TLDR

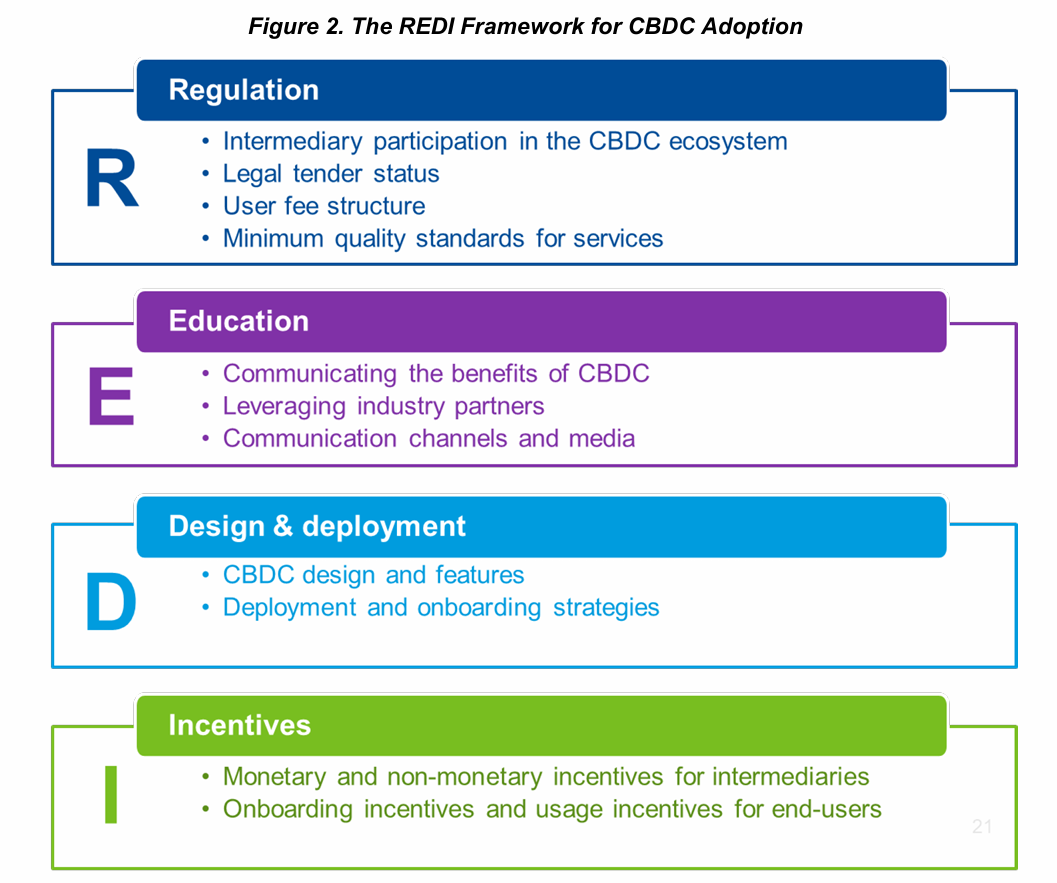

IMF staff introduced a REDI framework for CBDC adoption

Framework focuses on Regulation, Education, Design, and Incentives

Goal is to enhance CBDC uptake globally

Recommends strategies for end-users and intermediaries

Encourages central banks to focus on stakeholder engagement

International Monetary Fund (IMF) staff members have unveiled a new framework aimed at accelerating the adoption of central bank digital currencies (CBDCs) worldwide.

The framework, dubbed REDI (Regulation, Education, Design, and Incentives), was introduced in a paper titled “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users” on September 21, 2023.

The REDI framework is designed to provide guidance to policymakers and banking institutions on implementing strategies that could increase CBDC uptake.

It emphasizes the need for a comprehensive approach that considers both end-users and intermediaries in the financial system.

The first pillar of the framework, Regulation, suggests that central banks explore potential regulatory and legislative measures to foster CBDC adoption.

This could involve creating a supportive legal environment that encourages the use of digital currencies while addressing potential risks.

Education, the second pillar, focuses on developing communication strategies to build awareness about CBDCs. The IMF staff recommends that central banks act as the primary source of information, ensuring that the public understands the benefits and uses of these digital currencies.

REDI framework for CBDC Adoption

The Design aspect of the framework emphasizes the importance of creating strategies that target specific user groups. It also highlights the need to establish a wide network of intermediaries to facilitate CBDC transactions and services.

Lastly, the Incentives pillar suggests introducing both monetary and non-monetary incentives to encourage mass adoption of CBDCs. Some recommendations include subsidizing setup costs, transaction fees, and taxes for merchants who accept CBDCs.

The IMF staff members stress that successful CBDC adoption will require proactive strategic policy and design choices that benefit both end-users and intermediaries.

They urge central banks to prioritize stakeholder engagement throughout the process of developing and implementing CBDCs.

While the REDI framework provides a roadmap for CBDC adoption, the IMF staff acknowledges that certain policy issues still need further exploration.

These include ensuring the sustainability of the CBDC system, maintaining the integrity of the system, and balancing adoption with financial stability.

The introduction of this framework comes at a time when many countries are exploring or piloting CBDCs. As digital currencies continue to gain prominence in the global financial landscape, the IMF’s guidance could play a crucial role in shaping the future of monetary systems worldwide.

It’s worth noting that this initiative aligns with other recent IMF efforts related to digital currencies. In August 2023, IMF executives proposed increasing global crypto-mining electricity costs through taxes to reduce carbon emissions.

The post IMF Staff Introduces REDI Framework for CBDC Adoption appeared first on Blockonomi.