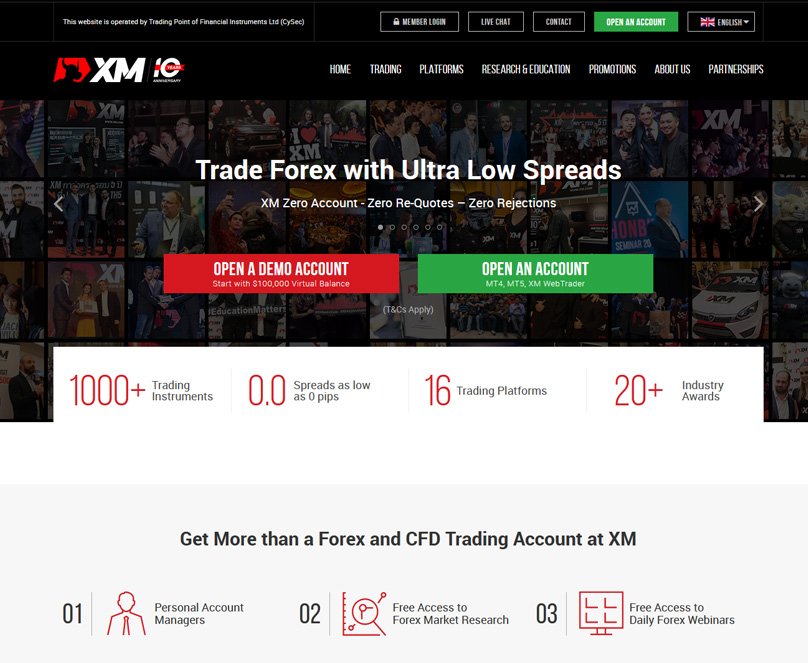

XM is an online broker and trading website that allows clients to trade a range of assets.

Founded in 2009, XM group provides traders with the full MetaTrader platform suite by MetaQuotes Software Corporation.

XM Group has evolved into an online multi-asset broker offering 57 currency pairs and 1000 CFDs. Five CFDs on cryptocurrencies are also offered covering Bitcoin, Dash, Ethereum, Litecoin and Ripple.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

XM has 10 million clients in 190 countries around the world.

So far, it has executed more than 1.4 billion trades with an impressive zero rejections or requotes. The management team of XM has visited more than 120 cities to meet with partners and clients.

The history of XM goes back to 2009 when it was founded. Now, it is an industry leader and a well-established investment firm. XM currently has more than 300 professionals, each of whom has long-year experiences within the financial industry.

XM has extensive experience and offers support in more than 30 languages. This helps the broker appeal to those all over the world and of any skill levels. XM also has 16 full-feature trading platforms for clients to choose from.

XM at a Glance

Broker

XM

Regulation

FCA (UK), CySEC (Cyprus), ASIC (Australia), IFSC (Belize)

Minium Initial Deposit

$5

Demo Account

Yes

Asset Coverage

Forex, Crypto CFDs, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, Shares

Leverage

Maximum Leverage of 1:1000

Trading Platforms

MetaTrader 4 & MetaTrader 5, Web Trader, Mobile

How Is XM Regulated?

The XM brand (XM Group) is a group of online regulated brokers. The group’s first entity was founded in 2009 in Cyprus (regulated by CySEC under license 120/10) under the name Trading Point of Financial Instruments Ltd.

In 2015, the group established an entity (ASIC-regulated, license number 443670) in Sydney, Australia, and the same year obtained regulatory status in London (FCA-regulated, license number 705428), under Trading Point of Financial Instruments UK Ltd.

More recently, XM Global Limited was established in 2017 in Belize (regulated by the IFSC, with license number IFSC/60/354/TS/18).

Other Legal Information

XM Global has its registered address at No. 5 Cork Street, Belize City, Belize, C.A. XM Global (CY) Limited has offices in Cyprus. This is at 36, Makariou & Agias Elenis, ‘Galaxias’ Building, 5th floor, Office 502, 1061, Nicosia, Cyprus.

Anyone interested in trading with XM should also be aware of areas where it is not available. Residents from certain countries cannot receive services from XM Global Limited. These include the USA, the Islamic Republic of Iran, and Israel.

You can view all of the relevant legal documents for XM on the Legal Documents page of the website. This includes documents such as terms and conditions, the bonus program, the loyalty program, the conflicts of interest policy, and more. At the time of writing, there are 12 documents in this section, all available for download as PDFs.

XM Overview

The broker offers an advanced trading platform as well as flexible trading conditions to accommodate a range of global clients. XM’s expertise comes from in-depth knowledge of and experience with the global financial markets.

The broker is dedicated to offering superior services. Those include trading currencies, CFDs, precious metals, energies, and equity indices.

XM also offers its operational philosophy as a reason to consider choosing this company as a broker. Its philosophy is to earn loyalty as a way to ensure the satisfaction of clients. XM recognizes that credibility and reputation are closely linked.

XM also takes steps to adapt to changing client needs as they become more demanding and sophisticated. This is done by monitoring industry trends and technologies. XM is proud to have never compromised on factors impacting client performance. This directly leads to the broker’s ability to deliver the best execution and tight spreads.

One of the important characteristics of XM is the company’s strive to remain human and connect with clients. This is why management has visited more than 120 cities worldwide to meet with clients as well as partners. XM feels that human interactions have a high value and always aims to deliver those interactions.

XM strives to offer a range of learning opportunities for traders of all skill levels. Part of this is hosting seminars around the world. The goal is to give traders the skills needed to make improved trading decisions. XM has already hosted hundreds of these seminars, with even more planned.

The XM Foundation

XM also runs the XM Foundation. This foundation focuses on creating equal opportunities via humanitarian action. The mission of the XM Foundation is making a positive difference to people and assist them with achieving their potential. This goal applies regardless of religion, ethnic background, and culture.

The XM Foundation assists with development and access to vocational skills and education via initiating projects. It also provides international aid by working with international and local human aid foundations that are active.

The XM Foundation page on the XM broker’s website includes recent news and initiatives from the foundation. These include specific donations made and the goals of those donations.

What Types of Accounts Does XM Offer?

XM lets clients choose from four main types of accounts: Micro, Standard, XM Ultra Low, and Shares Accounts. All account types have exceptional trading conditions and unlimited access to MT4/MT4 with EA trading.

XM also offers the ability to trade standard or micro lots, and the same execution quality across account types. There are free and regular intra-day market updates plus technical analysis. There is also multilingual customer support plus Personal Account Managers.

Micro and Standard Accounts

Micro Accounts can have the base currency of USD, GBP, EUR, CHF, JPY, AUD, PLN, HUF, RUB, ZAR, or SGD. 1 lot is 1,000 and there are no commissions. This type of account has negative balance protection, trading bonuses, and no deposit bonuses.

An Islamic account is optional and the minimum deposit is $5. Hedging is allowed. Trading on MT4 must meet the trade volume minimum of 0.01 lots, which is 0.1 lots on MT5. These clients can only have up to 200 positions open or pending at a time. There is a limit of 100 lots per ticket.

The main difference for Standard Accounts with XM is that 1 lot is 100,000. There is a restriction of 50 lots per ticket and the minimum trade volume is 0.01 lots. Other than this, the Standard and Micro Accounts are essentially identical.

XM Ultra Low Account

An XM Ultra Low Account is available with the base currency of USD, GBP, EUR, SGD, AUD, or ZAD. You still have no commissions and negative balance protection. Islamic Accounts remain optional. There are no trading bonuses and no deposit bonuses, plus hedging is allowed.

The minimum deposit is $5. There is still a maximum of 200 open or pending positions.

XM Ultra Low Accounts can be Standard Ultra or Micro Ultra.

For Standard Ultra, minimum trade volume is 0.01 lots and there is a limit of 50 lots per ticket.

For Micro Ultra, these figures are 0.1 lots and 100 lots, respectively.

What Other Accounts Does XM Offer?

Shares Accounts are always Islamic and have a minimum deposit of $10,000. There are no trading bonuses, no deposit bonuses, and hedging is not allowed.

The contract size is 1 share with a minimum trade volume of 1 lot. Clients can have a maximum of 50 positions open and pending, and the lot restriction per ticket depends on the share.

XM can also help clients create custom-tailored accounts for trading forex. This allows flexibility to meet the needs of any client.

Islamic Accounts

As previously mentioned, most of the account types available on XM are offered as Islamic accounts. Islamic or swap-free accounts do not have any rollover or swap interest for overnight positions.

To open an Islamic account, simply open an account normally and then validate it in the Member’s Area. At this point, you just contact XM to change it to an Islamic Account. Keep in mind that XM does reserve the ability to revoke the swap-free status in case of abuse.

Compared to other forex brokers who offer Islamic accounts, XM’s offerings stand out. That is because most brokers will give Islamic accounts higher spreads. XM, however, does not apply additional charges on Islamic Accounts.

Additionally, XM remains respectful to the idea of Islamic Accounts, never using “swap-free in disguise” accounts. Some brokers use this type of account, in which they transfer the interest charge to a different fee. As this would still be a charge covering interest, it goes against ethical and fair trading.

What Assets Can You Trade With XM?

XM gives clients the ability to trade more than 1,000 instruments across 9 asset classes:

Forex,

Crypto CFDs,

Stock CFDs,

Turbo Stocks,

Commodities,

Equity Indices,

Precious Metals,

Energies,

Shares

You can view all the specific instruments available for trading on the individual asset pages.

There are 57 forex pairs available, including majors, minors, and exotics.

There are 1,210 stock CFDs. You can browse or search them, including by country.

The stock CFDs span 17 countries.

Those include the USA, the UK, Germany, France, the Netherlands, Belgium, Switzerland, Spain, Greece, Italy, Portugal, Norway, Finland, Sweden, Austria, Australia, and Russia.

XM offers access to eight commodities via futures CFDs. There is access to 18 cash indices CFDs and 12 futures indices CFDs. XM also lets clients trade two spot metals instruments, gold and silver. Finally, there are five futures CFDs of energies.

Leverage and Margin at XM

XM offers leverage from 2:1 up to 30:1 depending on the instrument traded. Higher leverage allows traders to open larger positions with less capital, but also increases risk.

Margin refers to the amount that must be deposited to open a position. For forex, gold, and silver, new positions can be opened if the margin requirement is less than or equal to the free margin (available funds) in the account. For other instruments, margin requirements are stricter.

Margin Requirements

Margin requirements are calculated separately for each position and adapt based on the account leverage and symbol leverage, whichever is lower, as shown in this example:

Margin Requirement = [Lots * Contract Size * Open Price] / [Lower of (Account Leverage, Symbol Leverage)]

So if account leverage is 200:1 but symbol leverage is only 100:1, the lower 100:1 leverage would be used to calculate margin.

Risks of Leverage

Leverage allows trading larger positions with less capital

Losses can also become much larger with high leverage

Leverage over 30:1 is very risky and not recommended

To manage risk, XM provides:

Real-time monitoring of used and free margin

Margin call warnings if equity drops too low

Automatic closing of positions if equity falls below 50% of required margin (stop-out level)

XM offers high leverage but also tools to monitor risk exposure. Traders should use leverage judiciously based on their risk tolerance.

XM Spreads

It is important to note that XM uses variable spreads, as does the interbank forex market. By offering variable spreads, XM is able to eliminate the need for an insurance premium. That would be necessary for fixed spreads since they tend to be higher than the variable spreads.

This is further hampered by the fact that many brokers restrict trading close to news announcements. As such, the required insurance premium becomes worthless.

By offering variable spreads, XM is able to avoid these issues for traders. There are also no restrictions related to trading at the time of news releases.

XM also gives clients access to fractional pip pricing. This allows for the best prices from the XM liquidity providers.

Essentially, a 5th digit can be added to the typical 4-digit price quotes. This lets clients take advantage of even tiny price movements. It also allows for the most accurate quoting and tighter spreads.

What Should You Know About Overnight Positions With XM?

For overnight positions, XM prides itself on offering competitive and transparent swap rates. The rollover policy is that XM will credit or debit client accounts and take care of rollover interest.

This applies to any position held open following 22:00 GMT. It is important to note that rollovers do not take place during Saturdays and Sundays since the markets are closed.

Despite this, banks will calculate interest on positions held during the weekend. As such, XM applies 3-day rollover strategies on Wednesday.

How Do You Place an Order With XM?

XM allows you to place a range of order types. These include trailing stops, stops, limits, and market orders. Place the trade at any time of the day, provided that it is during trading hours. There is also the ability to place trades via the telephone for those who prefer this method.

What Are the Trading Hours?

The trading hours on XM are those of the market. For the forex market, one market will close when another opens thanks to markets in New York, Sydney, Tokyo, and London.

This allows for 24/5 trading on the forex market. The XM trading hours are from Sunday at 22:05 GMT to Friday at 21:50 GMT. This applies to phone trading.

If you use the trading platform outside of these hours, trades will not execute. Instead, you can only view the relevant features.

What Is the XM Execution Policy?

With XM, clients can trade with real-time execution and no requotes. Since the policy began in 2010, XM has had no rejection of orders and no requotes at all. 100 percent of orders are executed, with an impressive 99.35 percent executed within a second.

You can place orders on the XM-supported platforms at any time during the trading hours. Positions stay open until your closing trade gets executed. The balance of your account will be updated in real time to reflect the current market prices. Just keep in mind that there is a maximum of 200 positions that can be opened at a time. This includes pending orders and is per client.

XM offers fractional pip pricing that makes it possible to trade using tighter spreads. It also allows for the most accurate quoting possible.

Fills for market orders occur with a simple click. Market orders can be filled with up to 50 lots (or 5 million). Those who want to trade even larger quantities with market orders have two options. You can place the trade by phone or divide the order into several smaller ones.

Fills for limit and stop-loss orders are guaranteed with up to 50 lots. These occur at the market price that is the best available. This policy allows clients to manage their risk.

There is a clear policy for market gaps between Friday close and the Sunday opening. This can include holidays and weekends. XM will execute the pending stop and limit orders at the first market price available for the position size.

Even in cases of illiquidity and volatility, XM has a competitive policy. XM partners with numerous liquidity providers to significantly limit the risk of illiquidity. In volatile market conditions, XM will execute orders at the market price that is the best available.

What Trading Platforms Can You Use With XM?

Clients of XM have access to either MT4 or MT5, both of which are popular MetaTrader platforms. They are available across devices and you can trade via the XM WebTrader in the browser.

Despite the popularity and prevalence of the MetaTrader 4 and MetaTrader 5 platforms, XM stands out. XM was a pioneer in offering an MT4 platform that focuses on trading execution quality. Trading on MT4 with XM gives you access to leverage between 1:1 and 1:1000. There are also no rejections or requotes.

MetaTrader 4

The MetaTrader 4 platform for XM gives you a range of features. There are more than 1,000 instruments available to trade via this platform. With a single login, you can access 8 different platforms.

There is full support for Expert Advisors and one-click trading. Choose from three chart types and use the technical analysis tools, which include 50 indicators plus charting tools.

Spreads on this platform start at just 0.6 pips and there is the option of micro lots. There is also VPS functionality, and hedging is allowed.

Additionally, there are built-in help guides for MT4 as well as Metaquotes Language 4. The platform can handle a wide range of orders. It also allows for the creation of custom indicators as well as time periods.

You can use MetaTrader 4 to manage your trade history in the database, including importing and exporting. There is also an internal mailing system and a guarantee of full security and backup.

MetaTrader 4 is available for PC, Mac, iPad, iPhone, Android, Android Tablet, and as the WebTrader. All versions have similar functionality and allow for working on one device and then switching to another.

MT4 Multiterminal

Although MT4 Multiterminal is technically a variation of MT4 for XM, it has additional functionality. This platform is specifically designed to let traders handle more than one MT4 accounts from a single terminal.

Using MT4 Multiterminal gives you a single login and password to access the accounts. It supports as many as 128 trading accounts.

You still get similar features to other MT4 platforms. MT4 Multiterminal offers three allocation methods, multiple order types, and execution and management in real time.

MetaTrader 5

The other major platform available from XM is MetaTrader 5. MT5 builds on the offerings of MT4, adding 1,000 stocks/shares CFDs. As such, it is a great multi-asset platform.

You still get the same flexible leverage and no requotes or rejections. There is a single login for seven separate platforms.

MT5 is available for PC, Mac, iPad, iPhone, Android, and Android Tablets, or as a WebTrader.

MT5 allows hedging, full EA functionality, and one-click trading. It supports all order types and spreads start at 0.6 pips.

There are more than 80 technical analysis objects plus more than 40 analytical objects. MT5 shows the market depth of the latest price quotes.

This platform also lets you display an impressive 100 charts simultaneously. Those who want more will appreciate the superior MQL5 development environment built-in. There is also a multi-currency tester, alerts, and an internal mailing system.

How Can You Learn to Use the XM Platforms?

In addition to other educational resources, XM offers extensive information to guide the use of MT4 and MT5. On the pages for each platform, you will find multiple tutorial videos. These cover things like using Expert Advisors, placing orders, the terminal window, using templates, and more. There are 27 tutorial videos for MT4 alone.

At the bottom of the same page, you will find FAQs for MT4, including validating and gaining access to your account. XM has a similar FAQ section for MT5.

It is also worth noting that MetaTrader 4 and MetaTrader 5 are very widely used. As such, there are also numerous support and educational materials available online from third parties.

XM Trading Tools

XM gives clients access to a long list of algorithmic trading tools.

These include River Indicator, Ribbon Indicator, Ichimoku Indicator, Bollinger Bands Indicator, and ADX and PSAR Indicator.

You can make use of any by contacting your Personal Account Manager. Those supplement the algorithmic trading tools already built into MT4 and MT5.

XM also offers live account holders free forex signals from Avramis Despotis in the Member Area. Or you can use MQL5 Trading Signals. There is also an economic calendar and forex calculators.

Research and Education

XM gives clients access to an extensive Research and Education center. There are daily updates on major trading sessions. There are also daily briefings for critical market events.

Twenty multilingual market professionals man the center to ensure up-to-date information in a range of languages.

What Type of Research Does XM Offer?

There are separate homepages on XM for research and for education. The research section includes highlights and links to the subsections. The right side of the screen shows some of the most common assets and their current spreads and prices. Below this, there is a calendar of webinars.

The Market Preview page features daily previews of the European open. Here, you can find assets to watch and some expert insights. The Stock Market News section is as it sounds, with news related to stocks.

Articles may be news-related when relevant or labeled as technical analysis. There is then a separate page for Forex Previews, also with news and insights. You can also find a separate Technical Analysis page on XM. This page has recent expert technical analysis on a range of crucial assets and their movements.

The Special Reports page has more in-depth articles, but they are posted less frequently. The previously mentioned pages have new articles nearly every day, if not more often. By contrast, there are Special Reports posted a handful of times each month, when the need arises.

Those who prefer videos over reading will appreciate the Analysis Videos. There are videos for the Daily Forex News, Daily Technical Analysis, and Weekly Forex Outlook. All videos feature professionals in the industry, with their expertise listed below the video.

The Daily Forex news includes both news and analysis. The Daily Technical Analysis focuses on forex markets and includes simple technical indicators. The Weekly Forex Outlook covers the main events of the past week and explores their effect on major currencies. It also looks at the economic data we will be seeing soon.

XM Webinars

Like most brokers, XM offers a range of seminars and other educational tools to help traders enhance their skills. This includes hundreds of seminars that have already been hosted around the world, with more to come.

Compared to other brokers, XM does an excellent job of offering webinars. They are available 7 days a week from 37 webinar instructors and in 19 languages. To view the schedule, simply click on the language of your choice.

The education rooms mentioned below also serve as daily webinars in English. For other languages, you will find dozens of webinars with focused topics, such as specific tools.

Some webinars are more general. Each webinar includes the title, description, date, and time as well as what you can expect to learn. You can also register for the webinars right there.

If you visit the seminar page, you can view recent seminars. There are also archives for information on older ones. Clicking on a past seminar will show you the location and date as well as photos and news.

At the top of the page, you will see the upcoming seminars. At the time of writing, 16 were listed in a range of countries from the Philippines to Mexico.

Click “Register Here” to view information on the seminars date, time, location, and language. This is also where you can register for the seminar.

What Other Education Does XM Offer?

XM also offers Education Rooms. There are three of these, each custom-built. They all have daily live interactive training on weekdays. They include coverage of all topics with real-time guidance and up-to-date information.

Every education room has a systematically designed syllabus to help you strengthen your skills. Anyone, whether or not they are a client of XM, can access the Primary Education Room. This room focuses on fundamentals, basic concepts, opening accounts, and trading, among other topics.

The Intermediate Education Room is open to those with a validated XM account. This room helps with the development of strategies needed to hone strategic thinking. It also includes education about various analysis tools, like Bollinger Bands and the Avramis Ribbon.

Finally, the Advanced Education Room is open to anyone with a funded XM Account. To access it, you must have deposited a minimum of $500 USD in the past three months. This room delivers real trading experience using real-time simulated trading conditions. Visiting this room helps clients actually use time frame techniques, charting techniques, indicators, and more.

There is also a range of educational videos available on XM. They are divided by the same Primary, Intermediate, and Advanced distinctions. All videos are Primary or Intermediate so anyone with a validated XM Account can access all of them.

There are eight videos, covering topics such as an intro to financial markets and trading essentials for Primary levels. The Intermediate videos cover fundamental and technical analysis, money management, trading psychology, and trading strategies.

You can also find the previously mentioned MT4 Video Tutorials in the education section of XM.

XM Customer Support

XM offers support via live chat as well as the phone. You can contact the company via its registered address at No.5 Cork Street, Belize City, Belize, C.A. Or you can take advantage of the support email address or the live chat. Or you can access phone support. Both the live chat and phone support are available 24/5 for convenience. This way, clients do not have to wait to get answers to important questions.

Client support is available in more than 30 languages. This makes it possible for nearly anyone to communicate with the support team in their preferred language.

If you have a complaint, XM encourages you to contact either your Client Relations Manager or the Customer Care Company. Most customer complaints can easily be resolved via this step. In cases of an unresolved complaint, XM asks that you contact the Compliance Department of the company.

The Compliance Office handles all complaints impartially. It also takes necessary actions in accordance with XM’s Complaints Handling Procedures. The Complaints Form is easy to find within the Members Area.

XM Awards

Third parties also indicate their approval for XM via awards and accolades. XM organizes its awards and accolades into categories.

Its most recent Forex Service Award is the title of the Best FX Service Provider. This honor was awarded by the City of London Wealth Management Awards 2019.

XM was also named Best Forex Customer Service by Shares Magazine in the UK Forex Awards 2018.

Capital Finance International Magazine (CFI.co) named XM the Best Market Research & Education and Best Trading Support for 2017.

XM Competitions

Beginner and professional traders can compete among each other, test out their trading skills and stand a chance to win exciting rewards and prizes.

Traders can get the chance to be on top of the leaderboard, build their portfolio and assemble their own followers.

There are daily, weekly, and monthly competitions for traders to participate in – each competition has different total prize pool, tiers of rewards, and terms and conditions

Champion traders can get the chance to win a funded account and be a Strategy Manager

XM Copy Trading

Traders can follow the strategies of the experts and copy their trades, but it is up to their own risks.

They also can view the performance of some of our most profitable traders and browse through it.

Traders can choose to be either an Investor or Strategy Manager for this Copy Trading.

As an Investor, traders can choose the strategies they want to follow and decide how much to invest in each. This benefits new traders as it allows them to participate in the markets while enhancing their trading education and developing their own strategies.

As a Strategy Manager, traders create their own strategies and share them with the community. Traders then can earn up to 50% profit share on any profits from the other traders copying their strategies.

Conclusion

XM is an international broker offering clients access to more than 1,000 instruments across 7 asset classes. XM has high liquidity and no requotes or rejections of orders.

There are four account types to choose from, plus the ability to customize an account. A demo account is available and you can open a live account with just $5.

Depending on where you are based, XM also offers some nice signup bonuses including a no-deposit bonus of $30 and another 100% bonus matching your deposit up to $5000.

XM has an excellent educational area for clients new to trading, including videos, tools and live webinars it’s one of the best educational areas we have seen with a broker of this type.

They don’t offer their own propriety trading platform, instead opting to support Meta Trader 4 & 5.

XM is a large and well regarded company with some good offers and is well regulated so you can feel safe when choosing this broker to trade with.

The post XM Broker Review: Forex & CFDs Trading Platform, All You Need to Know appeared first on Blockonomi.