WLD price prediction gains momentum as Sam Altman’s World Chain integrated Chainlink CCIP for cross-chain token transfers, allowing 35 million users to seamlessly move WLD between the Ethereum and World Chain networks.

The Cross-Chain Token standard implementation coincides with Chainlink Data Streams adoption for sub-second market data on World Chain.

Technical analysis reveals WLD testing key support around $1.28 within a long-term descending triangle pattern from March 2024 highs near $11.70.

Currently, WLD’s triangle support, key support levels, and fundamental catalysts all point towards potential reversal conditions.

However, broader market sentiment remains key for sustaining a recovery toward $2 targets.

Chainlink Integration Expands WLD Utility Across Networks

World Chain’s adoption of Chainlink CCIP transforms WLD into a Cross-Chain Token, which allows native transfers between Ethereum and World Chain without traditional bridging complexities.

The integration serves 35 million users who can now seamlessly transfer WLD across blockchain networks using battle-tested security infrastructure.

Chainlink Data Streams provides World Chain developers with sub-second latency oracles for high-quality financial market data.

The pull-based oracle system allows DeFi applications to access real-time price feeds, which support secure market development around WLD and enhance overall liquidity prospects.

Additionally, recent Kalshi integration allows users to fund prediction market accounts directly through World App wallets.

Users can deposit Worldcoin or USDC on World Chain with instant arrival in Kalshi accounts via ZeroHashX partnership, expanding WLD utility into prediction markets.

The Cross-Chain Token standard allows token developers to integrate existing tokens via CCIP within minutes using self-serve functionality.

This streamlined approach reduces technical barriers for cross-chain development around WLD while maintaining security standards across blockchain networks.

Tools for Humanity’s Steven Smith emphasized the role of this integration, saying, “World is using Chainlink Data Streams to support secure markets around WLD and enhance its liquidity.”

Chainlink Labs’ Thodoris Karakostas also highlighted the combination of secure cross-chain transfers and high-quality market data as catalysts for mainstream adoption of the World Chain ecosystem.

Descending Triangle Tests Key $1.28 Support

WLD’s 3-day chart reveals a major descending triangle pattern forming since March 2024, with peaks around $11.70.

The pattern shows consistent lower highs with horizontal support around $1.28-$1.35, creating a narrowing price range approaching resolution.

Triangle supports meet with the horizontal support levels at $3.34, $2.15, and the current $1.30 zone creates multiple layers of potential buying interest.

These areas are a”strong support” for the next breakout.

Med-term 12-hour structure positions WLD near the “level of interest” around $1.32, as analysts call it, within the gray support zone.

The recommendation for scale-in DCA purchases adds to the uncertainty while positioning for potential reversal signals on smaller timeframes.

For instance, a short-term 6-hour analysis shows WLD testing the intersection of the descending trendline and horizontal support at the critical decision point.

The volume profile indicates strong trading activity around current levels, with volume nodes at $1.39, $1.46, and higher levels, extending toward $1.69-$1.86.

Current projections target recovery toward $1.86 levels. The 78.76% retracement level at $0.87 serves as a deeper support, with the $0.80-$0.85 range marking extreme downside scenarios.

The technical setup provides clear risk parameters with breaks below $1.20 indicating potential weakness toward $0.80-$0.90 range.

WLD’s next trajectory depends on defending the $1.28-$1.32 support zone while building momentum above $1.40 resistance.

Success above $1.50 could trigger recovery toward $1.86-$2.00 targets, while failure below $1.20 may prompt a retest of $0.80-$0.90 extreme support levels.

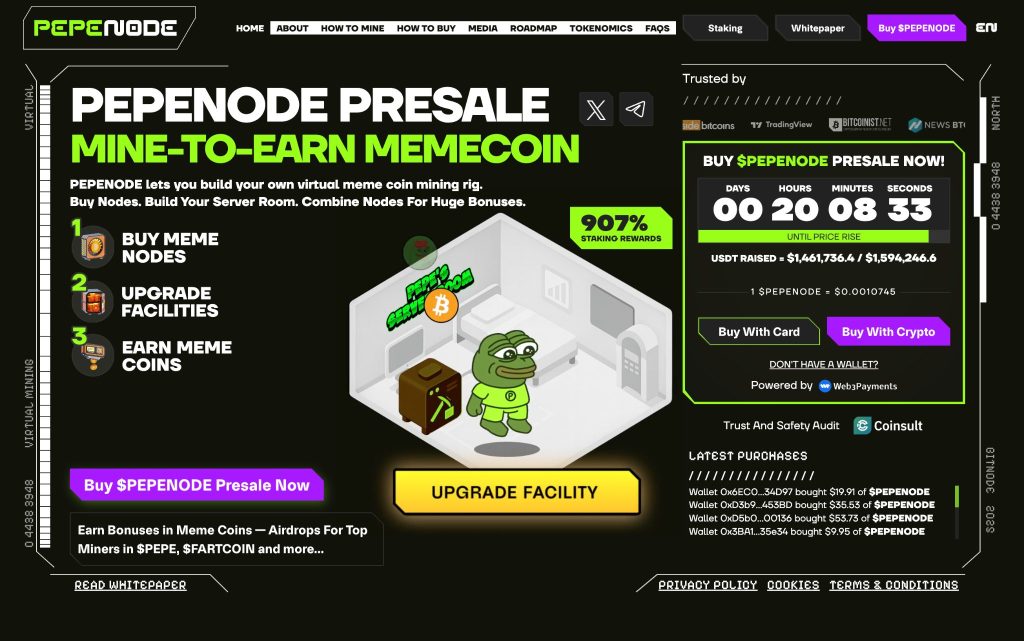

Is PepeNode the Next 1000x Meme Coin Game Everyone’s Playing?

While WLD is targeting recovery, this virtual mining game is building strong presale momentum.

The truth is that getting into gamified projects like this early can lead to massive returns during meme coin seasons.

PepeNode is getting attention because it turns crypto mining into a fun browser game. Players buy virtual mining rigs that earn rewards without needing real hardware or electricity costs.

The presale raised almost $1 million with plans to end on December 31, 2025. Early players can earn over 1,500% staking rewards while the game burns 70% of tokens used for upgrades.

It is not a new thing that the best gaming projects get discovered fast once players start having fun and earning rewards.

PepeNode launches with audited smart contracts and partnerships with other meme projects. This means you should join now if you want presale pricing.

You can buy PEPENODE tokens on their website using ETH, USDT, or credit cards.

Visit the Official Website Here

The post WLD Price Prediction: $1.28 Support Holds as CCIP Unlocks Native Cross-Chain Moves appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.