The crypto market is up today, with total market capitalization reaching $3.95 trillion — a 2.3% increase in the last 24 hours. The 24-hour trading volume stands at $134.7 billion, reflecting growing activity across both spot and derivatives markets.

TLDR:

- The crypto market is seeing a broad recovery, with 6 of the top 10 coins in the green today;

- Bitcoin is up 2.5% to $112,047, and Ethereum rose 2.8% to $4,105;

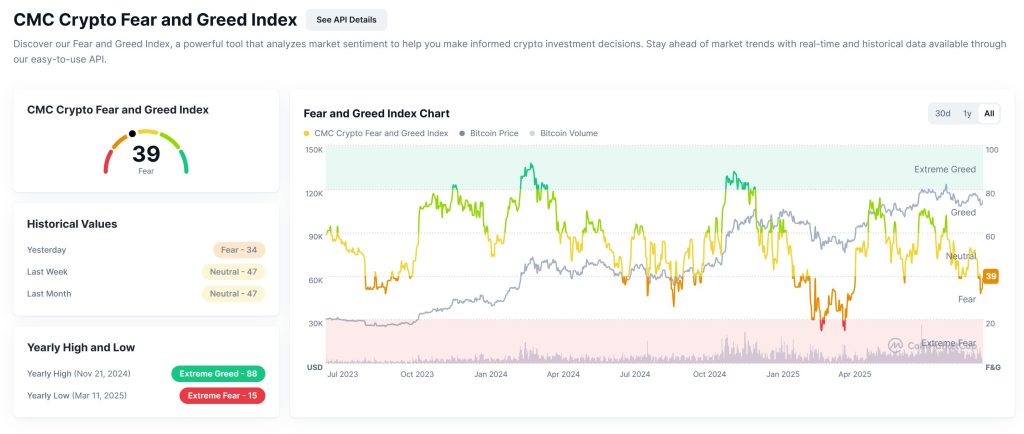

- The Fear and Greed Index sits at 39, up from 34 yesterday, but still in “Fear”;

- Bitunix analysts say Fed’s rate cuts support crypto liquidity;

- BTC support sits between $108K–$106K, with resistance at $116K–$118K;

- ETH holds $4,100, with support near $4,000 and resistance at $4,250;

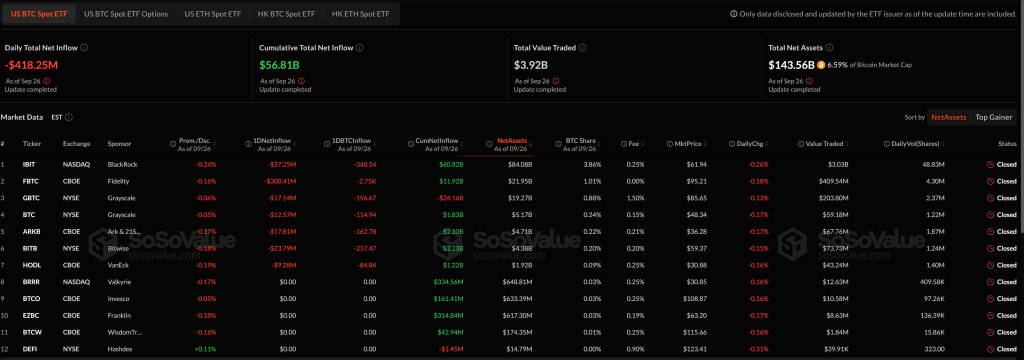

- US BTC spot ETFs saw heavy net outflows of $418.25M on Sept. 26;

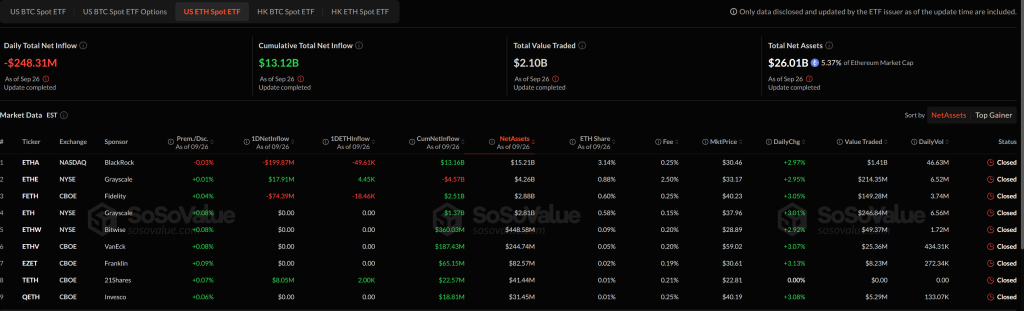

- US ETH spot ETFs lost $248.31M the same day;

- Revolut is reportedly planning a dual IPO in London and New York.

Crypto Winners & Losers

As of now, six of the top 10 cryptocurrencies by market cap are trading in the green, with moderate gains across major assets.

Bitcoin (BTC) is up 2.5% on the day, trading at $112,047, recovering from yesterday’s slight dip.

Ethereum (ETH) gained 2.8%, now sitting at $4,105.

BNB (BNB) recorded a 3.9% increase, trading at $1,007.27, the highest percentage gain among the top five coins.

XRP (XRP) rose 3.0% to $2.86, continuing its week-long uptrend.

Solana (SOL) posted a 3.2% gain, currently at $206.85.

BNB (BNB) climbed 3.0% to $0.7924, keeping pace with broader market sentiment.

Meanwhile, Dogecoin (DOGE) saw a smaller uptick of 1.1%, while TRON (TRX) also moved higher by 0.7%.

Among trending tokens, Aster stands out with a 6.0% increase, while Anoma and Undeads Games are down 43.9% and 10.8%, respectively.

In the Top Gainers category, SuperVerse jumped 7.71%, followed by Purr (+59.2%) and Orderly (+79.2%).

Overall, today’s gains suggest a continued recovery across major assets, with altcoins showing strong momentum as market sentiment improves.

Bitcoin is closing Q3 with minimal volatility and relatively flat performance, which aligns with historical trends. According to trader Daan Crypto Trades, Q3 has historically been Bitcoin’s weakest quarter, averaging only around a 6% gain, making this quarter’s outcome consistent with past patterns.

Fed Rate Cuts Support Crypto Liquidity but Heighten Short-Term Volatility

On September 29, the US Federal Reserve resumed its rate-cut cycle to support a softening labor market, a move that Bitunix analysts say is broadly positive for risk assets like Bitcoin, but warn that near-term volatility remains elevated due to bubble concerns and political risks.

“Rate-cut expectations are supportive of liquidity,” Bitunix noted in its latest update, “but traders must also factor in the risk of overvalued equities and a potential government shutdown, which can lead to sudden risk-off moves.”

The analyst team recommends that traders keep a close eye on BTC’s key levels: short-term support at $108,000–$106,000, with a secondary base near $104,000.

Resistance sits between $116,000 and $118,000, with a potential upside to $120,000 if capital inflows confirm a breakout.

The recent pullback from $112,000–$113,000 toward $110,000 suggests range-bound trading in the near term, with sentiment likely to swing between “rate-cut optimism” and “valuation risk.”

“Traders are advised to reduce leverage and scale positions cautiously,” Bitunix said, adding that the current environment favors short-term tactical moves over aggressive positioning.

Levels & Events to Watch Next

At the time of writing on Monday, Bitcoin is trading at $112,132, down slightly by 0.06% on the day. The asset has recently recovered from a local low near $110,000 after a sharp selloff, and now appears to be stabilizing in a range.

Price action shows resistance around $113,500, with potential upside toward $115,000 if momentum holds. On the downside, a close below $110,000 could open the door for a pullback toward the $108,000–$106,000 zone, which has acted as key support in recent weeks.

Meanwhile, Ethereum is trading at $4,108.69, down 0.83% in the past 24 hours. ETH recently dropped from highs above $4,250 but bounced back after briefly dipping below $4,000.

Support sits at $4,000, followed by secondary support at $3,850. On the upside, ETH faces resistance at $4,250, and a confirmed breakout above that could send it toward $4,400. ETH has been underperforming compared to early September highs but remains structurally bullish in the medium term.

With U.S. rate cuts back in focus and regulatory news expected this week, traders are advised to watch macroeconomic headlines and capital inflows closely. Both BTC and ETH are showing signs of consolidation, with volatility likely to pick up around major breakout zones.

Meanwhile, crypto market sentiment remains cautious. The CMC Crypto Fear and Greed Index currently stands at 39, reflecting a “Fear” reading. This marks a slight uptick from 34 yesterday, but still a decline from 47 last week and 47 last month, indicating a growing sense of hesitation among investors.

The index shows that market sentiment has weakened in recent days, as traders weigh macroeconomic risks, including the US government shutdown threat and renewed volatility around Federal Reserve policy shifts. Although still above the “Extreme Fear” zone, the current reading suggests that risk appetite remains subdued, and many are awaiting clearer signals before re-entering the market in size.

US Bitcoin spot ETFs recorded a sharp net outflow of $418.25 million on September 26, marking one of the largest daily capital pulls in recent weeks, according to data from SoSoValue.

Among the 12 funds tracked, Fidelity’s FBTC experienced the most significant outflow, losing $300.41 million in a single day. It was followed by Bitwise’s BITB, which shed $23.79 million, and Grayscale’s GBTC, down $17.14 million.

Even BlackRock’s IBIT, typically known for steady inflows, saw a $37.25 million net outflow on the day—indicating broader caution across the ETF landscape. Other notable outflows included ARKB (-$17.81M), BTC (-$12.57M), and HODL (-$9.28M).

US Ethereum spot ETFs registered a significant net outflow of $248.31 million on September 26. BlackRock’s ETHA led the redemptions with a $199.87 million outflow, followed by Fidelity’s FETH, which lost $74.39 million. Grayscale’s ETHE was the only ETF to record inflows, adding $8.05 million, while its other product, ETH, held flat with no net change.

VanEck’s ETHV, Bitwise’s ETHW, and Franklin’s EZET all posted no net inflows or outflows on the day, maintaining their positions despite broader market pressure.

Meanwhile, Revolut is reportedly weighing a dual listing in London and New York, a move that could value the company at $75 billion and mark a historic first, simultaneously joining the FTSE 100 and the NYSE. If completed, Revolut would become one of the top 15 most valuable firms on the London Stock Exchange.

The post Why Is Crypto Up Today? – September 29, 2025 appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.