As digital currencies and traditional assets are converging, gold-backed crypto tokens have emerged as a unique investment vehicle. Also referred to as “tokenized gold,” these assets combine the stability of gold with the flexibility of blockchain technology.

As the price of gold continues to hit new all-time highs, the demand for gold-backed tokens has increased. Blockchain analytics platform Lookonchain recently posted on X that two crypto whales bought more than $30 million worth of Tether Gold (XAUt) over the past week.

Alex Tapscott, CEO of CMCC Global Capital Markets, told Cryptonews that as gold continues to break $4,000, tokenized gold volumes will likely skyrocket.

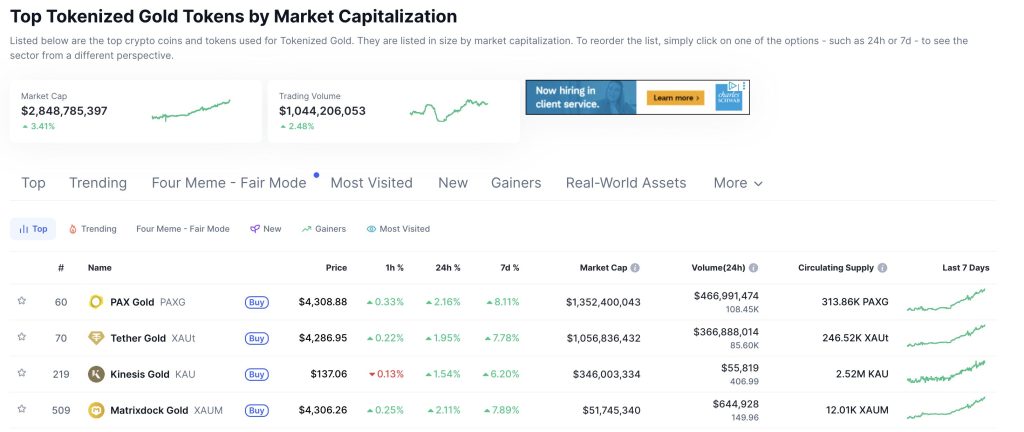

“The total volume of tokenized gold is about $3 billion—up from less than $500 million at the beginning of this year—and daily volumes are over $600 million,” Tapscott said.

He added that gold-backed tokens have become the fastest-growing category of tokenized assets to date. This is impressive, as Galaxy Digital predicts tokenized assets will hit $1.9 trillion over the next five years.

What Are Gold-Backed Crypto Tokens?

Alex Melikhov, co-founder of digital asset management firm BrettonWoods, told Cryptonews that gold-backed cryptocurrencies are digital tokens whose value is directly tied to physical gold held in reserve.

“Each token represents ownership of a fixed amount of gold, typically one troy ounce or a fraction of it,” Melikhov said.

He elaborated that the physical gold is typically stored by a certified custodian, while the issuer of the gold-backed currency holds legal ownership. The issuer, in turn, commits to redeeming an equivalent amount of gold upon presentation of the currency.

Given the volatile nature of cryptocurrency, Melikhov believes that gold-backed tokens may appeal more to conservative investors who desire stability and real-world value support rather than price volatility.

“Gold has a 5,000-year track record as a store of value, while Bitcoin and Ethereum are more speculative,” he noted.

Melikhov added that tokenized gold offers digital convenience for traditional investors. Benefits include 24/7 transfer and trading, along with instant settlement, all while retaining the familiarity of an underlying tangible asset.

“Tokenized gold bridges the psychological gap between traditional finance and decentralized finance,” Melikhov remarked.

Examples of Gold-Backed Tokens

While the market cap of gold-backed cryptocurrency is close to $3 billion, Tether Gold (XAUt) and PAX Gold (PAXG) are currently among the top-performing gold-backed tokens on the market.

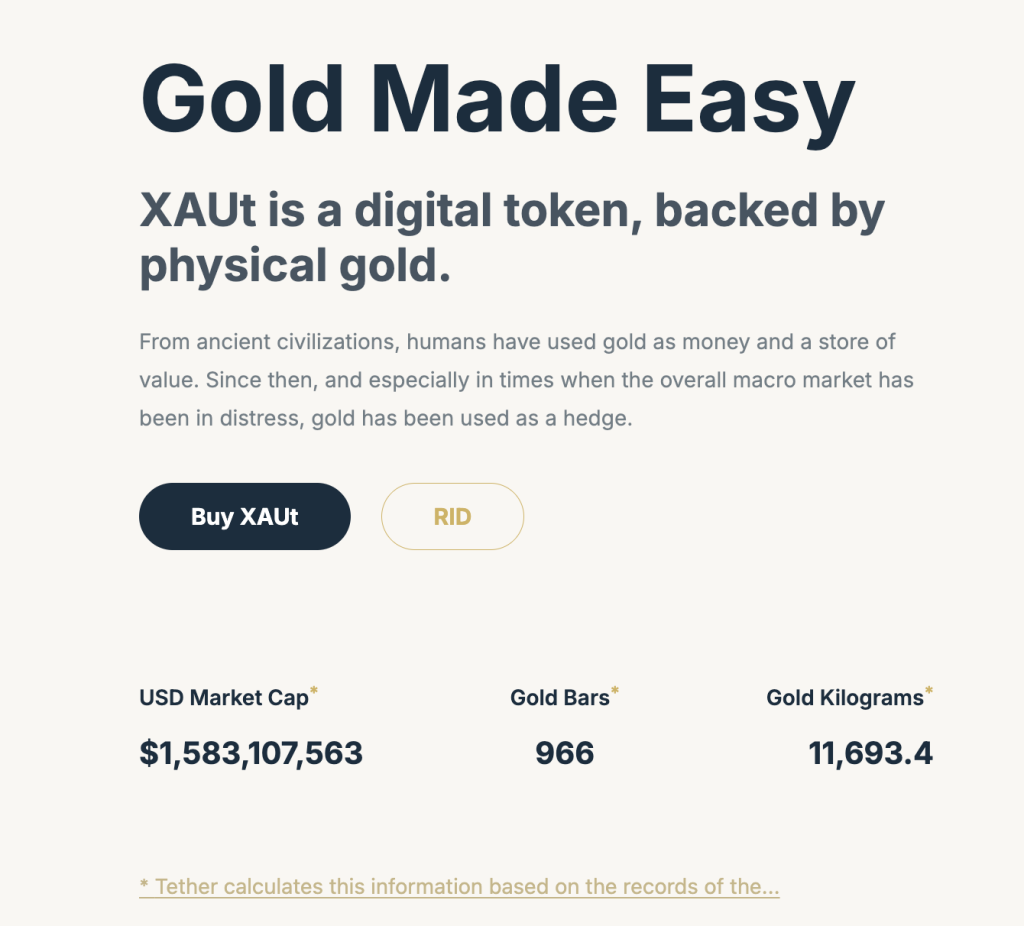

Tether Gold, or XAUt, is a stablecoin that represents ownership of one fine troy ounce of digital gold. Sources note that the physical gold behind XAUt is held in secure, audited vaults. This is verified by Tether, as the company is required to provide regular proof-of-ownership and transparency reports.

PAX Gold, or PAXG, is backed by one fine troy ounce of gold in the form of London Good Delivery gold bars. The bars are stored in Brink’s vaults located in London. This means that 1 PAXG equates to 1 ounce of physical gold. Paxos Trust Company is the issuer of PAXG and is regulated by the New York State Department of Financial Services.

Other top-performing gold-backed cryptocurrencies include Kinesis Gold (KAU), Matrixdock Gold (XAUM), and Comtech Gold (CGO).

Gold-Backed Crypto Token Use Cases

One of the best use cases for gold-backed crypto tokens is to serve as a hedge against inflation. For instance, Melikhov believes that inflation persistence and geopolitical tension are pushing investors toward hard assets like gold.

“Now that tokenized gold has credible infrastructure, regulated issuers, audited reserves, and access through major exchanges, investors are comfortable holding tokenized commodities as an alternative to fiat-backed stables,” he said.

In addition, Tapscott mentioned that tokenized gold can be pledged as collateral in DeFi protocols, allowing investors to get leverage.

“Similar to a margin loan in a brokerage account but on-chain—big picture tokenized gold makes the gold more useful, fungible, and marginable,” he said.

Additionally, as more investors seek exposure to gold in today’s digital economy, gold-backed crypto tokens seem to be the answer.

“Holding physical gold poses security risks, and it’s not easy to move, store, or manage. Tokens are—tokenized gold democratizes gold ownership,” Tapscott mentioned.

Risks and Challenges to Consider

While gold-backed crypto tokens gain traction, it’s also important to point out the risks associated with these digital assets.

For instance, Melikhov believes that the main challenges are custodial and regulatory. “Investors must trust that the gold truly exists, remains unencumbered, and is redeemable on demand,” he said.

Echoing this, Illia Otychenko, lead analyst at CEX.IO, thinks trust and transparency remain an issue, noting that investors need proof that the gold truly exists and is fully backed.

“If investors feel confident about the reserves, this could provide an additional boost for the asset,” Otychenko said.

For example, on July 24, Tether published its Q2 attestation report confirming that XAUt was backed by more than 7.66 tons of physical gold. Otychenko noted that shortly afterward, XAUt began confidently surpassing both PAXG and KAU in daily trading volume.

“A few weeks after that, XAUt executed the largest single-day supply expansion in tokenized gold history,” Otychenko added.

While transparency remains key, liquidity is yet another challenge. Melikhov pointed out that only a few venues currently offer deep trading markets for gold-backed crypto tokens.

What’s Next For Gold-Backed Crypto Tokens

Challenges aside, gold-backed crypto tokens will likely continue to perform well. This also depends on key fundamental drivers, such as expectations of future U.S. interest rate cuts, threats to U.S. Fed independence, geopolitical risks around the world, U.S. trade policy and tariffs, and government fiscal policy and rising debt.

“I think within a few years there will be trillions in tokenized real-world assets and gold will be one of the biggest beneficiaries,” Tapscott said. “Tokenizing gold is just one of many ways in which blockchains are bringing finance into the 21st century.”

The post Why Tokenized Gold Is Booming as Spot Gold Breaks Records appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.