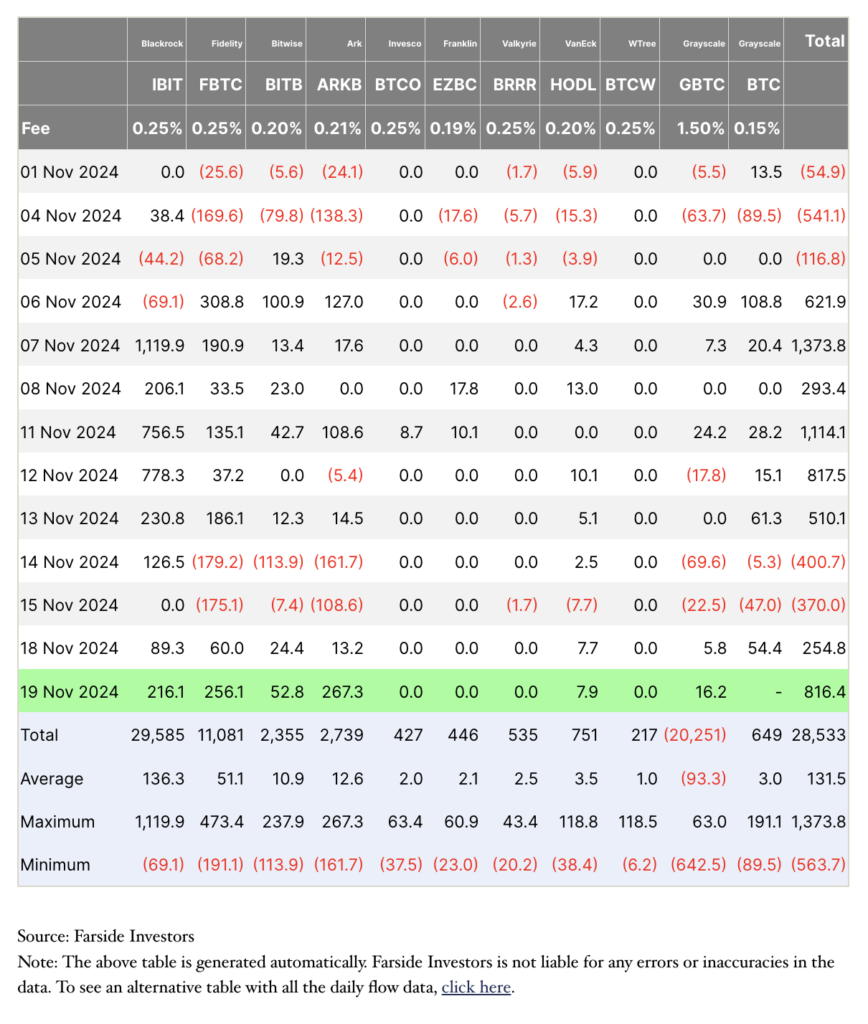

Bitcoin ETFs have attracted over $1 billion in inflows so far this week. Data from Nov. 18 shows total ETF inflows at $254.8 million, which surged to $816.4 million on Nov. 19.

On Nov. 19, ARK’s ARKB led with inflows of $267.3 million, followed by Fidelity’s FBTC with $256.1 million and BlackRock’s IBIT with $216.1 million. These figures represent substantial increases from the previous day, where IBIT and FBTC recorded inflows of $89.3 million and $60 million, respectively.

The surge coincides with Bitcoin reaching a new all-time high of $93,900 on Nov. 19.

Some ETFs, such as Invesco’s BTCO and Franklin’s EZBC, reported zero inflows on both days, indicating a concentration of investor preference toward certain funds. Grayscale’s GBTC also saw an uptick, with inflows rising from $5.8 million to $16.2 million between the two days.

The post Bitcoin ETFs record over $1 billion inflow in 2 days as new price peak boosts investments appeared first on CryptoSlate.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.