In the chaotic aftermath of last week’s market-wide wipeout, one granular forensic stands out: order-book depth on major venues thinned to “air,” letting relatively modest market orders rip through price levels with almost no resistance.

The phenomenon, captured by independent market analyst Dom (@traderview2) on X, is now central to a stark takeaway for XRP: under the same microstructure conditions, price can mechanically gap as easily to $1.19 as to $20. It is not a forecast; it’s a statement about how quotes, liquidity, and matching engines behave under stress.

XRP Price May Gap To $1.19 Or $20

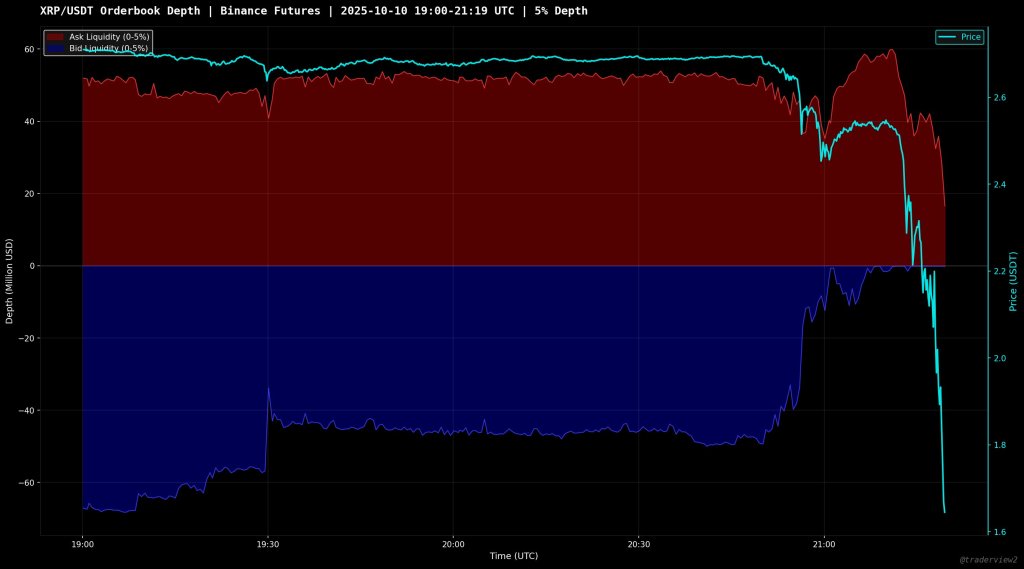

Dom’s post reconstructing the XRP leg of the move uses Binance Futures’ order-book depth to illustrate the dynamic. “XRP orderbook depth on Binance Futures during the crash. Prime example of ‘liquidity evaporation’,” he wrote, noting that for more than two hours pre-cascade, there was roughly “$50–60M in liquidity within 5% of price on both sides. Stable, deep book.”

The hour everything broke was different. “Look closely right before 21:00 during that first leg down, nearly 20M USD market sold (shorts entering/longs liquidated). Bid side (blue) goes from $50M to near zero… At this point, XRP is near $2.50 while all liquidity under it is basically gone, air.” Minutes later, with “more sells… trickling into a basically air pocketed book,” price slid from “$2.50 to $1.19. Nobody replenished the book. MMs either pulled or just walked away to protect. These markets really are more fragile than most think,” he wrote.

The same thread and follow-ups widened the lens to cross-venue behavior. Dom highlighted a striking divergence on the Dogecoin tape: “DOGE nuked to $0.09 on Binance, OKX, Bybit and Kraken… Coinbase was trading over 40% higher. Their market makers were either running a completely different playbook or protecting the books. That divergence wasn’t random and someone kept the floor intact.” The implication is not that aggressive buyers or sellers “controlled the move,” but that quote providers—market-making algorithms with the discretion to pull or reprice quotes—dictated where executable liquidity actually existed as prices gapped.

That framing also addresses a common post-mortem question from traders staring at cumulative volume delta (CVD) prints that went vertical even as prices fell: net buy pressure can rise while price still drops if the best offers are yanked and re-quoted lower in milliseconds, forcing buyers to chase a descending ask.

As Dom put it in a separate explainer on DOGE, “Liquidity was pulled and repriced lower in milliseconds, over and over again. Doesn’t matter how much you buy. The closest ask keeps sliding down faster than you can hit it… Price doesn’t fall because of ‘selling’—it falls because the ground itself keeps disappearing. […] My analysis so far supports the case this was happening with many coins…”

The logic is symmetric: when quote liquidity vanishes above price, upside gaps can be as mechanically abrupt as downside air-pockets—hence Dom’s answer to whether a $2 to $10 or even $20 spike could happen “on the way up”: “Technically speaking, yes.”

At press time, XRP traded at $2.46.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.