TLDR

- Xiaomi delivered 48,654 EVs in China during October 2025, beating Tesla’s 26,006 units

- Tesla posted its weakest China sales in three years while Xiaomi hit record monthly deliveries

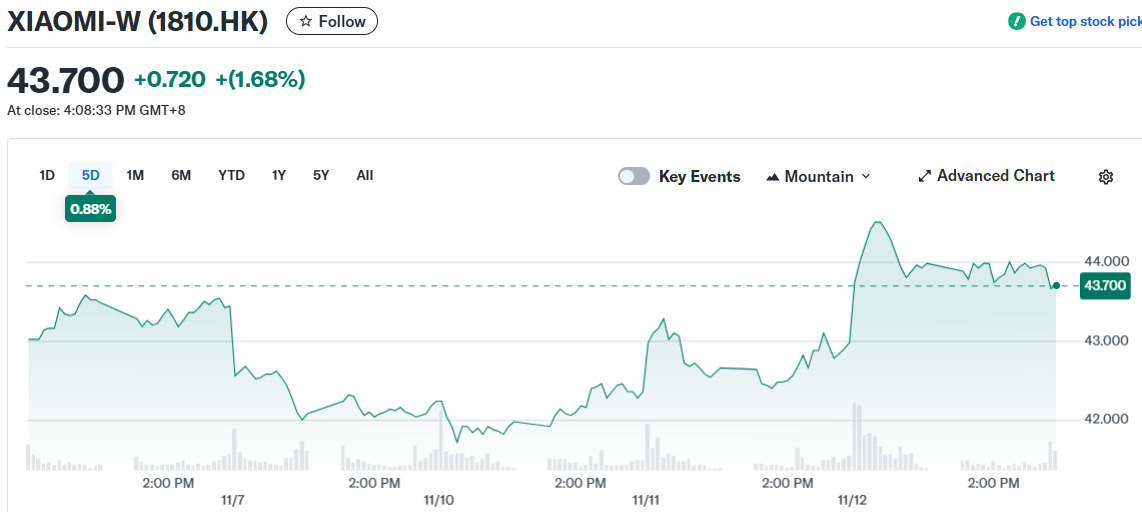

- Xiaomi stock rose 4% to HK$44.62 after China Passenger Car Association released the data

- Chinese EV market cooled overall with BYD sales down 12% after subsidies expired

- Xiaomi’s SU7 and YU7 models compete directly with Tesla through lower prices and device integration

Xiaomi stock climbed 4% Wednesday after new data revealed the company outsold Tesla in China’s electric vehicle market. The shift marks a major win for the tech company’s automotive division.

October sales figures from the China Passenger Car Association showed Xiaomi delivered 48,654 electric vehicles. Tesla sold just 26,006 units in the same month. This represents Tesla’s lowest China performance since 2022.

Xiaomi launched its first car, the SU7 sedan, in 2024. The YU7 SUV followed in early 2025. Both vehicles target buyers considering Tesla’s Model Y and Model X.

The company applied lessons from smartphone manufacturing to car production. Vehicles connect seamlessly with Xiaomi phones and smart home products. Over-the-air software updates work like phone updates. Pricing undercuts competitors while delivering premium tech features.

Tesla Struggles as Local Brands Gain Ground

Tesla attempted price cuts and model refreshes throughout 2024 and 2025. The strategy failed to stop declining sales. Chinese consumers increasingly prefer domestic brands that understand local market needs.

Tesla dropped out of China’s top ten monthly new energy vehicle sellers. The company boosted exports from its Shanghai plant to offset weak domestic demand. However, the fundamental challenge remains market share loss to local competitors.

Chinese buyers now prioritize value, advanced features and reliable service networks. Domestic automakers match or exceed foreign quality while offering better prices. Trust in local brands has strengthened.

Market Conditions Challenge All Players

China’s overall auto market weakened in October after government subsidies expired. Beijing ended several purchase incentive programs without announcing replacements. Authorities viewed the market as overheated and pulled back support.

Even BYD, China’s EV leader, saw sales drop 12% year-over-year. The cooling trend affected most manufacturers. Xiaomi’s growth against this backdrop impressed investors.

The October results set a monthly record for Xiaomi. Strong demand for both the SU7 and YU7 drove numbers higher. The company leveraged supply chain expertise from electronics manufacturing.

Stock Performance and Future Outlook

Xiaomi shares gained as much as 4% in Hong Kong trading to HK$44.62. The move helped push the Hang Seng index up 0.5%. Investors have closely tracked monthly delivery figures since the automotive launch.

Questions remain about profit margins. Early-stage car production typically squeezes profitability. Xiaomi must balance rapid growth with financial sustainability.

The company faces production risks and potential quality issues. Any safety problems could damage brand reputation. Fading subsidies may soften consumer demand across the market.

Xiaomi’s device ecosystem provides competitive advantages. Cars work natively with products customers already own. This integration creates switching costs and encourages brand loyalty.

Digital marketing and preorder campaigns built early momentum. The existing customer base provided immediate prospects. Many Xiaomi device owners wanted vehicles that matched their tech ecosystem.

Local manufacturing partnerships accelerated production scaling. Government support for domestic EV makers helped delivery ramps. The company avoided supply chain problems that hit some competitors.

China Passenger Car Association data confirmed Xiaomi sold 48,654 vehicles in October while Tesla delivered 26,006 units in the Chinese market.

The post Xiaomi Stock: Tech Giant Crushes Tesla in China EV Sales Battle appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.