Crypto staking is the backbone of every Proof-of-Stake (PoS) blockchain. Without it, most crypto networks wouldn’t be able to secure their primary mechanism for security and transaction validation. That’s how important it is.

Staking also ensures that validators have a financial incentive to act honestly, as their staked tokens can be slashed, either partially or fully, for engaging in malicious behavior or failure to perform their respective duties.

Another key point is that staking is crucial for keeping blockchain ecosystems decentralized. It provides a structured way to reward participants for contributing to a network’s health and overall functionality.

This article takes a deep dive into the best crypto staking platforms, each reviewed carefully by their functionalities and amount of assets supported. It also goes through the basics of staking and how to stake crypto in multiple ways.

Quick Navigation

What Is DeFi Staking?

Staking is the process of locking up cryptocurrency in a wallet to help secure and maintain a blockchain network that uses a Proof of Stake (PoS) consensus mechanism. In return for committing your tokens, you earn rewards—typically in the form of additional cryptocurrency. By staking, you contribute to the network’s security, validate transactions, and help create new blocks on the blockchain.

In essence, staking incentivizes honest behavior. Users who stake their coins can gain rewards for supporting the network, while malicious or negligent validators risk having their tokens “slashed” (i.e., a portion of their stake is removed). This setup encourages active participation and maintains the blockchain’s integrity.

Benefits of Crypto Staking

There are several advantages to crypto staking, not just for users but also for blockchain networks and DeFi protocols:

- Passive yield generation:

Staking allows you to earn rewards without selling cryptocurrency, creating a consistent passive income stream. If reinvested, these rewards can compound, boosting your overall returns.

- Higher returns:

Depending on the blockchain and market environment, annual percentage yields (APYs) can range from single digits to over 20%, making them a more lucrative option than many conventional financial instruments.

- More accessibility and network support:

Unlike PoW blockchains, staking requires no specialized hardware or heavy energy use because PoS networks only require relatively smaller amounts, making it accessible to a broad range of participants.

Moreover, by locking up tokens, you help validate transactions on the blockchain, protecting it against threats like 51% attacks and maintaining long-term stability. This rewards users for their role in network health.

- Liquidity options:

Liquid staking derivatives (Lido’s stETH, Rocket Pool’s rETH, etc) let you access your staked assets in DeFi while still earning staking rewards, providing flexibility for additional trading or lending activities.

- Restaking:

Some popular protocols like EigenLayer allow you to “restake” your already-staked tokens, using them as collateral or deploying them in other staking systems. This strategy can compound yields further and increase engagement within the DeFi ecosystem. But, the biggest perk is that restaking allows DeFi projects to leverage the security and capital of already established networks.

This will be explained further in the article, but for now, note that restaking is far more complex than traditional or liquid staking, requiring more responsibilities and technical knowledge to carry out the process.

Best Crypto Staking Platforms in 2025: Our Top Picks

Below are some of the best staking platforms, providing a comprehensive breakdown of their features, supported assets, and other important information.

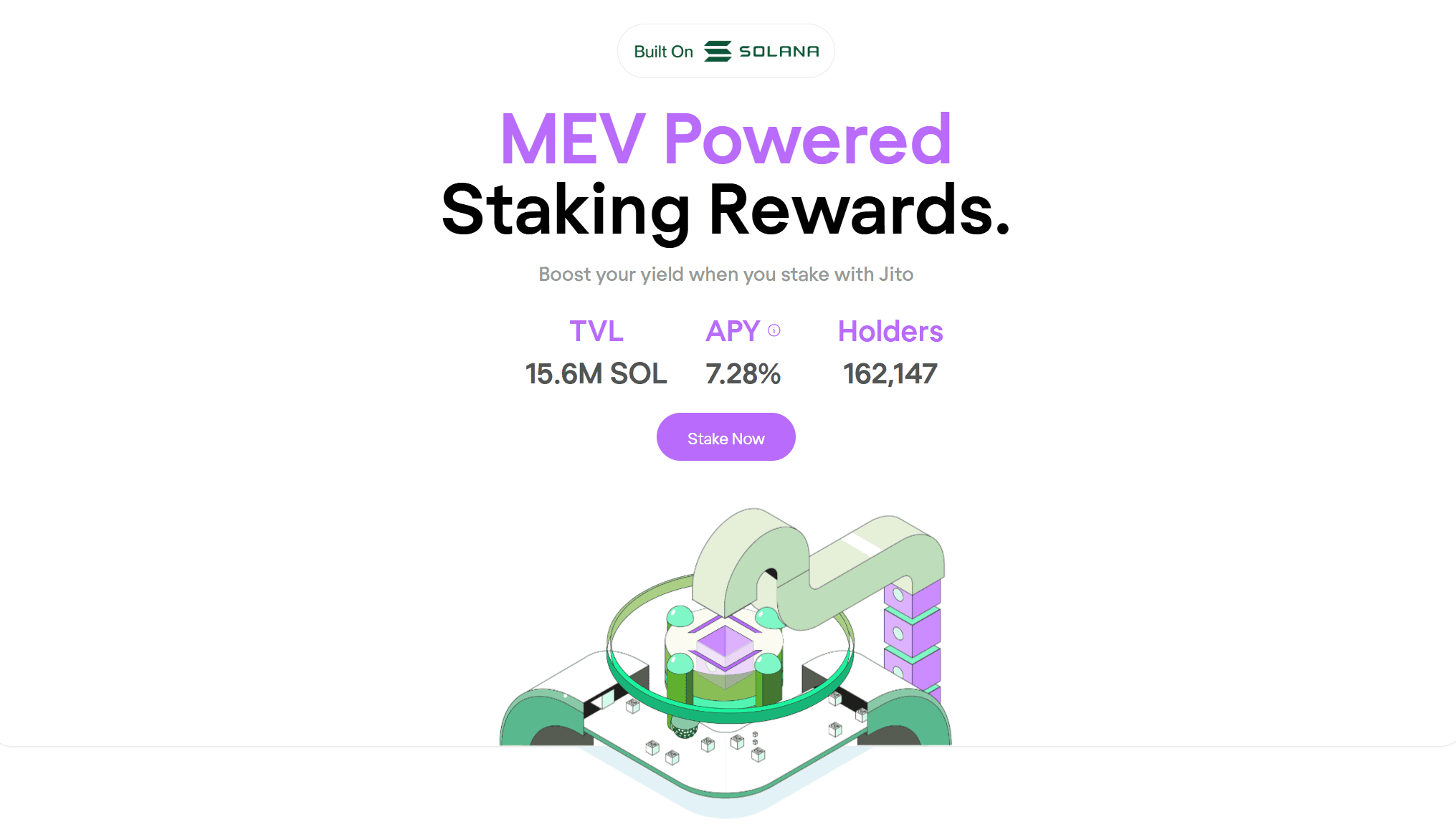

Jito – Solana’s Largest Liquid Staking Platform

Jito is the largest liquid staking platform on the Solana blockchain. Participants stake SOL and receive JitoSOL in exchange, which is a liquid staking token (LST) that can be used in other Solana-based dApps. This allows users to lock their staked tokens but use a tokenized version in other DeFi projects to generate more yields.

The project’s MEV approach—often controversial—has drawn attention. Some critics argue that MEV exploits traders by front-running orders or reordering transactions, while others see it as a way to improve market efficiency and ensure lenders are repaid.

Jito tackles MEV by implementing an auction system where traders bid on profitable transaction sequences. Third-party block engines simulate these bids to identify the most valuable transaction groupings. The resulting profits are funneled back to validators and JitoSOL holders, effectively curbing spam benefits and increasing staking rewards.

Key Features of Jito

- Liquid staking with JitoSOL: Users stake SOL and receive JitoSOL, representing their staked assets. JitoSOL can be deployed across DeFi (e.g., lending, trading, or liquidity pools) while continuing to earn staking rewards.

- MEV Integration: Jito captures MEV by optimizing transaction ordering within blocks, redistributing extra revenue to JitoSOL holders, and boosting overall staking yields.

- Full decentralization: The protocol’s governance token, JTO, grants holders voting rights on delegation strategies, treasury management, and protocol updates, while the Jito DAO ensures community-driven oversight.

- Security and transparency: Jito relies on audited smart contracts and delegates SOL to established validators within the Solana ecosystem. Governance by the Jito DAO further enhances transparency.

Supported Assets

Given Jito’s exclusive integration with the Solana blockchain, it only supports SOL tokens.

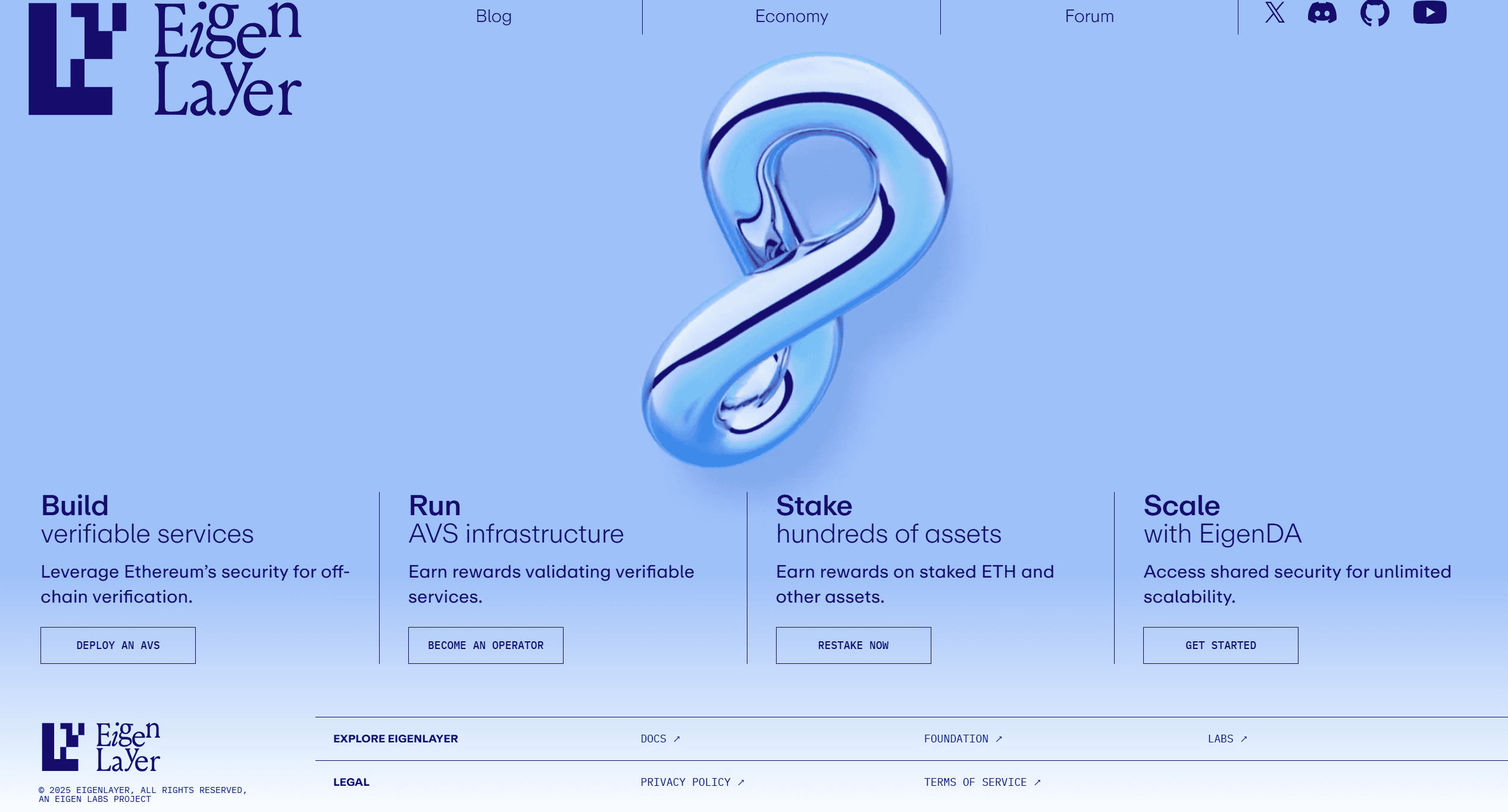

EigenLayer – The Restaking King

EigenLayer is a middleware protocol built on Ethereum that pioneered the idea of restaking, meaning you can deposit staked ETH (like stETH) into a new set of liquidity pools. These staked tokens are then distributed across various decentralized applications or AVS (Actively Validated Services), oracles, Layer 2s, data availability layers, cross-chain bridges, and more.

By doing so, EigenLayer allows these services to tap into Ethereum’s robust security without creating their own separate validator networks.

Key Features of EigenLayer

- Restaking marketplace: In a sense, EigenLayer is a sort of marketplace where validators and protocols negotiate pooled security for a cost. Protocols can buy staked tokens or stETH as an “extra layer” of security. Meanwhile, validators can choose which protocols they want to secure, evaluating them for risk and reward. They also control how much staked capital is allocated, preventing overexposure to any single protocol.

- Flexible staking options: Users can opt for solo staking, run their own nodes, delegate their stake to third parties, and even perform dual staking, requiring both ETH and a native token to be staked. This way, the protocol welcomes more advanced validators, users, and developers.

- Programmability: Developers can customize validation rules and security parameters for their EigenLayer-based applications, allowing for more nuanced protection, including multi-token quorums tailored to specific risk profiles.

- Modular security: EigenLayer supports a modular approach, letting stakers secure specific functionalities or “modules,” such as decentralized storage, DeFi applications, or cross-chain bridges. This flexibility tailors security to each project’s unique requirements.

Supported Assets

EigenLayer only supports ETH, any ERC-20 token, and liquid staking tokens such as Lido’s stETH and Rocketpool’s rETH.

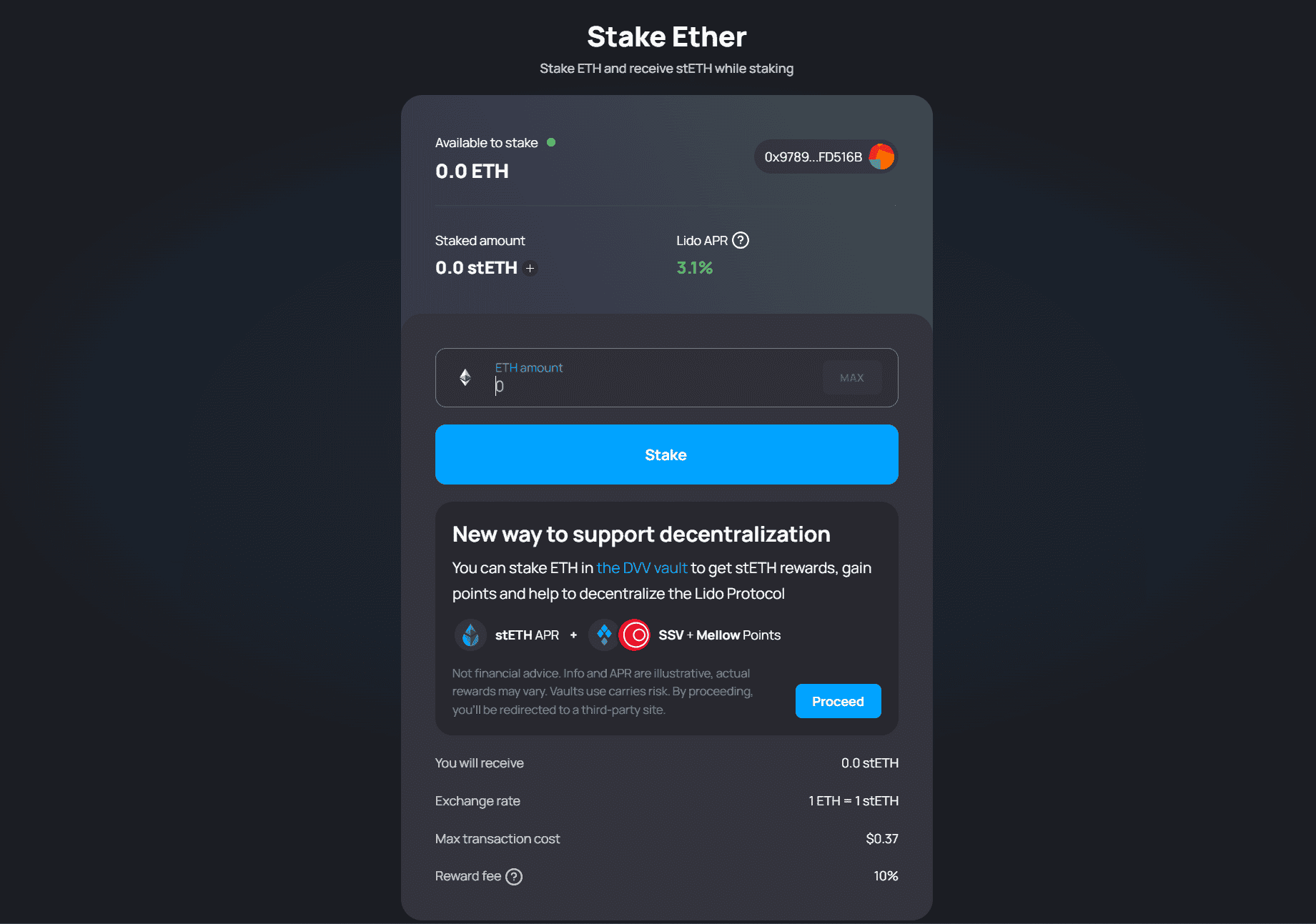

Lido Staking

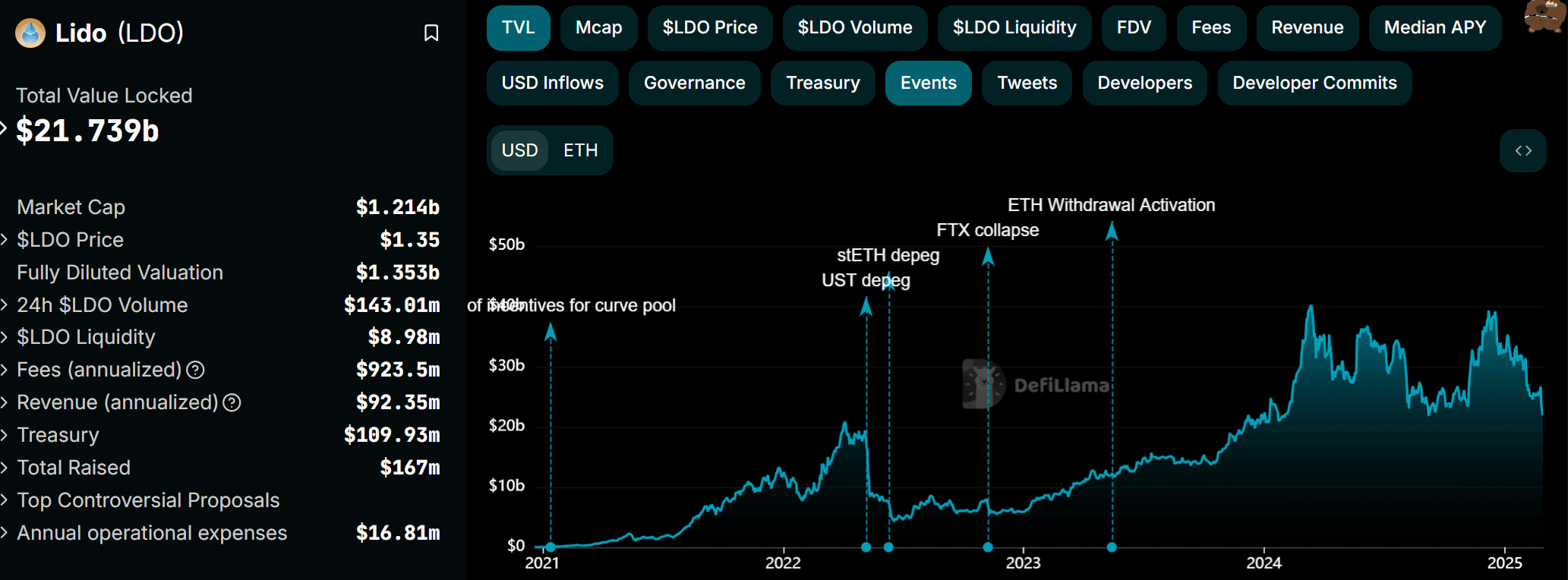

Lido is the largest decentralized liquid staking platform in the industry, reaching a peak of roughly $40B in total value locked (TVL) in mid-2024, representing a massive share of the total DeFi TVL.

Lido’s appeal is straightforward: It allows users to earn staking rewards on various PoS cryptocurrencies without requiring them to unstake their assets. This makes Lido the pioneer of liquid staking: The protocol issues a tokenized version of ETH, stETH, which represents the staked assets.

Users can deploy stETH across several DeFi projects in Ethereum, allowing them to earn additional yield on top of their staked assets.

Key Features of Lido

- Liquid Staking: When you stake with Lido, you receive a derivative token, like stETH, on a 1:1 basis. Moreover, users can stake any amount of crypto, except for validators, which require the typical 32 ETH deposit.

- Validator Distribution: Staked tokens are spread across a network of professional validators chosen by the Lido DAO, reducing risks tied to validator downtime or slashing penalties.

- Open source and audited: Lido’s smart contracts are publicly available and regularly audited. Audits can be found on GitHub.

- Fee structure: Lido charges a 10% fee on staking rewards, which is shared between node operators and the Lido DAO treasury.

Supported Assets

Lido supports a wide variety of crypto assets, including:

- ETH is the most widely used staking option on Lido.

- Polygon (MATIC): Tokenized as stMATIC.

- Kusama (KSM): Tokenized as stKSM.

- Polkadot (DOT): Tokenized as stDOT.

However, support for SOL was discontinued due to disagreements and community votes over unsustainable long-term fees on both blockchains.

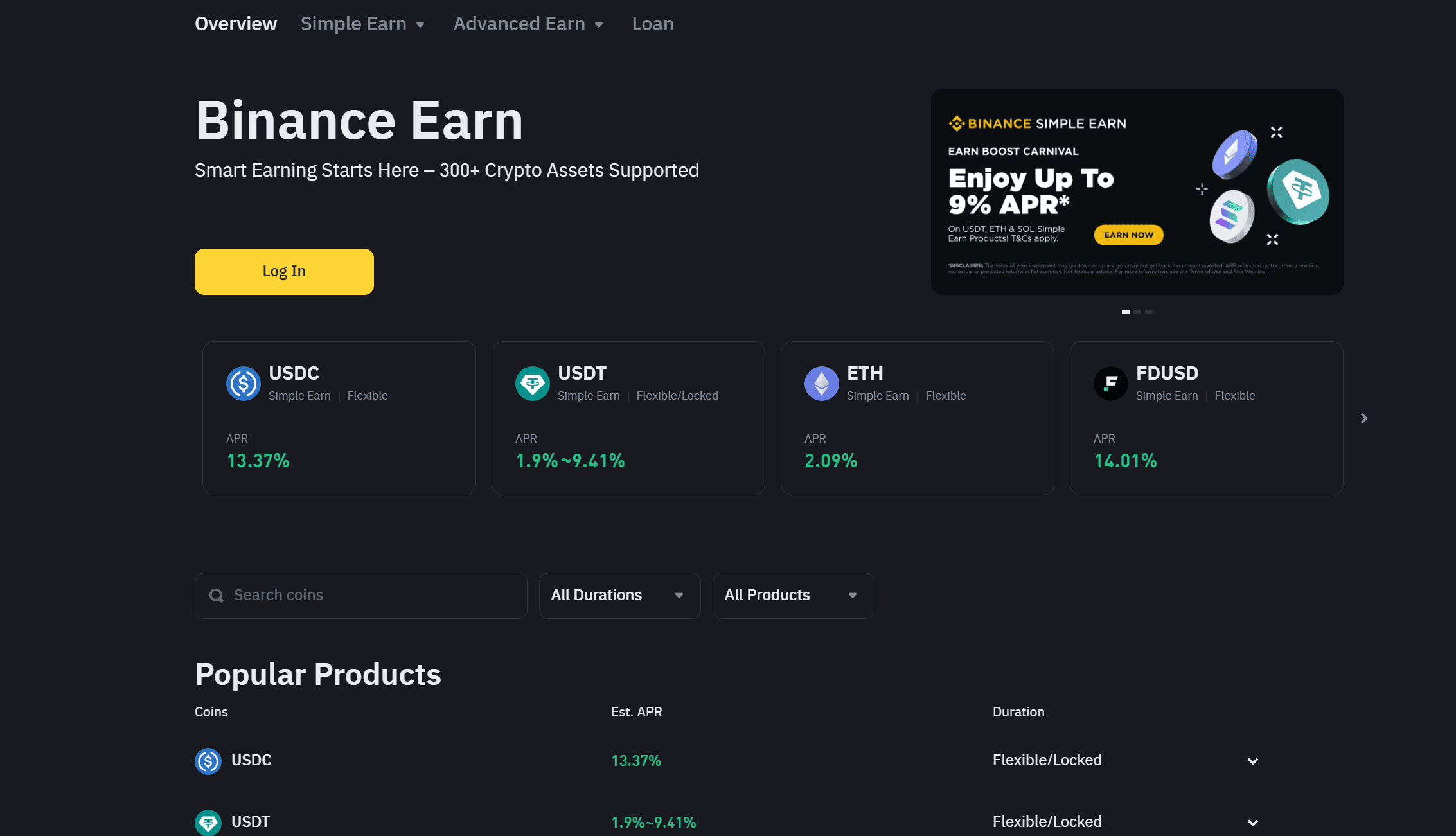

Binance Earn

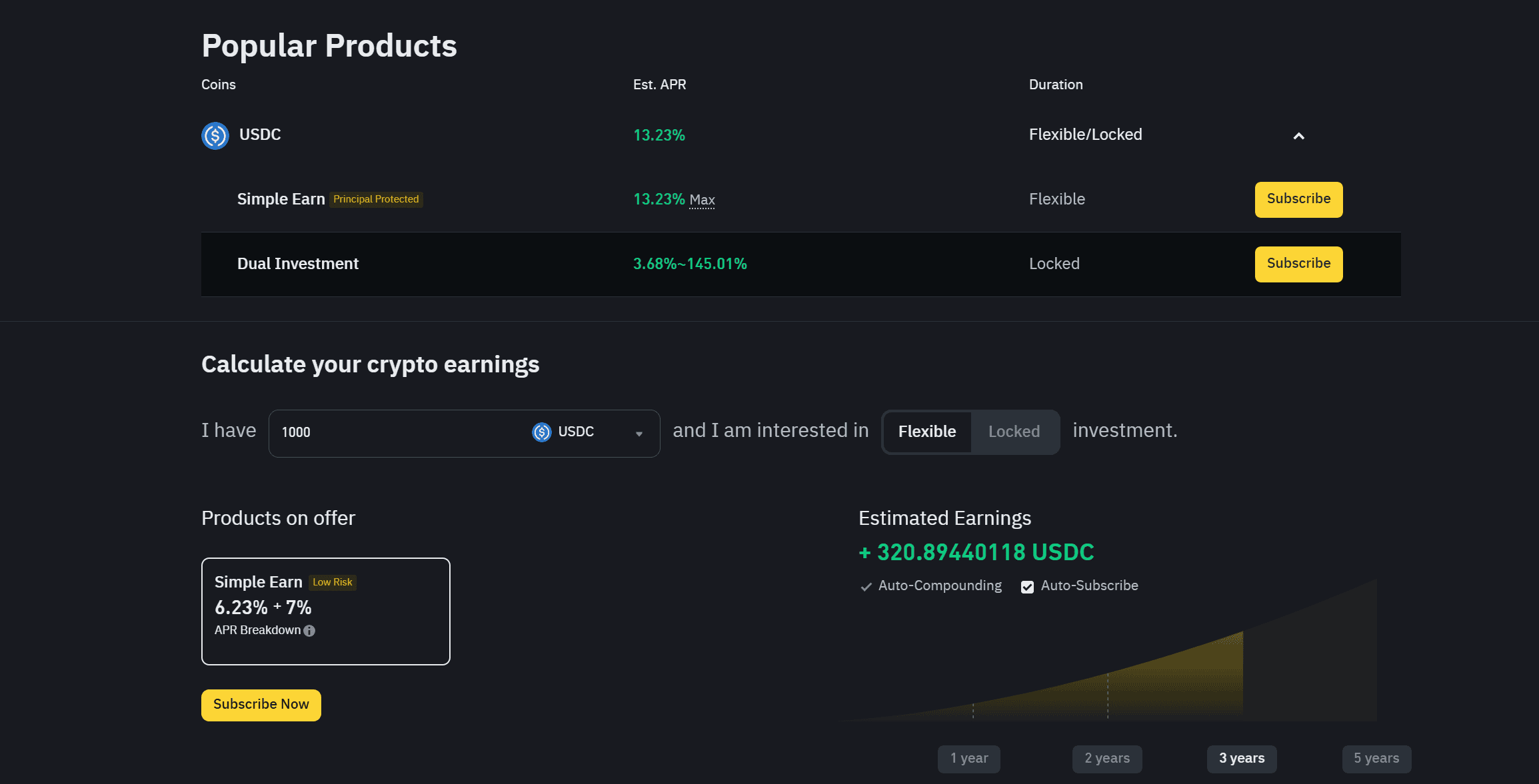

Binance Earn is a yield-focused offering within the Binance ecosystem, designed to help both novice and experienced investors earn passive income on their cryptocurrency holdings.

It serves as a one-stop solution for several investment products, championed by its extensive staking program, where users can choose Locked Staking, where they deposit their crypto for a set duration (e.g., 30, 60, or 90 days) to earn higher rewards.

Key Features of Binance Earn

- DeFi and liquid staking: Connects users to external protocols, offering higher APYs but carrying general risks associated with using these DeFi platforms. Binance also supports ETH 2.0 Staking, enabling participants to stake Ethereum without operating their own validator node; in return, users receive BETH as a tokenized representation of their staked ETH.

- Savings products: Besides staking, Binance Earn provides Flexible Savings, which allows immediate access to funds but offers more modest interest rates. Locked Savings, on the other hand, require users to commit their assets for a predefined period in exchange for higher yields.

- Dual investment: The platform offers more advanced products like Dual Investment, a high-yield option involving two different cryptocurrencies with returns contingent on market conditions.

- BNB Vault: A popular feature for Binance Coin (BNB) holders. It combines blending staking, savings, and liquidity farming all in one to maximize returns on BNB holdings.

Supported Assets

Binance Earn supports over 180 cryptocurrencies up for staking, including major assets like Bitcoin, Ethereum, Solana, and Cardano, as well as stablecoins such as USDT and USDC.

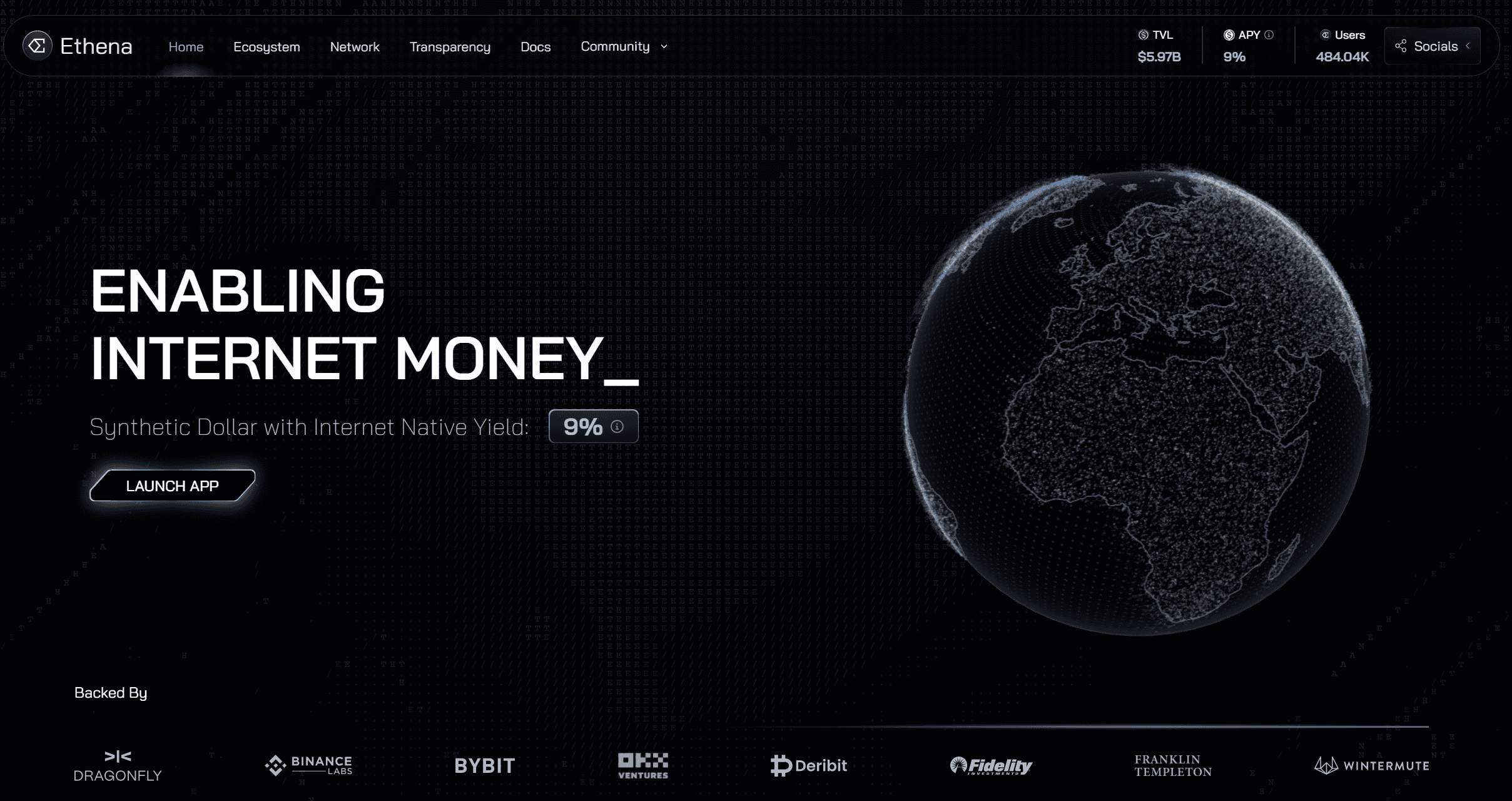

Ethena – A Yield-Bearing Stablecoin Backed by Crypto

Ethena USDe is a synthetic dollar stablecoin built on Ethereum, designed to maintain a 1:1 peg with the U.S. dollar through delta-neutral hedging and on-chain collateral.

Launched by Ethena Labs, the platform offers a censorship-resistant alternative to traditional stablecoins. It is backed entirely by crypto assets such as ETH, BTC, and liquid staking derivatives.

Key Features of Ethena

- USDe: Ethena’s USDe employs a delta-neutral hedging model to balance any fluctuations in the value of its underlying collateral. The protocol takes short positions on derivatives contracts to keep the stablecoin pegged at $1 without depending on fiat reserves or traditional custodians.

- Crypto collateral: All minted USDe is backed by on-chain cryptocurrencies, including ETH, stETH, BTC, and various other stablecoins. This maintains a consistent ratio of collateral to outstanding tokens.

- Yield-bearing token: One of Ethena’s most popular offerings is the ability to stake USDe to earn sUSDe, a yield-bearing derivative token that appreciates over time. All returns on investments are generated through 1) Ethereum staking rewards and 2) the funding spreads earned through delta-neutral derivatives positions. The staking process follows the ERC-4626 Token Vault standard.

- Insurance fund: Ethena is one of the few DeFi protocols to offer a reserve fund that acts as a buyer of last resort. This fund is a safety net in case of extreme scenarios, like negative funding rates or sudden market shocks.

Supported Assets for Staking

Ethena supports staking primarily with its native token, USDe. Upon staking, users receive sUSDe, which captures accumulated rewards from both derivatives funding spreads and Ethereum staking yields.

How to Stake Crypto In a Few Steps

There are several ways to stake crypto. But whichever way, you must first get a proper crypto wallet to begin your staking journey. You can look at our guide on the best DeFi wallets to analyze and compare some of the top options in 2025.

Staking With Crypto Wallets

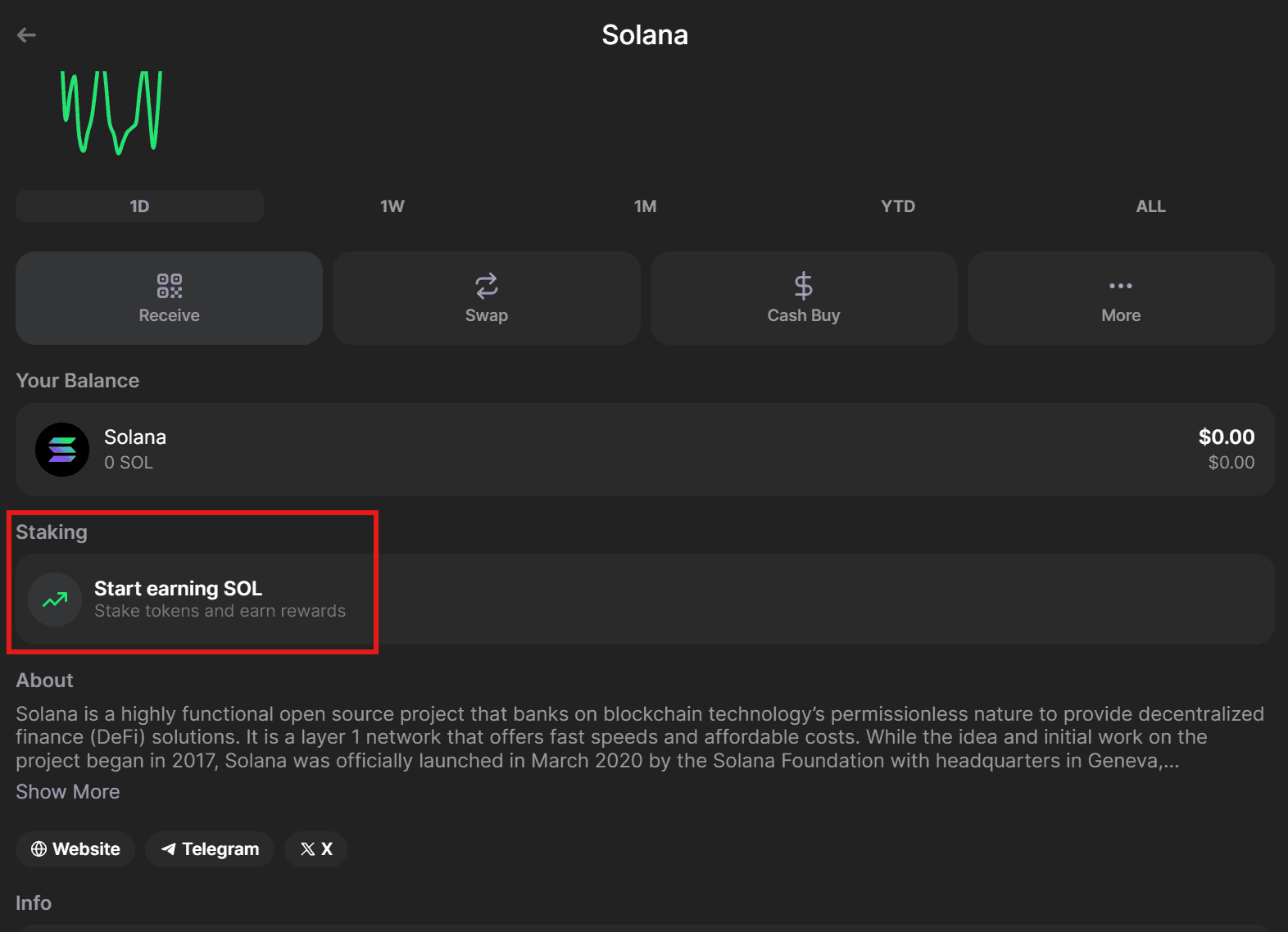

Some crypto wallets like Trust Wallet, Exodus, and Phantom allow you to stake assets directly without leaving the app.

For example, if you want to stake using the Phantom wallet, simply go to your account and choose an asset. Next, click on the asset and select Staking.

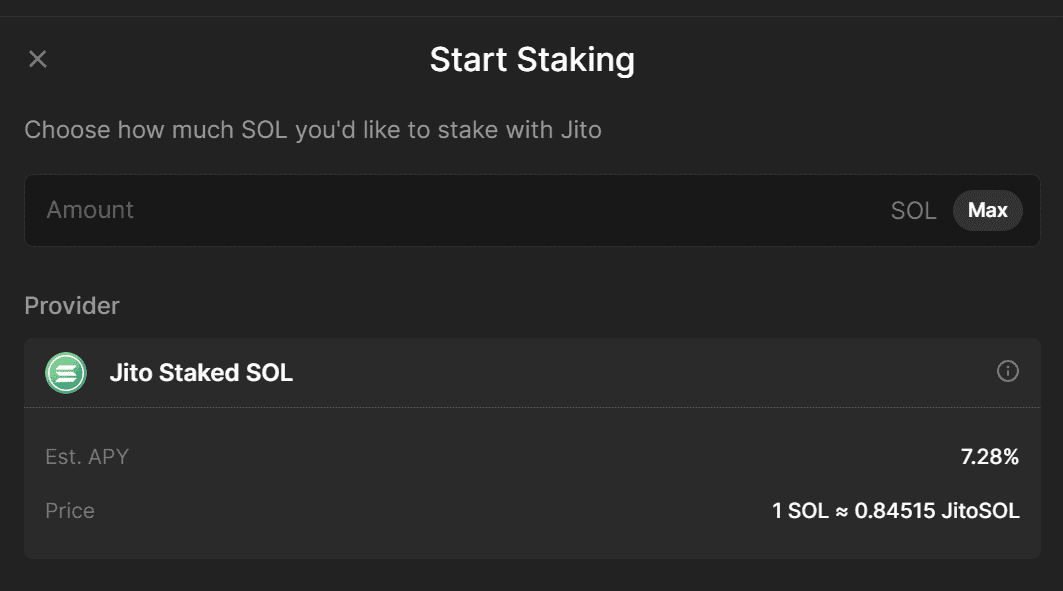

Phantom offers two options: native staking, where you simply lock up assets in the Solana blockchain, and liquid staking using Jito.

If you choose native staking, then you have to pick a validator. The Phantom Validator is the most popular due to its trustworthiness and security, but rewards are usually lower. Afterward, just enter the amount you wish to stake. Note that with native staking, your assets are locked, so you cannot use them across dApps for extra yield until the cooldown period ends.

On the other hand, staking with Jito may result in bigger rewards and lower fees. Once you deposit your assets, you’ll get JitSOL, which you can use across DeFi protocols to win some extra rewards.

Using a Staking Platform

Using a crypto wallet, you can join a crypto staking pool where users deposit their funds to increase the chances of earning rewards. This is ideal for those with smaller amounts of crypto or who can’t meet minimum staking requirements in a given protocol.

For example, if you want to stake ETH, you can simply go to Lido, choose the number of tokens you wish to stake, click on proceed, and, once you have done so, receive stETH tokens representing the staked amount. This allows you to use the tokenized version of your funds across Ethereum-based DeFi protocols.

Node Staking

Node staking is more complicated and reserved for those who run a validator node on Solana or Ethereum. This means validators get to stake their own currency plus the currency of other liquid stakers. You earn rewards on your own staked assets and a commission fee based on the rewards your node generates for liquid stakers.

One of the best pools for node staking is Rocketpool, one of the largest ETH staking pools. It requires at least 16 ETH to operate a node but comes with a 14% cut from rewards. Other platforms are StakeWise V3 and Marinade Finance for Solana users.

Exchange Staking

An alternative option would be centralized staking, in which exchanges like Binance or Coinbase handle the staking process on your behalf, simplifying the experience but requiring trust in their security measures.

For instance, Binance Earn allows you to choose from different staking products, from popular cryptocurrencies to stablecoins, with different durations and APRs.

Frequently Asked Questions

Can I Unstake My Assets?

Yes, you can unstake assets after a cooldown period, which depends on the protocol you’re using. This is to prevent validators from immediately withdrawing their funds, which could allow malicious actors to avoid penalties, such as slashing. It also helps maintain economic stability by preventing large-scale, sudden withdrawals.

What’s the Difference Between Native Staking and Liquid Staking?

Native staking requires the user to lock assets to generate rewards. Meanwhile, Liquid staking platforms give users a tokenized version of their already staked assets, which can be used across different DeFi projects, boosting their earning potential.

What Makes Restaking More Complex Than Traditional Staking?

Restaking allows you to reuse already staked tokens as collateral in other protocols. This allows users to compound rewards while offering extra security for multiple decentralized applications and blockchain protocols. The issue is that restaking requires a lot of technical expertise in DeFi since the user is interacting with multiple smart contracts and DeFi projects and must manage a higher level of risk.

The post The 5 Best Crypto Staking Platforms in 2025: Everything You Need to Know appeared first on CryptoPotato.

Wondering what are the best ways to stake your coins? Here are some of the best crypto staking platforms available right now. Crypto News, Editorials, Guides, Bitcoin

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.