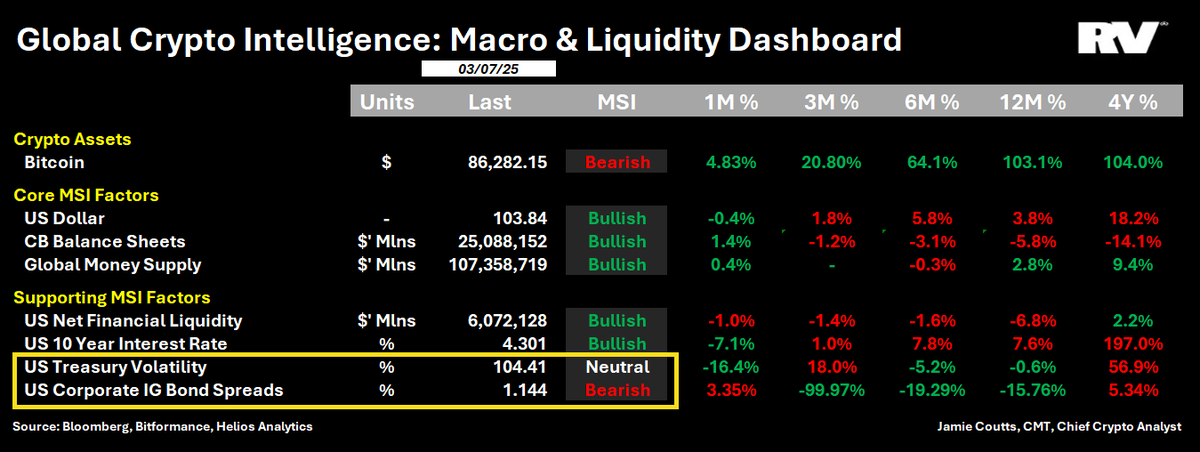

According to market analyst Jamie Coutts from RealVision, Bitcoin’s price trajectory hinges increasingly on the behavior of US Treasury volatility and corporate bond spreads, despite the dollar’s recent plunge reinforcing bullish sentiment.

Treasury bond volatility, tracked by the MOVE Index, remains crucial since US Treasuries underpin global collateral markets and influence trillions of dollars in leveraged positions.

A sustained rise in volatility can trigger tighter liquidity conditions, prompting lenders to reassess collateral valuations. Coutts highlights that the MOVE Index, stable within its range since 2022, could spur central bank concerns if it surpasses a threshold of around 110.

Meanwhile, corporate bond spreads, a metric reflecting risk appetite in credit markets, have widened steadily over recent weeks, indicating diminished investor confidence in corporate debt. Historical analysis presented by Coutts shows an inverse relationship between widening spreads and Bitcoin’s price, implying potential headwinds for digital assets if this trend persists.

However, offsetting these concerns is the significant recent decline in the US dollar, its largest monthly drop in 12 years, historically correlated with Bitcoin’s bull market reversals. Coutts emphasized this dynamic, emphasizing the dollar’s depreciation as a bullish catalyst within his current market framework.

Coutts believes Bitcoin’s immediate direction appears dependent on central bank responses to bond market stability and credit conditions, balanced against the overarching influence of the depreciating dollar.

The post Bitcoin’s fate may be tied to US Treasury volatility and corporate bond spreads appeared first on CryptoSlate.

According to market analyst Jamie Coutts from RealVision, Bitcoin’s price trajectory hinges increasingly on the behavior of US Treasury volatility and corporate bond spreads, despite the dollar’s recent plunge reinforcing bullish sentiment. Treasury bond volatility, tracked by the MOVE Index, remains crucial since US Treasuries underpin global collateral markets and influence trillions of dollars in

The post Bitcoin’s fate may be tied to US Treasury volatility and corporate bond spreads appeared first on CryptoSlate.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.