.6% → +10.1% There are currently 6,392 wallets holding between 1K and 100K Ethereum. Over the past month alone, these key whale and shark wallets have rapidly added more coins as retail traders have taken profit.

There are currently 6,392 wallets holding between 1K and 100K Ethereum. Over the past month alone, these key whale and shark wallets have rapidly added more coins as retail traders have taken profit.