Ethereum has experienced a massive drop, reaching its lowest level since late November 2023. The entire market has been hit by extreme volatility, uncertainty, and aggressive price swings, with ETH losing over 20% of its value in just hours. Investors fear that this correction could extend further as Ethereum struggles to reclaim key demand levels.

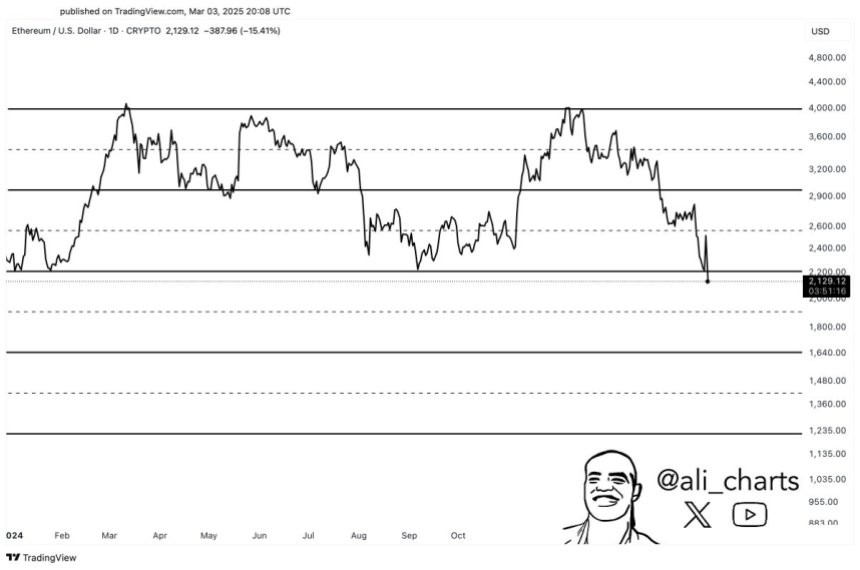

Analysts are closely monitoring Ethereum’s price action, as the next few days could determine the short-term outlook for the second-largest cryptocurrency. Top analyst Ali Martinez shared a technical analysis on X, suggesting that Ethereum is on the verge of breaking out of a parallel channel to the downside. If this push below the $2,000 mark happens, ETH could be set for a deeper correction before any recovery attempts.

Ethereum’s weakness raises concerns about the broader crypto market, as altcoins have also been hit hard during this latest sell-off. Sentiment remains bearish, and traders are waiting for confirmation of whether ETH will regain strength or continue dropping toward lower demand zones. The next few trading sessions will be crucial in determining whether Ethereum can hold above critical support or if further downside is inevitable.

Ethereum Faces More Downside Risk

Ethereum’s price action has been underwhelming as the broader crypto market struggles to find stability. Despite brief rallies and sharp declines, ETH has failed to establish a clear trend, leaving investors uncertain about its future direction. The asset has been stuck in a prolonged downtrend, consistently setting new lows and reinforcing the bearish sentiment across the market.

Currently, Ethereum is trading at bear market prices with little to no signs of a sustainable recovery. As the market structure weakens, many investors expect ETH to drop even further. Analyst Martinez has highlighted a concerning development, noting that Ethereum appears to be breaking down from a parallel channel that has contained price for months. ETH could be on track for a sharp move toward $1,250, a level that would signal a deeper market collapse.

A drop to $1,250 would not only reinforce Ethereum’s bearish outlook but also serve as a key signal for a broader market breakdown. This scenario could lead to panic selling across the board, dragging other major assets lower and confirming an extended bear market. Despite occasional price swings, Ethereum remains at a critical juncture, with bulls struggling to reclaim key support levels. Unless ETH can reclaim lost ground and establish a strong support base, the risk of further downside remains high.

With Ethereum failing to show strength amid market volatility, investors remain cautious, anticipating lower price levels before any meaningful recovery can take place. The coming days will be crucial in determining whether ETH can stabilize or if Martinez’s $1,250 target will become a reality, confirming the bearish outlook for the entire crypto market.

ETH Testing Critical Demand Level

Ethereum is trading at $2,090 after a period of weak price action, marking a 30% decline since February 24. This significant drop has left investors questioning whether ETH can maintain its long-term bullish structure or if a deeper correction is imminent.

Currently, Ethereum is at a critical support level that must hold to sustain any hope of a bullish continuation. A breakdown below this level would likely confirm a bear market scenario, pushing ETH toward lower price levels as selling pressure intensifies. The uncertainty surrounding Ethereum’s price action has left traders cautious, as any further weakness could accelerate the decline.

However, a recovery remains possible if ETH can reclaim the $2,500 resistance level. Such a move would signal renewed buying momentum and could spark a strong recovery, potentially reversing the recent bearish trend. If Ethereum manages to flip $2,500 into support, it would indicate renewed confidence in the asset and set the stage for higher price targets.

For now, all eyes are on Ethereum’s ability to defend $2,090. The coming days will be crucial in determining whether ETH can stabilize or if the market is heading toward a more prolonged bearish phase.

Featured image from Dall-E, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.