Utilizing Wall Avenue analysts’ value targets to find out whether or not a inventory is a purchase or a promote is not the very best technique. Whereas it ought to assist inform traders of how others consider the inventory, it should not be the be-all and end-all. One widespread synthetic intelligence (AI) inventory that these analysts (on common) say to promote now could be Palantir (NYSE: PLTR).

In keeping with a median of 15 analysts, the common value goal for Palantir inventory is $27.08, which signifies a virtually 30% draw back. So, ought to traders heed their recommendation and promote Palantir inventory?

Palantir’s AI providers have by no means been extra widespread

Palantir has develop into a preferred AI funding as a consequence of its experience on this subject. Nonetheless, Palantir hasn’t determined to supply an AI answer previously two years as a result of it’s widespread. As an alternative, it has constructed its complete software program package deal round AI from the start, giving it a leg up on many opponents within the house.

Palantir began as an organization that made AI software program for the federal government. The fundamental concept was to take information streams in and ship real-time insights, equipping customers with essentially the most up-to-date data doable. After administration noticed a robust use case for its software program outdoors the federal government realm, it expanded to the industrial aspect. As of its most up-to-date outcomes, authorities purchasers are nonetheless the most important prospects, accounting for 55% of income.

Nonetheless, Palantir’s newest run-up was as a consequence of big demand for its Synthetic Intelligence Platform (AIP) product. AIP permits AI integration all through a enterprise slightly than utilizing a generative AI mannequin on the aspect. By integrating AI into workflows, companies can management how they need AI for use inside their operations. This can be a key step ahead within the integration of AI, and it has develop into wildly widespread, particularly with the U.S. industrial buyer base.

Within the firm’s second quarter (ended June 30), U.S. industrial income rose 55% yr over yr to $159 million. Whereas that is solely 24% of whole income, it is the fastest-growing enterprise phase. U.S. buyer depend additionally exploded, rising 83% yr over yr to 295 prospects. This low determine might trigger some traders to assume that Palantir has a a lot bigger alternative forward, as different software-as-a-service corporations typically record their shopper base within the 1000’s.

Nonetheless, should you annualize the Q2 income and divide it by the client depend, you get a median income per U.S. buyer of $2.16 million. Few companies can afford greater than $2 million per yr for a software program package deal, so this limits the scale of purchasers Palantir can join.

Nonetheless, that hasn’t stopped Palantir from succeeding as an organization. In Q2, income grew by 27% to $678 million whereas posting a profit margin of nearly 20%.

Nonetheless, the market has given the inventory an unbelievable price ticket, which has triggered its valuation to swell.

It should take years for Palantir’s valuation to make sense

In case you have a look at the value tag of Palantir’s inventory, you might be tempted to assume it is “low-cost” as a result of it solely prices about $40. Nonetheless, whenever you have a look at the valuation of the corporate, it has develop into absurd.

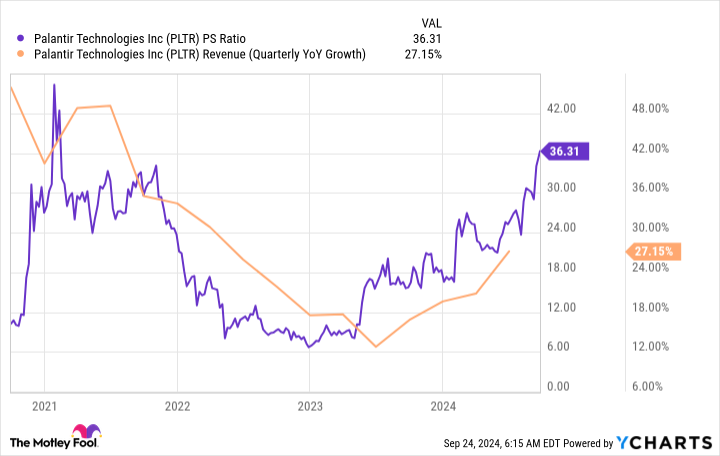

PLTR PS Ratio Chart

Palantir trades at greater than 36 instances gross sales. The final time it traded this excessive, it did not finish nicely for the inventory. Moreover, a great rule of thumb when utilizing the price-to-sales (P/S) ratio is to keep away from shares that commerce above their progress fee.

For instance Palantir can obtain a 30% revenue margin and develop its income by 30% for the following 5 years to offer you an concept of how costly this price ticket is. If it does that, it will be valued at 31 instances earnings, a traditionally costly value to pay for a inventory. Keep in mind that valuation would solely be achieved if the inventory value did not transfer for 5 years.

So, Palantir’s progress fee should speed up to a degree increased than what it is already at and keep it for an unbelievable 5 years simply to succeed in a standard valuation level.

This exhibits how costly Palantir’s inventory is, and it is no marvel that Wall Avenue says to promote the inventory.

Palantir’s enterprise could also be excelling, however the inventory has run up to some extent the place its valuation not is smart. In consequence, I believe the inventory is a promote, however on the very least, traders ought to keep away from buying any extra shares until the valuation has returned to more reasonable levels.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $756,882!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure policy.

1 Popular Artificial Intelligence (AI) Stock That Wall Street Says to Sell Now was initially printed by The Motley Idiot